"If You Fail to Plan, You Are Planning to Fail"

Benjamin Franklin’s quote applies to many choices we make, including personal finances. If we don’t take his message to heart, then a lack of planning can be costly.

There are traditionally two paths one will take when preparing for a large expense. They will either build a plan ahead of time to achieve a financial goal, or the more common path, wait until the expense arises and deal with it then. It’s important to consider the hidden cost of financing a large future purchase instead of planning for it in advance.

NOT PLANNING AHEAD MAY COST YOU MORE THAN YOU THINK

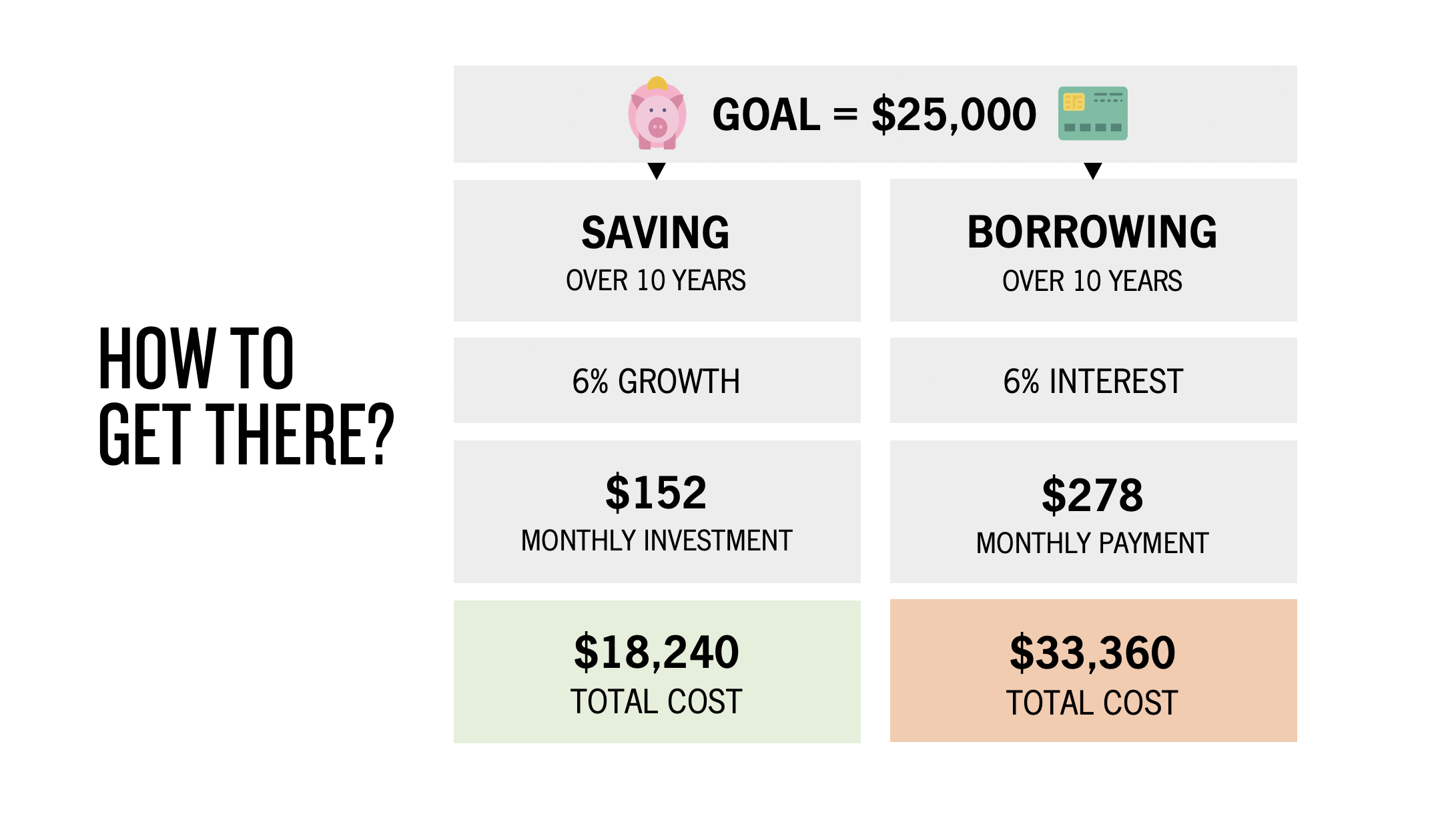

Let’s take the example of a future expense of $25,000 for any situation:

Fill in the blank: year of college for a child, down payment for a home, wedding, car purchase, or a dream vacation.

How do you pay for the $25,000 future expense?

(A) Make a monthly investment over the next 10 years, or

(B) Borrow the $25,000 and make monthly payments to pay off the debt over the next 10 years.

Note: This is for illustrative purposes only. Investment returns, interest rates, and loan periods will vary.

SO WHAT ARE YOU PLANNING FOR TOMORROW?

Building a savings plan and starting early provides around 27% in savings over 10 years, with a total out-of-pocket cost of approximately $18,240 (assuming a 6% annual investment return).

Conversely, the cost of convenience by borrowing adds more than 33% to the overall cost, raising the total to about $33,360 (assuming a 6% interest rate).

Unfortunately, much consumer debt is financed on credit cards, where the average APR in 2025 is over 21% according to the Federal Reserve. At that rate, the total cost of financing a one-time $25,000 purchase could more than double over 10 years, pushing the total cost well past $50,000.

This illustration provides a two-sided lesson. As shown above, building a financial plan can save thousands of dollars over time. On the other hand, procrastinating and choosing to borrow rather than plan can just as easily cost thousands.

Either way, the takeaway is clear: it’s important to understand the real cost of any financial decision in order to make a well-informed choice for your future.

Our team at Human Investing is available if you have questions or would like help building a financial plan that fits your goals.

Disclosure: This material is for informational and educational purposes only and should not be considered personalized tax, legal, or investment advice. You should consult your own qualified tax, legal, and financial professionals before making any decisions based on this information. The examples provided are hypothetical and are intended to illustrate general financial concepts such as saving versus borrowing; they do not represent any specific investment performance or loan terms. Interest rates, returns, and inflation assumptions are subject to change and may vary based on individual circumstances. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. Advisory services are offered through Human Investing, LLC, an SEC-registered investment adviser.