Is Owning Nike Stock in Your Nike 401(k) a Good Idea?

Understanding the Rules, Risks and Special Tax Incentives

As a Nike employee, it is common to have a desire to participate in the success of the company. For many, this opportunity exists within the Nike 401(k) by investing retirement funds in Nike stock. Even though it is available, is it a good idea and if so, how much is appropriate? We will explore the rules, risks, and special tax incentives that exist within the plan.

The Nike Plan Rules and Limitations

Future Investments in the Nike Stock Fund are limited to a maximum of 10%, which includes Employee Contributions, Nike Matching, and Rollovers.

Existing Investments in the Nike Stock Fund:

You can fully diversify out of Nike stock at any time by moving the dollars to a different available investment fund(s).

If you want to increase your amount in the Nike Stock Fund from other existing investment funds, Nike will only allow it if the Nike Stock will be 20% or less of your overall account balance.

Even though Nike places the 20% limit on transfers, there is no limit on the total amount of stock you can accumulate in the Nike Stock Fund. If you accumulate more than 20%, you can still contribute up to 10% to the Stock Fund.

Why the limitations on Nike Stock Fund within the RSP 401(k)?

You can see by the rules and limitations that Nike wants to encourage participation in the stock but in a responsible manner. It allows you to regularly contribute small amounts over time but with a cap of 10% at that time. It wants to discourage employees from making quick short-term decisions to move a large portion of their retirement savings into the Stock Fund by limiting that to 20%. To balance all of this out, it leaves an unlimited upside for the stock to grow in the 401(k) by having no overall limit in the value. Nike created guardrails to limit the risk and make sure that investment in Nike Stock is a long-term decision.

Understanding the Risks

Risk #1: Concentrated Stock Risk

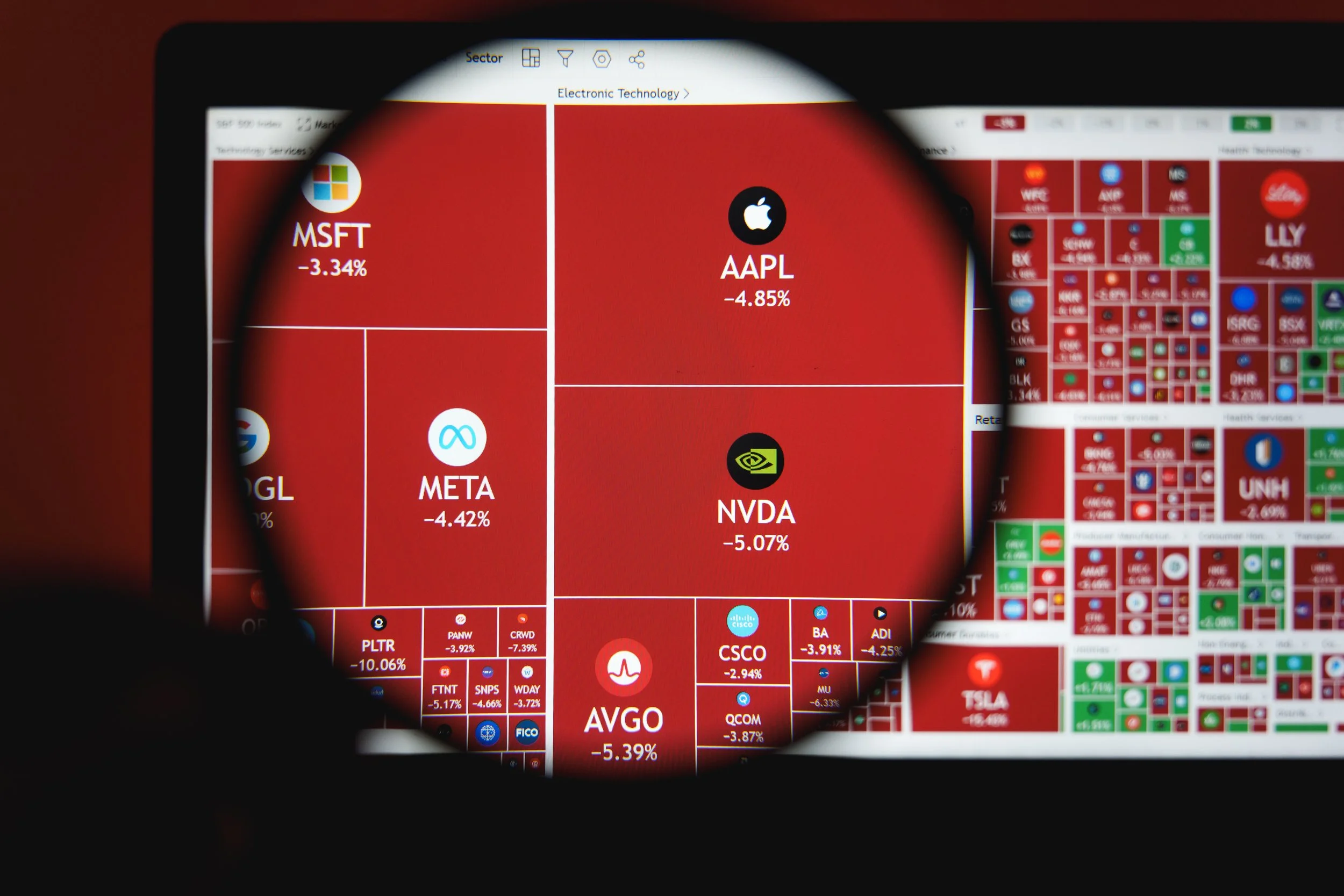

Any stock or portfolio of stocks is subject to one type of risk known as Market Risk, which affects the entire stock market. Examples of factors that can create Market Risk are changes in interest rates, government regulations, taxes, and wars.

There is an additional risk that can affect you when you hold a large amount in a single stock. This risk is known as Company Risk, and it is related to the financial viability of that specific company. The emergence of new trends, technology, or even a scandal can decimate or take down an entire company. Examples of companies that have experienced this type of risk are Enron, Sears, Blockbuster, and AOL. This type of risk can be mitigated by diversifying and owning multiple stocks or investing in a diversified stock mutual fund or exchange-traded fund (ETF).

Risk #2: Employment Risk

If a company ever begins to struggle financially, the ramifications can likely be seen in the elimination of jobs and lower bonus’ for employees since they are tied to company performance. At the same time, the stock price of the company will typically drop, impacting the personal savings of anyone owning that stock. The effect of a stock price drop in your personal savings can become magnified if it happens simultaneously with losing your job or the elimination of your bonus.

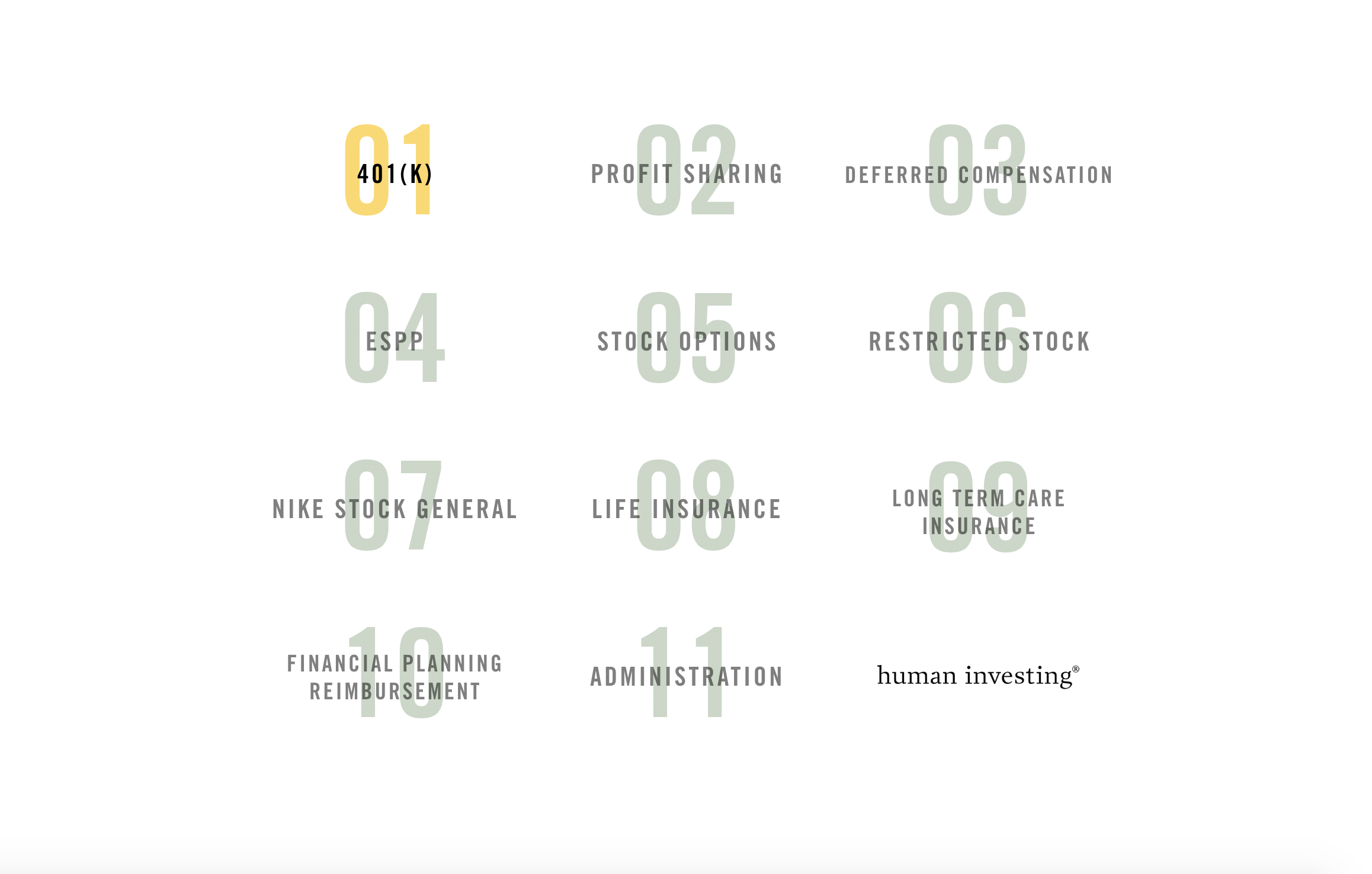

How much Nike stock is too much?

The first step is to assess your overall exposure to Nike stock. Depending on the level at Nike, employees have access to different forms of Nike stock as part of the benefits package. It is common for Nike employees to accumulate a significant amount of Nike stock through benefits in the form of ESPP, Stock Options or Restricted Stock Units (RSUs). If you incorporate any Nike stock owned in your 401(k) and compare that to any other investments (retirement accounts, cash, real estate), what percentage of your assets are in Nike stock? So once you know the percentage, what is the right percentage for you?

Diversification and the “Rule of Thumb”

In the financial services industry, there is a rule of thumb that states that you should not own more than 5% or 10% of your overall investment portfolio in one single stock since it can create a significant amount of risk related to that Company Risk described earlier in this article. There definitely is prudence to this rule of thumb, but it can be challenging for employees to follow this “rule of thumb” strictly because of the stock benefits provided by Nike.

When It Can Make Sense to Exceed the Rule of Thumb

Part of maximizing your time at Nike is to take advantage of the benefits that are provided. Nike stock benefits all include a special incentive when compared to normal Nike stock. Whenever you consider risk, it should be evaluated in relation to the potential reward, so the higher the risk, the higher the reward should be for it to be a worthwhile investment. These incentives from the Nike benefits increase the reward so it can justify taking the additional risk of owning a concentrated amount of one stock.

The GAME-CHANGING Incentive for Owning Nike Stock in Your 401(K)

Net Unrealized Appreciation (NUA)

There is a unique tax strategy that exists within the Nike 401(k) that can make owning Nike stock more advantageous. The strategy is known as “Net Unrealized Appreciation” or “NUA” and applies to qualified retirement plans where you own company stock within the plan.

Net Unrealized Appreciation is the difference between what you have contributed (average cost basis) to the Nike Stock Fund and what it is worth today. Essentially, it is the growth above your contributions to the Nike Stock Fund.

The IRS has a provision that allows you to potentially receive a preferential tax rate on the NUA amount when you distribute Nike Stock from your 401(k) if you follow very specific rules. This preferential tax rate can save you between 13-37% in income taxes on the NUA amount depending on your specific situation.

When you make pre-tax contributions to your 401(k), future distributions will be taxed as Income when you take withdrawals from that account. If you follow the NUA Strategy steps, you would distribute all or part of the Stock Nike Fund as Nike Stock, pay taxes as Income on the contribution (Average Cost Basis) portion only. All growth of the Nike Stock (NUA) would be subject to a lower preferential tax rate of Capital Gains, which you can delay until you want to sell the Nike stock.

How to take advantage of the NUA strategy:

Nike stock must be transferred out of the 401(k) in-kind and cannot be sold before transfer.

The entire Nike 401(k) balance must be distributed in a single tax year. This could mean that the Non-Nike stock portion could be rolled into an IRA.

The distribution of the entire account can only be made after a “triggering event,” which are Death, Disability, Separation from Service, or Reaching age 59 ½.

As a future tax planning strategy, you could wait to sell the NUA Nike stock until you were in a low enough tax bracket and potentially have No Federal Capital Gains tax on the NUA amount. The most common timeframe for this opportunity is after retirement and before age 73, when Social Security income and required minimum distributions from your IRAs can force you into a higher tax bracket.

The final and most important consideration is how your Nike stock exposure fits into your overall financial plan. If you have a financial plan to show you how dependent your financial future is on Nike stock, this can help you make the most well-informed decision on your overall Nike stock exposure.

If you want to know more about incorporating Nike stock within your 401(k), please get in touch.

You can schedule time with me on Calendly, e-mail me at marc@humanvesting.com, or call or text me at (503) 608-2968.