Making the Most of Your Social Security Benefit

The more I work through financial planning scenarios with individuals and families the more I realize how important it is to have a clear understanding of your social security benefit. A study in 2014 showed that 55% of retirees defined social security as their main source of retirement income and 88% responded saying that social security would need to be a steady source of income in order to meet retirement goals. These numbers make perfect sense due to longer lifespans, increased healthcare costs, and corporations using 401k accounts rather than pension plans. Now more than ever, it is becoming necessary to have a steady stream of income that has the ability to last the rest of your life.

The goal of this post is simple; equip you with tools on how to best take advantage of your Social Security benefit. See below for three things to consider when looking to get the most out of a program you’ve been paying into your entire working career:

1. The Waiting Game

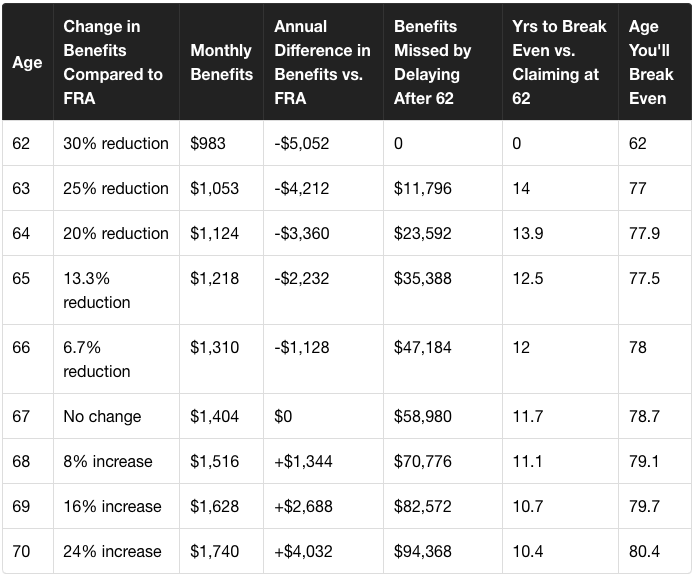

Generally speaking, you’re eligible to receive 100% of your Social Security benefit at your full retirement age (FRA) which is currently between the ages of 66 and 67. If you decide to claim before your FRA, the benefit amount will be reduced. For each month you delay claiming Social Security your benefit increases until you reach age 70. If you were born between 1943 and 1954 here’s an illustration that provides some context to your benefit percentage:

Notice that between your FRA and age 70 your benefit increases at a rate of 8% per year. This is risk free rate of return that you receive just for delaying your benefit. Note that investors in the stock market who have the potential to lose 10% of their money in a given week are very pleased with an 8% rate of return in a given year!

2. Finding Break Even Points

Once you have an understanding of why it might make sense to wait to take your benefit, combine that with a knowledge of your personal health and family history, and you're ready to make an educated guess regarding when to take your benefit. Below are a couple key numbers to keep in mind.

Between 77 and 78

Is the age where an individual who files at FRA today catches up and exceeds the age 62 filer in total money collected. Also remember that the FRA filer has higher monthly payments going forward so the gap is only going to increase.

Between 80 and 81

Is the age where an individual who files at age 70 catches up with and exceeds the age 62 filer in total money collected.

Between 82 and 83:

Is the age when the age 70 filer catches up with and exceeds the FRA filer in total money collected. Many variables can factor into these equations such as; taxes, employment status, and other financial considerations. While I encourage you to dig into these calculations on your own, make sure to consult a financial professional (like Human Investing) when making these decisions.

3. Additional Income and Social Security

While there are many things to consider when filing for Social Security don’t forget how other income affects your benefit. Many people that I've spoken with about this issue commonly confuse "keeping" your benefit at FRA vs. "being taxed on" your benefit at FRA. The short of it is once you reach FRA you can keep all of your benefits, but you can also be taxed on those benefits contrary to what some people think. See below for a summary on the differences between keeping your benefit and being taxed on your benefit when accounting for additional income:

If you work, and are full retirement age or older, you may keep all of your benefit, no matter how much you earn. If you’re younger than full retirement age, there is a limit to how much you can earn and still receive full Social Security benefits. If you’re younger than full retirement age during all of 2015, the government must deduct $1 from your benefits for each $2 you earn above $15,720. If you reach full retirement age during 2015, the government must deduct $1 from your benefits for each $3 you earn above $41,880 until the month you reach full retirement age. This brochure provides some additional commentary on how working income factors into your benefit.

Some people have to pay federal income taxes on their Social Security benefits. This usually happens only if you have other substantial income (such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return) in addition to your benefits. This link provides some more details on the taxes you pay on your social security when factoring in other income. Lastly, this web page gives the best example I've seen when factoring in taxes and Social Security.

By looking at the advantages of waiting to take your benefit, some break-even points, and tax strategies for social security hopefully you see that it takes time and effort to make the most of your benefit. It’s possible to literally leave tens of thousands, if not hundreds of thousands of dollars on the government's table if you’re not thoughtful in how you receive this benefit.

So, if you have questions on your Social Security benefit and how it affects your retirement timeline, feel free to email or call Human Investing at any point. We’d love to partner with you in making the most of this benefit.