The Fed Cuts Rates - Market Predictions

On July 31st Jerome Powell, Chair of the Federal Reserve, announced the Fed Rates are to be cut by a quarter-percentage point, its first reduction since 2008. The decision to cut rates was made “in light of the implications of global developments for the economic outlook as well as muted inflation pressures.”

WHAT DOES THIS MEAN FOR THE INVESTOR?

Investors holding bonds before the rate cut greatly benefit. Bond prices rise as yields fall, making the bondholder money with a decrease in the interest rates.

Good news for those who are looking to borrow money. A cut should mean a decrease in the cost of mortgages, auto loans, and credit cards. Thus, encouraging consumers to spend and sustain the expansion of economic activity.

A possible decrease in the yield for those who have dollars deposited in savings accounts.

AS FOR THE US ECONOMY?

With any changes to monetary policy, there tends to be a lot of talk about what will happen next and what this means for our economy. Where will we end up? The last few times the Fed cut rates, in 2008 and before that 1996 and 1998, the results varied:

The last time the Fed cut rates was December 16, 2008, where there was a market decline as the S&P 500 continued to fall by of over 25% by March 9, 2009.

While the cuts in 1996 and 1998 managed to positively impact the economy and drive up the S&P 500 more than 20% in the following year.

What will the impact of the Fed cuts be this time around? I am reminded that prognosticators often have a poor aptitude in predicting what’s next. There is a correlation between the Target Federal Fund Rate and the 10 Year Treasury Rate, providing an example for us of how hard it is to predict what’s next.

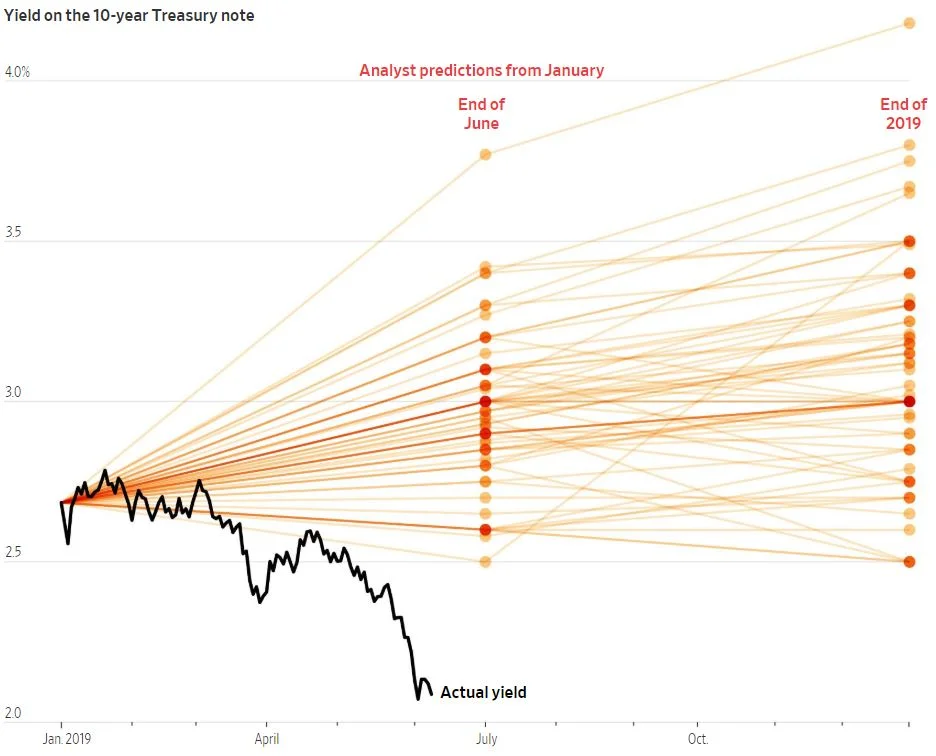

In an October 2018 survey conducted by the Wall Street Journal, more than 50 economists predicted where they thought the 10-Year Treasury yield go in 2019.

Did any of the analysts guess correct? No, not one was close. With the Fed’s recent announcement, the delta continues to grow between their assumptions and reality. As of August 1st, the yield for the 10-Year Treasury Note was below 2%.

Sources: WSJ Survey of Economists (predictions); Tullett Prebon (actual)

What does this say about our ability to predict the future of the stock market, interest rates and the next “10 Hot Stock Picks For 2019”? Betting our financial future on radio personalities, financial websites, and even economists can be emotional and folly. Building a financial plan provides a solid foundation for one’s financial future, rather than basing it on intuition and predictions.

HOW CAN WE HELP?

Are you interested in trading in guesswork for a disciplined process, or learning more about comprehensive financial planning (we call this hiPlan™)? Please call us at (503) 905-3100 or let us know about your needs.

Further Reading

Here’s what that Fed rate cut means for you, CNBC

Federal Reserve, Press Release on Rate Cut.

Bloomberg, Why Are Economists So Bad at Forecasting Recessions?

WSJ, Some Investors Had Hunch Yields Were About to Fall.

REFERENCES

Chilkoti, A., & Kruger, K. (2019, June 9). Some Investors Had Hunch Yields Were About to Fall. Retrieved from www.wsj.com

Board of Governors of the Federal Reserve System (2019). Federal Reserve issues FOMC statement [Press release]. Retrieved from: https://www.federalreserve.gov/newsevents/pressreleases /monetary20190731a.htm