Your Pre-Retirement Checklist

Transitioning into retirement can be an exciting time. For many it can also be a daunting reality. We hope the following Pre-Retirement Checklist is a helpful tool as you intentionally prepare for your retirement years.

5-10 years out

Create a plan to pay down debt.

Maintain Emergency Fund – Emergencies still happen in retirement.

Familiarize yourself with Social Security, Pension, and/or Defined Benefit options.

Consider Long Term Care (LTC) options – LTC Insurance vs Self-insuring using other assets.

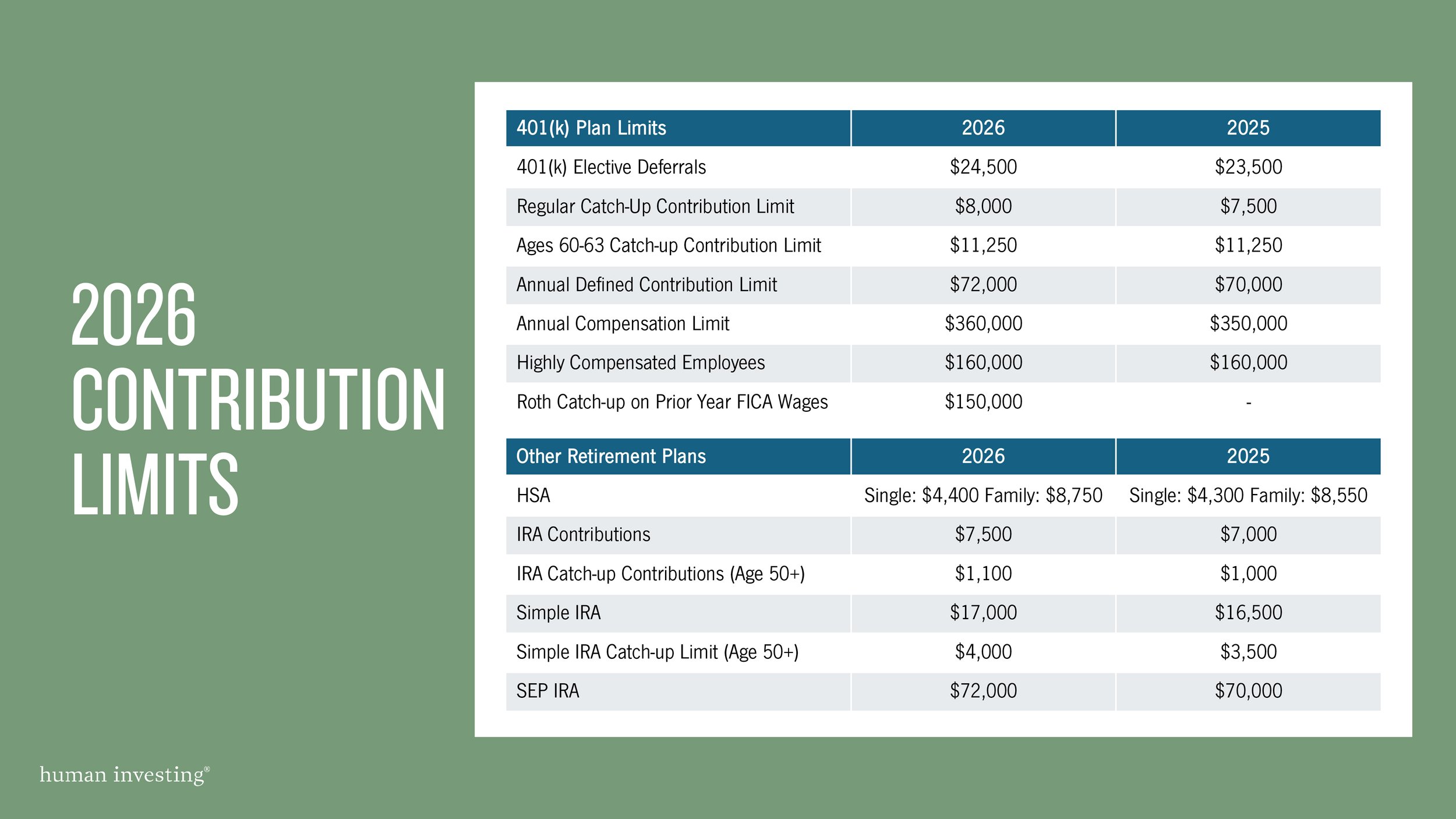

Maximize all tax-advantaged savings accounts – 2021 Contribution Limits.

Review your investment strategy to make sure your retirement accounts are in line with your risk tolerance and timeline.

Strategize how to divest from company stock.

2-4 years out

Devise a retirement spending plan:

Identify your retirement spending goals – basic needs, travel, one-time needs, etc.

Take inventory of assets and consolidate as needed.

Retrieve Social Security estimates and create a strategy for taking your social security.

Determine and clarify your retirement paycheck replacement strategy.

If you are retiring early, figure out how you will bridge spending needs prior to Social Security income, Medicare coverage, and accessing retirement accounts at age 59.5.

Review deferred compensation distribution strategies.

Begin developing a plan for a fulfilling retirement (goals, purpose, health).

Practice being retired – take a long vacation in the location you plan to retire and live within your retirement budget.

Retirement Living Plan:

Evaluate downsizing a home or relocation and the associated tax implications.

If a mortgage is required, relocate while you still have the income to qualify for the mortgage preapproval process.

Formulate a plan to exercise your stock options.

Review insurance needs – potentially to cancel or lower life/disability insurance.

< 1 Year out

Formulate a health care plan:

Investigate Medicare, Medigap, and Medicare Advantage plans.

Compare Individual Insurance policy or COBRA if you are younger than age 65.

Enroll in Medicare 3 months before age 65.

Apply for Social Security benefits 3-4 months before you want benefits to start.

Determine how much monthly income you need from your portfolio to cover your expenses.

Analyze your retirement income plan.

Consider a HELOC while you still have the income to qualify.

Update estate plan documents with retirement changes.

Take advantage of employer medical plans.

Download this as a printable one-sheeter.

Planning for retirement should be exciting. Please reach out if our team of credentialed experts can help you navigate the road to retirement.