Find a Dependable Retirement Plan for Your Small Business

Many small businesses are behind.

There are several retirement solutions that can help you secure your future and that of your employees, but the decision-making process can be challenging.

A survey of nearly 2,000 small business owners in 2017 found that over a third (34%) don't have a retirement plan. The main reason for this cited (by 37% of those respondents) was that they could not generate enough revenue to save. Another 18% of the business owners without retirement savings are looking at selling the businesses as a retirement plan.

Many small business owners avoid or are unaware of the crucial elements of planning for their futures. Here are a few questions to ask yourself before deciding on a retirement plan:

Do you have employees or expect to in the future?

Is it important that employees can contribute to a retirement plan?

Is your priority higher contributions or ease of administration?

Would you like plan contributions to be deductible as a business expense?

What retirement plan options do you have?

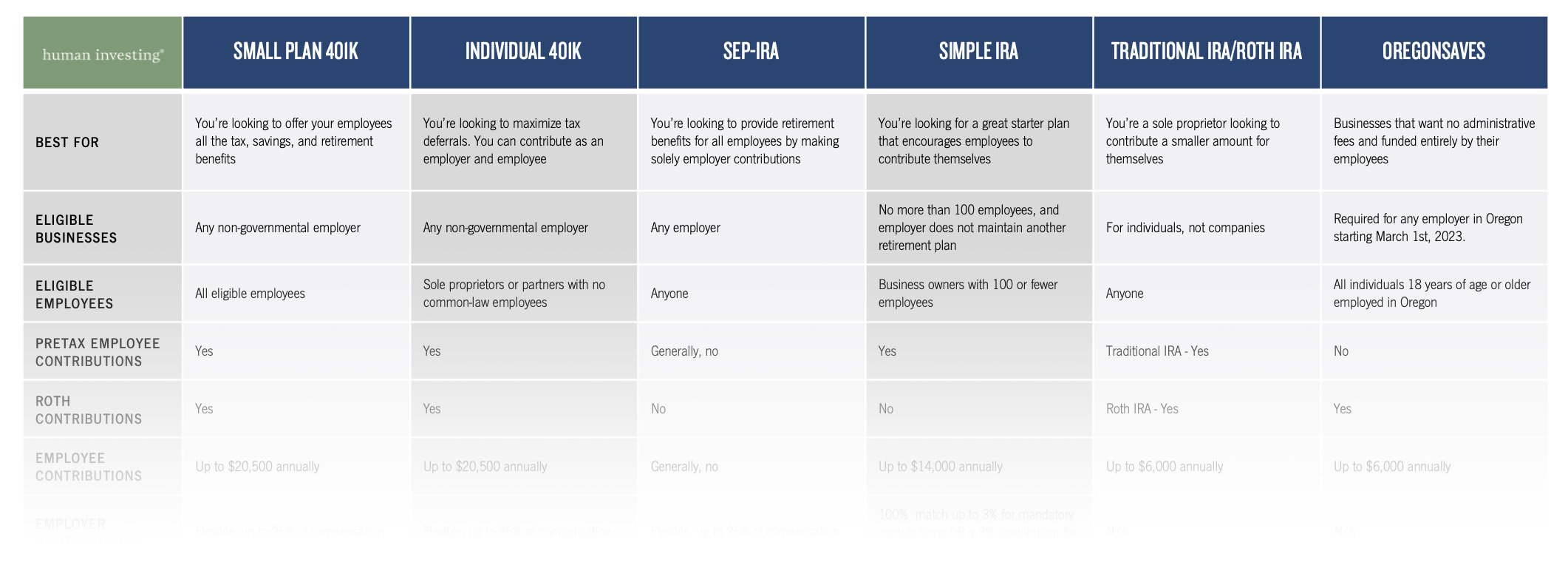

With help from Vanguard, we put together a one-sheeter that gives details and considerations on several small business retirement plans, including Small Plan 401(k), Individual 401(k), SEP IRA, Simple IRA, Traditional IRA, and Roth IRA.

Source: Vanguard

Keep in mind that Oregon law requires all employers who do not offer a qualified retirement plan to facilitate OregonSaves.

As of 2025, all existing Oregon businesses should already be registered with OregonSaves or have a certified exemption. Newly formed businesses must register or certify exemption by July 31, 2025. The rules are identical to a Roth IRA, where employees contribute post-tax dollars to the plan and distribute savings tax-free.

If your business already sponsors or wants to sponsor a 401(k) or another qualified retirement plan, you are not required to participate in OregonSaves but must certify the exemption online. Exemption certificates are valid for three years from the filing date.

Employers who don’t sponsor a retirement plan or participate in OregonSaves by the appointed deadline may be penalized $100 per affected employee. The maximum fine per year is $5,000. More details can be found here: OregonSaves

Which plan is best for you?

401(k): Best retirement plan for large and established small businesses.

Safe Harbor 401(k): Best retirement plan for small businesses with less than 100 workers to avoid expensive annual compliance testing.

Solo 401(k): Best retirement plan for maximizing contributions.

SEP IRA: Best retirement plan for a sole proprietor who wants easy administration.

Simple IRA: Best retirement plan for employee participation in funding the retirement account.

Profit Sharing Plan: Best retirement plan for business owners who want more 401(k) contributions and tax benefits.

The responsibilities of owning and operating a small business can be overwhelming, but having the right retirement plan and advocates on your side can make all the difference. If you would like assistance making the best decision for your business, we invite you to schedule an appointment on the calendar below.