Investment Strategies At Different Points In Your Life

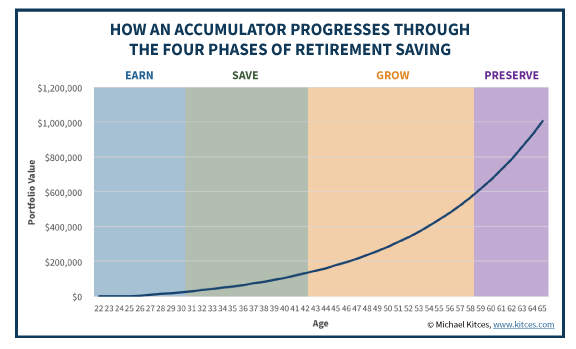

A blog that our advisors frequent is https://www.kitces.com. On the surface, the structure of the site may look a little unconventional, but after spending some time at the site you will realize that this guy really knows his stuff. One of his recent articles struck a chord with me. Kitces speaks to all the phases of investing and how each “moves the needle” when it comes to saving for retirement and creating an income to supplement a desired retirement. The article breaks down your working years into 4 distinct phases: Earn, Save, Grow, and Preserve. Before I get into the phases let’s have the chart below (showing someone saving $300/month at 8% earnings spanning from age 25 to age 65) guide us through the phases.

Something that stood out to me in the article was how powerful savings is at the beginning of retirement and how impactful an appropriate allocation is towards the end of your working years.

Consider these two scenarios:

Regardless of whether you are 25, 35, or 45 if you are just starting to save what matters even more than the allocation is how much you are contributing. Imagine if you have an account balance of $1,000 and contribute another $1,000 over the course of the year. With a $1,000 contribution you’ve doubled your money (or grown your balance by 100%). In contrast, if you were to have an above average year of performance, say 10% rate of return, but did not contribute to your account balance you would have grown your account $100. While $100 is nothing to dismiss, we can hopefully agree that it's not going to impact your retirement in a drastic way. Later on in life as your balance grows that 10% return will have a much greater dollar impact, but during the early phases of saving your contributions do most of the heavy lifting when building your account.

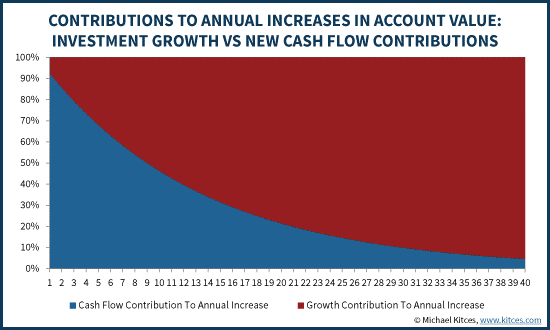

As you continue to work and save the pendulum will slowly swing from contributions having the most impact on your account to account growth (or capital appreciation) impacting your account. The below chart (again from Kitces) gives a representation of the importance your allocation has as you progress in your career.

As you can see there is truly a shift in what influences your account most over time. Let’s look at that same $1,000 contribution later in life. Assume you’ve been saving for 20 years and your retirement account has grown to $250,000. The same $1,000 contribution now has less than a 1% impact on your account with the 10% rate of return on your account doing the heavy work to increase your account value by $25,000 (keep in mind a negative 10% return has the same impact on the opposite end of the spectrum).

So where do you go from here? Your savings rate and your allocation are going to impact your account value throughout the course of your working years with each providing great impact at different times during the course of your savings life. In fact, on average after saving in an account for 20 years, market growth accounts for 75% of increases in your account! A great rule of thumb is if you can pinch pennies in your 20s and 30s to build a great base in your account while keeping a growth allocation throughout your working years, you’re on your way to a successful retirement plan.

Call 5039053100

Email 401k@humaninvesting.com Sources