The 3 Questions to Ask to Build a Solid Retirement Income Plan

Saving for retirement can seem straightforward compared to the daunting task of converting your hard-earned savings into retirement income.

When building a retirement income plan knowing what questions to ask will potentially save you money, lower your overall tax bill, and provide you peace of mind. Here are three questions you should ask when building a retirement income plan, as well as some considerations:

Question 1: What sources are available to you?

There are many ways to fund retirement. Thus, no retirement plan looks the same. To begin to understand how you will fund retirement, give yourself a quick assessment. What sources are available to you and how much?

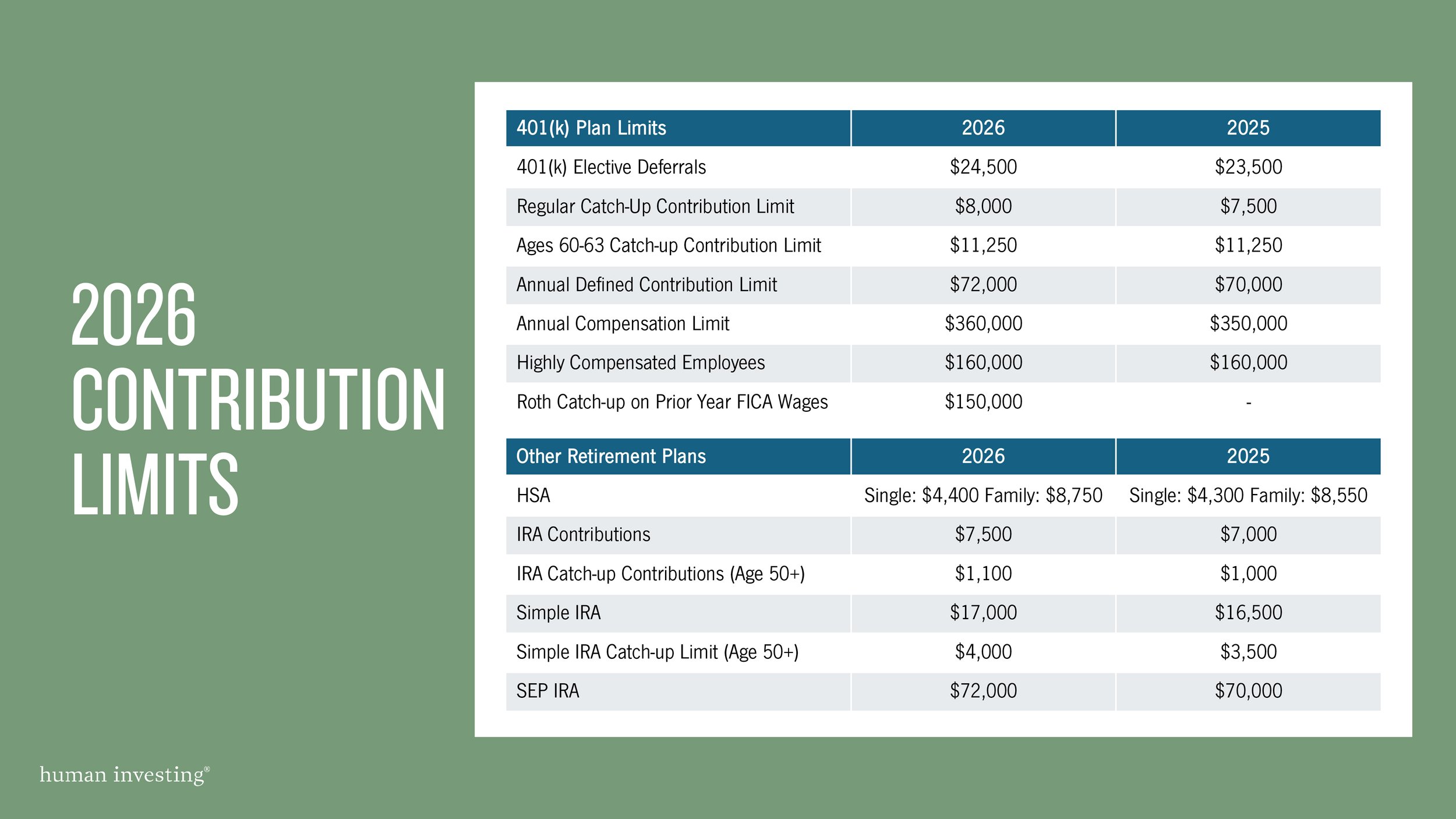

What you should consider: Simplicity in retirement. This can be achieved by consolidating retirement accounts such as your employer-sponsored retirement plans into an IRA. See - Why an IRA makes more sense in retirement than your 401(k)

Question 2: When do you plan on receiving income from your different sources?

There are a lot of unique planning opportunities regarding when to start receiving your sources of income. Knowing when to access these different sources can provide efficiency, lower taxes paid, and increase your retirement income.

The IRS and Social Security Administration have imposed rules that coincide with specific ages. Familiarizing yourself with these key rules and ages associated with accessing popular income sources can help you begin to answer the question of “When?”. Here are some key ages to consider when building a retirement income plan around these popular sources -

Tax-deferred accounts (401(k)/403(b)/IRAs):

Age 59.5 - you can’t access tax-deferred dollars without a 10% early withdrawal penalty before age 59.5. The IRS does highlight some exceptions to the 10% penalty for premature withdrawals.

Age 72 (or age 70.5 if you were born before 1951) – The IRS requires that an individual withdraws a minimum amount of their retirement plans (i.e. an IRA) each year starting in the year they reach age 72. This requirement is known as a required minimum distribution or an RMD. Account-holders that do not take their full RMD will be faced with a stiff excise tax equal to 50% of the RMD not withdrawn.

Social Security:

Most Americans can begin claiming Social Security retirement benefits as early as age 62, or as late as age 70. Once you stop working, it can be tempting to claim Social Security as soon as possible to subsidize your income. However, it’s often strategic to delay Social Security as long as possible. The longer you delay claiming your Social Security benefit the greater your guaranteed inflation-adjusted monthly benefit will grow (up to age 70). Factors that should be considered when creating a plan around Social Security are life expectancy, other sources of retirement income, and spousal benefits.

What you should consider:

Which sources you will draw first?

Should you delay social security as long as possible?

How long each source will last?

Question 3: What are the tax implications of accessing your retirement income sources?

Not all income sources are taxed at the same rate. Take the time to understand your applicable taxes and build a tax-sensitive retirement income plan to prevent paying unnecessary amounts to the government.

What you should consider:

The tax implications of the aforementioned RMD’s. RMD’s can unknowingly force you to pay a higher than necessary tax bill once you are forced to take required withdrawals.

A tax bracket optimization strategy that provides savings on your overall retirement tax bill. This can be especially beneficial in the early years of retirement. Learn more about Tax Bracket Optimization here.

The misfortune of not having a retirement income strategy.

Heading into retirement without an income strategy is financially precarious. To illustrate the benefit of creating an effective plan, we are sharing a hypothetical example. Meet Charlie and Frankie:

Charlie (age 61) and Frankie (age 60) live in Oregon and each plan to retire when they turn age 62.

Charlie has $1,000,000 in a 401k/traditional IRA.

Frankie has $250,000 in a 401k/traditional IRA.

They have $150,000 in joint accounts.

At age 67 Charlie and Frankie are eligible to receive $2,990/month and $2,376/month, respectively.

Their annual income goal during retirement is $90,000.

In the following charts, we compare the impact of an efficient retirement income strategy to one that is not. The only thing that is different in the two scenarios is the consideration of when to draw specific sources and the associated tax implications. Unfortunately, when managed inefficiently the couple is only able to maintain their target annual income for 26 years. Additionally, the inefficient strategy forces the couple to pay an additional $129,000 tax over 30 years when compared to a more efficient strategy.

Assumptions: 4% investment rate of return on all accounts. No additional contributions are made to investment accounts. Taxes include both Federal and Oregon State income tax.

This is one of the most important financial decisions you can make.

Taking the time to thoroughly answer these questions can provide long-term value.

Engaging with a financial planning firm can be helpful if you are not fully confident in making a retirement income plan. Working with the right financial planning firm for your unique situation can be the difference between a carefree retirement and a stressful one. To learn more about how we think about serving clients through comprehensive financial planning, check out our services here.