The IRS has Increased Contribution Limits for 2026

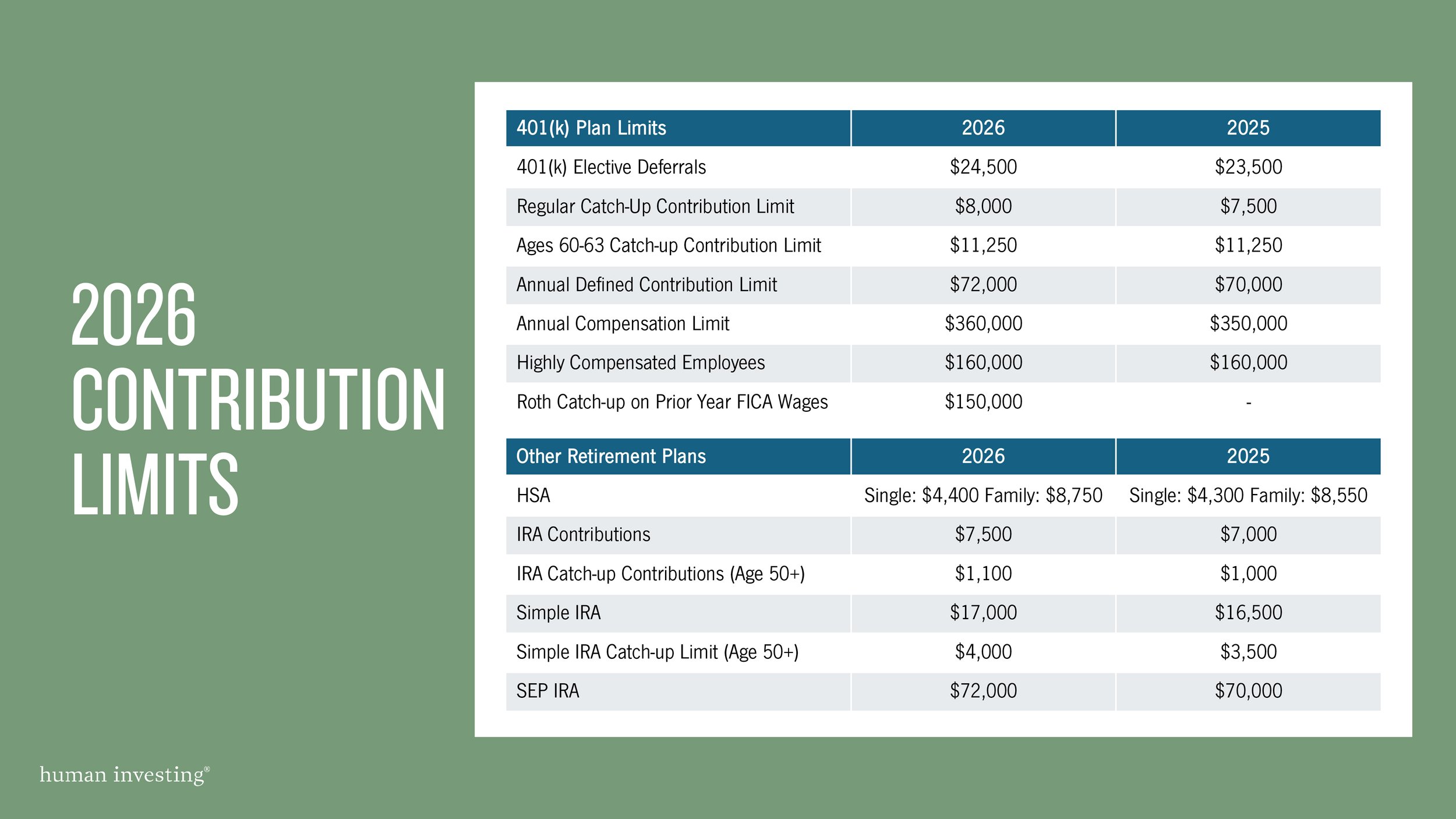

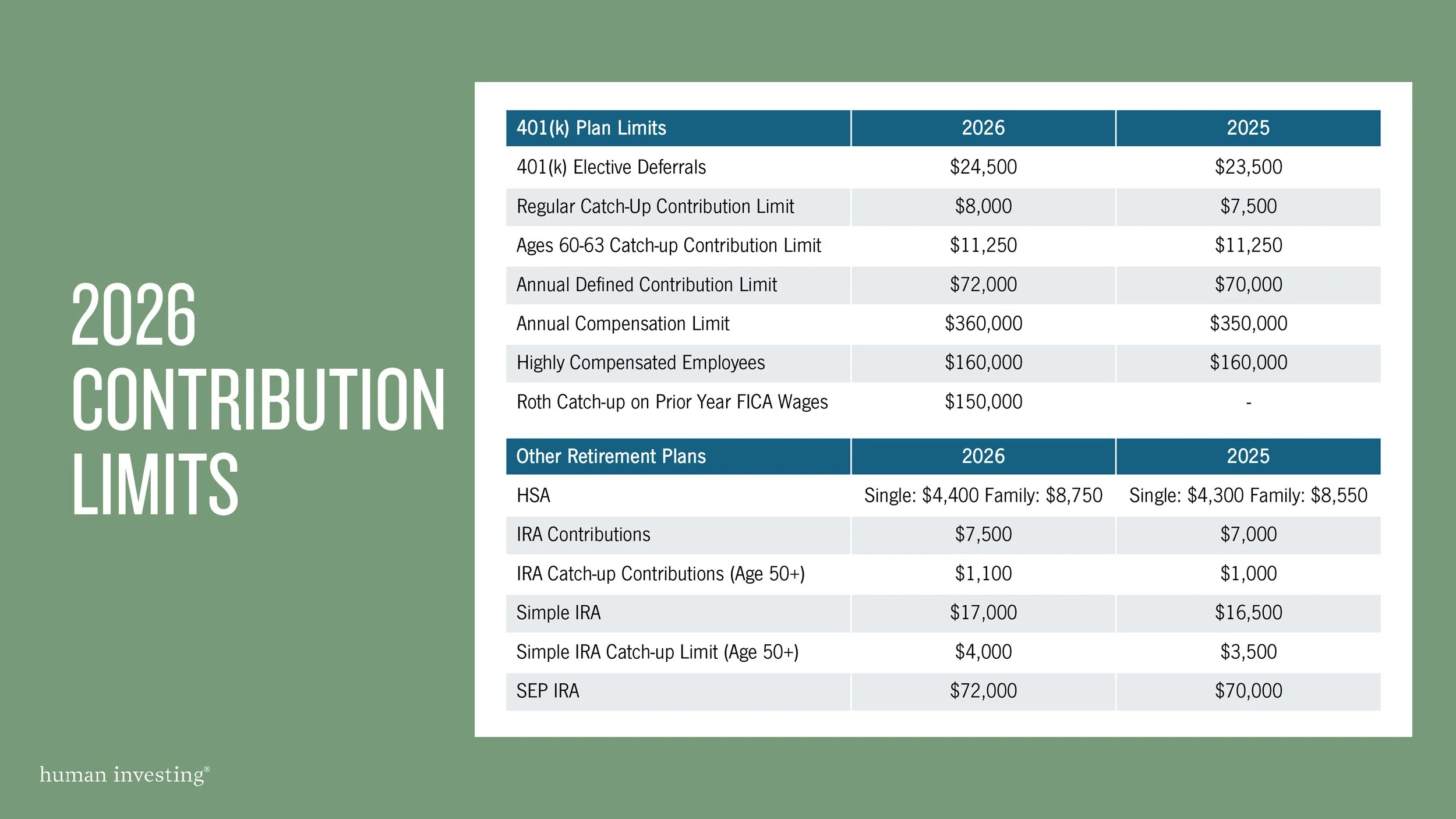

There is more good news for retirement accounts this year. The IRS has released the updated contribution limits for 2026, and several of the adjustments will allow investors to save even more. As you can see below, these new limits continue the trend of expanding opportunities for retirement savers.

Last year, we highlighted the new SECURE 2.0 rule introducing a higher catch-up contribution for employees aged 60, 61, 62 and 63. For 2026, that enhanced “super” catch-up window remains in place, giving late-career savers another year to take advantage of the increased limit.

How do these changes impact your savings in the upcoming year? Are there any changes you should be making? Schedule a time to meet one-on-one with our team. We look forward to working with you in 2026!