As the person who manages most of the financial decisions in your household, it's natural to want to ensure your spouse is financially secure if you're no longer around. The financial burden on a widow can be overwhelming, especially with the lesser-known tax implications that often follow the death of a spouse. By planning ahead, you can safeguard your spouse from unnecessary financial stress.

Taking a few proactive steps now can help shield your spouse from these challenges and give them peace of mind. This guide will walk you through the financial implications of losing a spouse and what you can do today to ensure you preserve your assets for their well-being.

There are two common tax shocks you want to get ahead of:

Tax shock #1: The “survivor's penalty”

After a spouse dies, the widow is often left facing what’s called the "survivor’s penalty," which refers to higher taxes that result from a change in filing status. While you may currently file taxes jointly as a married couple, your spouse would be required to file as a single taxpayer after your death. This change can increase their tax bill substantially.

Here’s why this matters:

Higher Marginal Tax Brackets: After your passing, your spouse’s income could fall into a higher tax bracket due to the narrower brackets for single filers compared to married couples.

Reduced Standard Deduction: In 2024, the standard deduction for married couples filing jointly will be $29,200, but for single filers, it will be just $14,600. This reduction will increase the amount of income subject to taxes.

Looking ahead, it’s important to note that individual tax brackets are set to revert to pre-2018 levels in 2026, further increasing the tax burden on your spouse if you’re no longer here.

Tax shock #2: Hefty taxes on IRA distributions

If your spouse inherits your retirement accounts, such as an IRA, they’ll also face higher taxes due to Required Minimum Distributions (RMDs). These distributions are considered ordinary income, and combined with their new single filing status, could push them into an even higher tax bracket! The larger your IRA, the bigger this tax burden becomes.

What may seem like a well-planned nest egg now could become a source of financial strain later on due to taxes. By understanding this, you can take steps now to lessen the impact on your spouse’s financial future.

Firsthand example from a retired couple

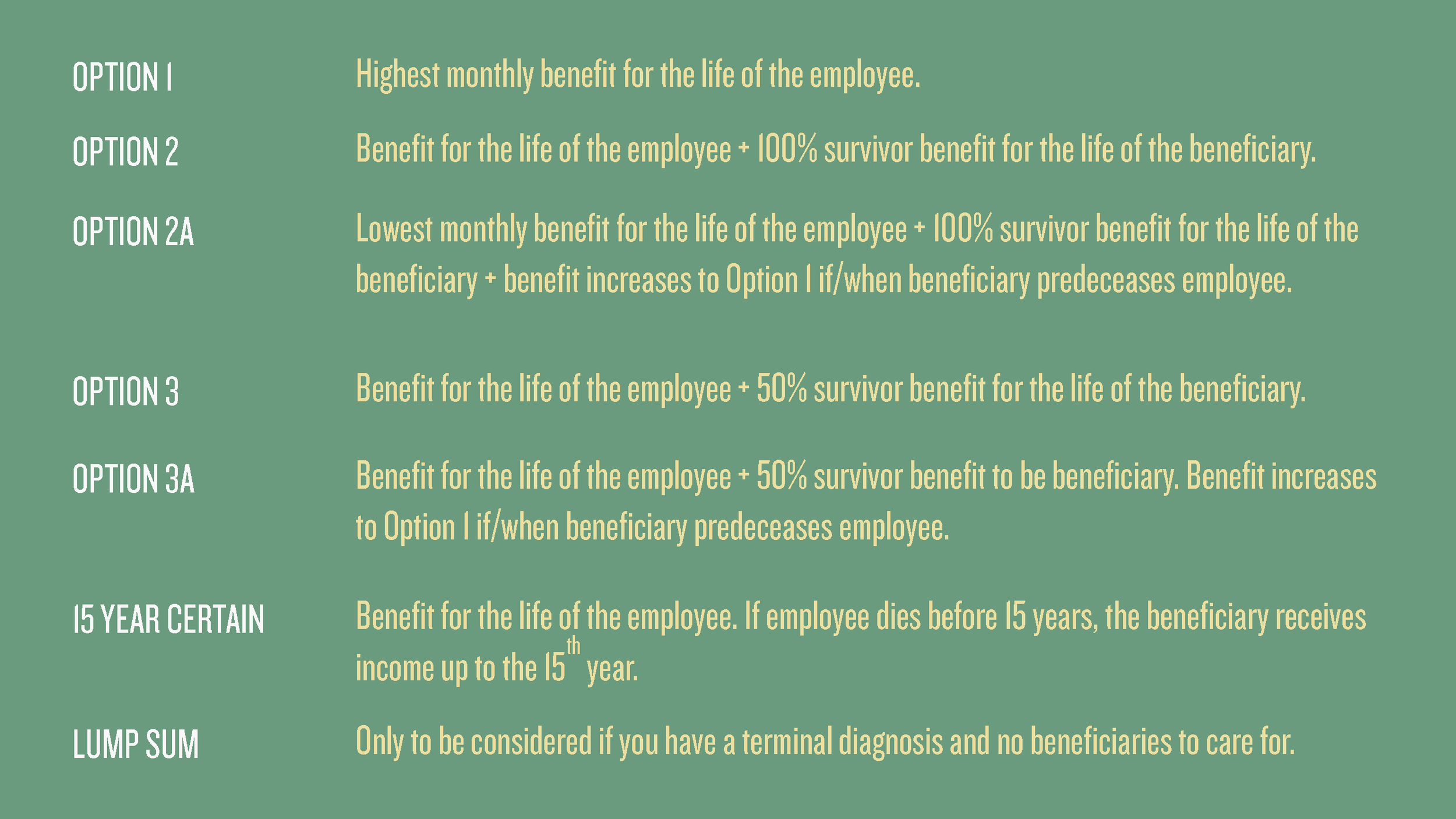

When Spouse #1 and Spouse #2 file jointly, both receive Social Security and must take Required Minimum Distributions (RMDs) from their retirement accounts. Let’s look at their income and tax bill while filing as Married Filing Jointly (MFJ):

Now, if Spouse #1 passes, Spouse #2 becomes the sole taxpayer, facing a shift to the Single filing status. Spouse #2 is still required to take the same RMD amount as the beneficiary of the retirement accounts and claims Spouse #1’s higher Social Security benefit under the survivor benefit rules. However, Spouse #2 cannot receive both Social Security payments, so Spouse 2’s income is reduced. Here’s what their tax situation would look like:

Despite an almost 16% drop in income, Spouse #2's tax bill increases by over 30%, showing the impact of the survivor’s penalty on income and tax liability.

This example highlights why it’s essential to plan ahead to help lessen the financial burden on surviving spouses.

Four strategies to protect your spouse from a heavy tax burden

Fortunately, there are several strategies you can use to reduce the tax burden on your spouse in the future:

Complete Tax Projections: To best plan for the future and make calculated decisions, it’s necessary to understand your expected lifetime tax bill. A comprehensive tax projection will identify your current and future tax rates, potential gaps, and overall lifetime tax obligations. This helps you make informed decisions today.

Partial Roth IRA Conversions: Converting part of your traditional IRA into a Roth IRA over time can help reduce the tax impact on your spouse later. While you’ll pay taxes on the conversion now, the Roth IRA’s future growth will be tax-free, meaning less taxable income for your spouse when they inherit it.

Take Advantage of the Step-Up in Basis: For non-retirement investments, your spouse can benefit from a "step-up in basis." This allows the cost basis of assets to reset to their value at the time of your death, potentially eliminating capital gains taxes if they were to sell those assets. Understanding this advantage can save your spouse from an unexpected tax bill down the road.

Naming Non-Spouse Beneficiaries: Another option to reduce taxes is to name non-spouse beneficiaries for some of your retirement accounts, such as your children and grandchildren. While this can lessen the tax burden for your spouse, it’s essential that these non-spouse beneficiaries understand the new withdrawal rules set by the SECURE Act. This law requires that non-spouse beneficiaries fully distribute inherited IRA funds within 10 years, which could trigger substantial tax liabilities for them if not carefully planned. Additionally, consider adding a qualified charity as a beneficiary to your IRA for a tax-free transfer gift.

You can start planning ahead with your spouse now

Planning for your spouse's financial future can be an impactful gift. While it may be uncomfortable to think about what happens if you're no longer here, taking proactive steps now will ease your spouse’s transition during a difficult time. Here are a few key actions to consider:

Have Regular Financial Discussions: Make sure your spouse understands your financial plan, knows how to manage accounts, and is familiar with where to find important documents.

Work with a Fiduciary Financial Advisor: A financial advisor can help you develop a plan tailored to your family’s situation. By understanding your overall financial situation, an advisor can provide guidance now and assist your spouse when you're no longer there. They can also help with tax projections, Roth conversions, beneficiary updates, and staying ahead of tax law changes.

Create a Clear, Organized Estate Plan: Ensure your estate plan is up to date, including wills, trusts, health care directives, power of attorney, and beneficiary designations. This will help prevent unnecessary complications for your spouse during an already challenging time.

Be Proactive About Taxes: By planning for your spouse’s future tax obligations, you can reduce the “survivor’s penalty” and give your spouse more financial security.

You’ve worked hard to provide for your family, and planning for your spouse’s financial future if something happens to you is a vital part of that legacy. While it may seem difficult to know the "right" time to prepare, we can't predict the future. Whether you're already in retirement or facing a serious diagnosis, projecting out scenarios can make all the difference for your spouse’s security.

Don’t wait until it’s too late—start planning now to protect your loved one from unnecessary financial strain.