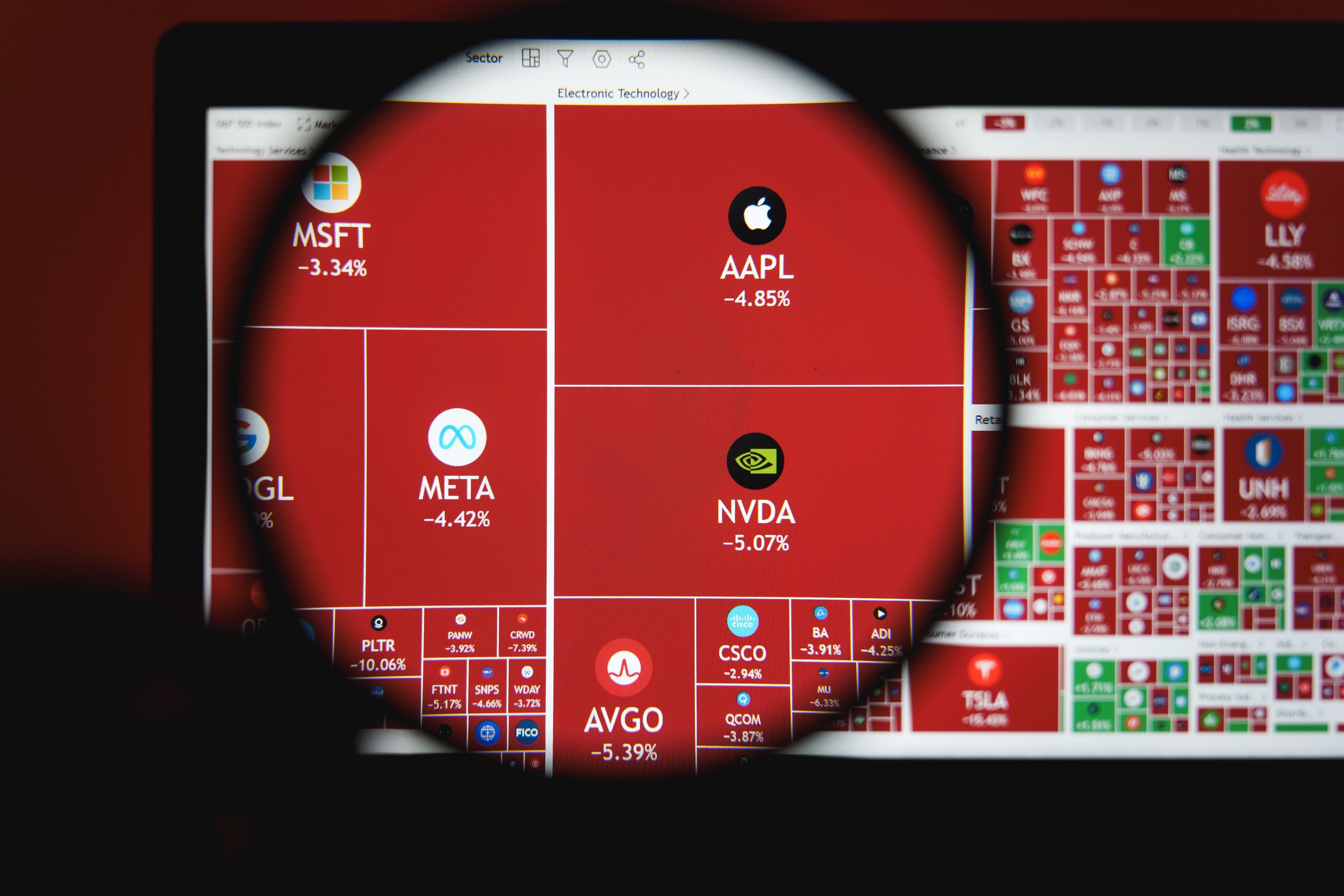

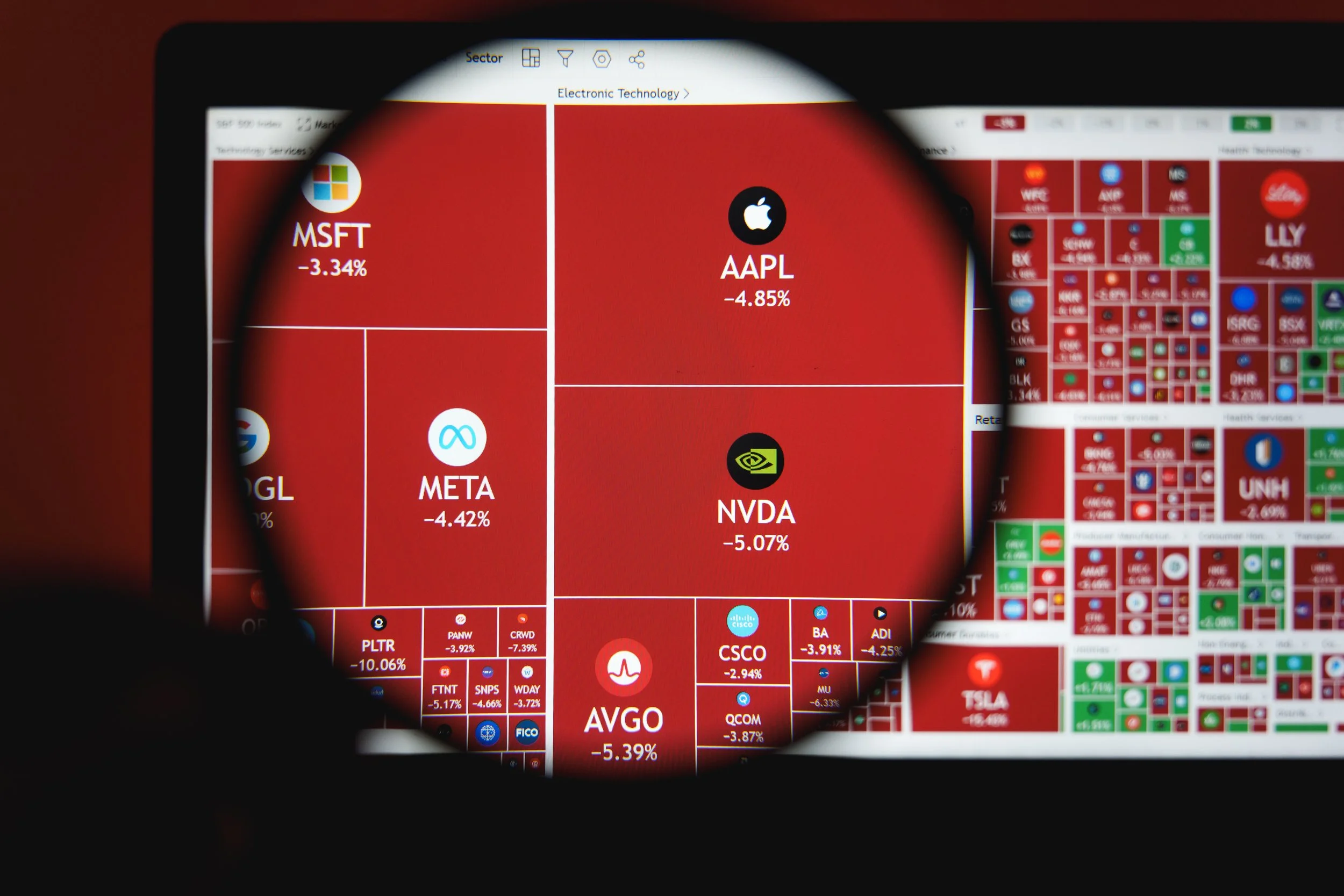

How to Approach Your RSUs, ESPPs & Stock Options in a Volatile Market

Given the recent stock market volatility, it is important to re-evaluate your plan for your Stock Benefits (RSUs, ESPP, Stock Options) to take advantage of opportunities that may arise in this environment.

A well-crafted strategy for your stock benefits should focus on:

Personal needs and situation

Maximizing the benefit

Minimizing taxes

Diversifying strategically

Incorporating the investing principle of “Buy Low + Sell High” (when available)

The Investing Principle of Buy Low + Sell High

A fundamental investing strategy is to buy stocks when they are undervalued and sell them once they’ve appreciated, allowing you to benefit from the price increase. While timing restrictions from stock benefits may limit this approach, it’s important to integrate it whenever possible.

Strategies for your stock benefits based on your timelines

How do you incorporate your personal situation and needs with an effective strategy during the current market volatility? We will dive into several strategies that address the needs for different time periods, since timelines are an even more important factor during volatile markets.

For short-term needs (2 years or less)

Stock compensation can provide funds for expenses beyond salary and bonus, such as tuition, home repairs, vacations, or tax bills.

First, consider selling recently purchased ESPP shares. Since you're buying these shares at a discount while the stock price is low, selling them for a gain doesn’t violate the “buy low, sell high” principle.

Next, consider selling recently granted and vested RSUs. Like the ESPP strategy, these RSUs can help meet short-term cash needs. The main difference is that RSUs are often granted at a higher price—before a market downturn—so their current value may be lower than when they were granted. However, if the RSUs were granted recently, the price difference might be minimal, making them a more attractive option to sell.

For intermediate term needs (3-7 years)

The intermediate term timeframe can be more challenging, since the answer isn’t clear and should depend on your risk tolerance.

The more conservative approach: Sell existing RSU grants that will vest in the next 12 months. This strategy reduces your exposure to stock volatility but doesn’t fully align with the “buy low, sell high” principle, since RSUs may be worth less than their original grant price. However, future annual grants—typically part of your compensation—can help offset this by being issued at lower prices during a market downturn.

A higher-risk approach: Hold all existing RSUs until the funds are needed, with the hope that the stock price recovers before then. This could allow you to better capitalize on the “buy low, sell high” strategy. The risk, however, is that the stock may not recover in time—or at all—leaving you potentially forced to sell at a loss when cash is needed.

The balanced approach: To hedge your bets, consider combining both strategies: sell some RSUs now while holding others for potential future gains. This hybrid approach can offer peace of mind, helping you avoid second-guessing your decision if the market doesn’t move in your favor.

For long-term needs (8+ years)

Planning for long-term goals like retirement tends to be more straightforward.

For vested RSUs and ESPP: Consider a strategy called Tax Loss Diversification, a variation of traditional tax loss harvesting. Tax loss harvesting involves strategically selling investments in non-retirement accounts to realize a loss, which can reduce your tax bill. You then reinvest that money into similar investments to stay in the market and benefit from potential recovery. With Tax Loss Diversification, the added benefit is that you're also shifting from concentrated stock (like your company shares) into a more diversified investment—such as an index fund with exposure to hundreds or thousands of companies. When the market is rising, diversifying can be painful due to the capital gains taxes involved, so it's wise to take advantage of a downturn as a window of opportunity.

Stock Options, RSUs, and ESPP: Stock Options offer the greatest potential upside but also carry the highest risk, especially when they’re “underwater” (i.e., the stock price is below the option’s strike price, making them currently worthless). In these cases, the best move is often to wait and give the stock time to recover, maximizing the chance to capture that upside. For RSUs and ESPP shares that you intend to hold for long-term growth, the best approach is often patience—holding through downturns and waiting for both the stock price and the broader market to recover.

The Exception: Expiring Stock Options

Expiring stock options require timely decision-making due to looming deadlines. Your strategy should reflect your risk tolerance, the number of options involved, and how critical they are to your overall financial goals.

Conservative approach: Sell all options now to avoid the risk of further price declines. This minimizes downside but also limits any potential future upside.

Moderate approach: Sell portions of your options at predetermined dates over time, balancing risk reduction with the opportunity for gains.

Moderately aggressive approach: Sell portions based on specific price targets. If those targets aren’t reached, you may need to sell the remaining options closer to expiration to avoid losing them entirely.

Aggressive approach: Hold all options until close to expiration in hopes of a stock price rebound or significant upswing. This offers the most potential upside, but also the highest risk of loss if the stock doesn’t recover in time.

Market volatility may feel uncertain and carry risks, but it also creates rare opportunities to make the most of your stock benefits. If you haven’t revisited your strategy recently, now is a great time to reassess and align your plan with the current market landscape.

Remember, there’s no one-size-fits-all approach. The right strategy depends on your company’s stock performance, your personal financial goals, risk tolerance, and overall circumstances. Use this moment to take control, make informed decisions, and turn today’s challenges into tomorrow’s opportunities.

For questions or more information about managing stock benefits during current conditions, please call (503) 905-3100 or contact us.

Disclosures: The information provided in this communication is for informational and educational purposes only and should not be construed as investment advice, a recommendation, or an offer to buy or sell any securities. Market conditions can change at any time, and there is no assurance that any investment strategy will be successful. Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results.

Diversification does not guarantee a profit or protect against a loss in declining markets. Asset allocation and portfolio strategies do not ensure a profit or guarantee against loss.

This material is not intended to provide, and should not be relied upon for, tax advice. Please consult your tax advisor regarding your specific situation.

The opinions expressed in this communication reflect our best judgment at the time of publication and are subject to change without notice. Any references to specific securities, asset classes, or financial strategies are for illustrative purposes only and should not be considered individualized recommendations.

Human Investing is a SEC Registered Investment Adviser. Registration as an investment adviser does not imply any level of skill or training and does not constitute an endorsement by the Commission. Please consult with your financial advisor to determine the appropriateness of any investment strategy based on your individual circumstances.