War and the Market: What Does History Teach Us?

With Russia’s invasion of Ukraine this week, many are wondering how a conflict in Europe will influence their own finances. In addressing this headline for our firm, please understand that the loss of life and the disruption of peace weighs heavy on me and our team. While considering investor concerns, our goal is to provide a point of view which I feel we are uniquely positioned to share amid war as a financial management firm.

Markets trade on future expectations. For example, if the market expects new jobs or a strong economy, then people and businesses adjust their decisions today, based on what they believe is coming. Remember how the market crashed when COVID-19 first hit the United States, but bounced back a month later? That’s because people were making choices based on expectations, not necessarily reality.[1] Because war follows a circuitous route, forecasts are less clear. Researchers accurately note that “the impact of conflict on human lives, economic development, and the environment is devastating.”[2]

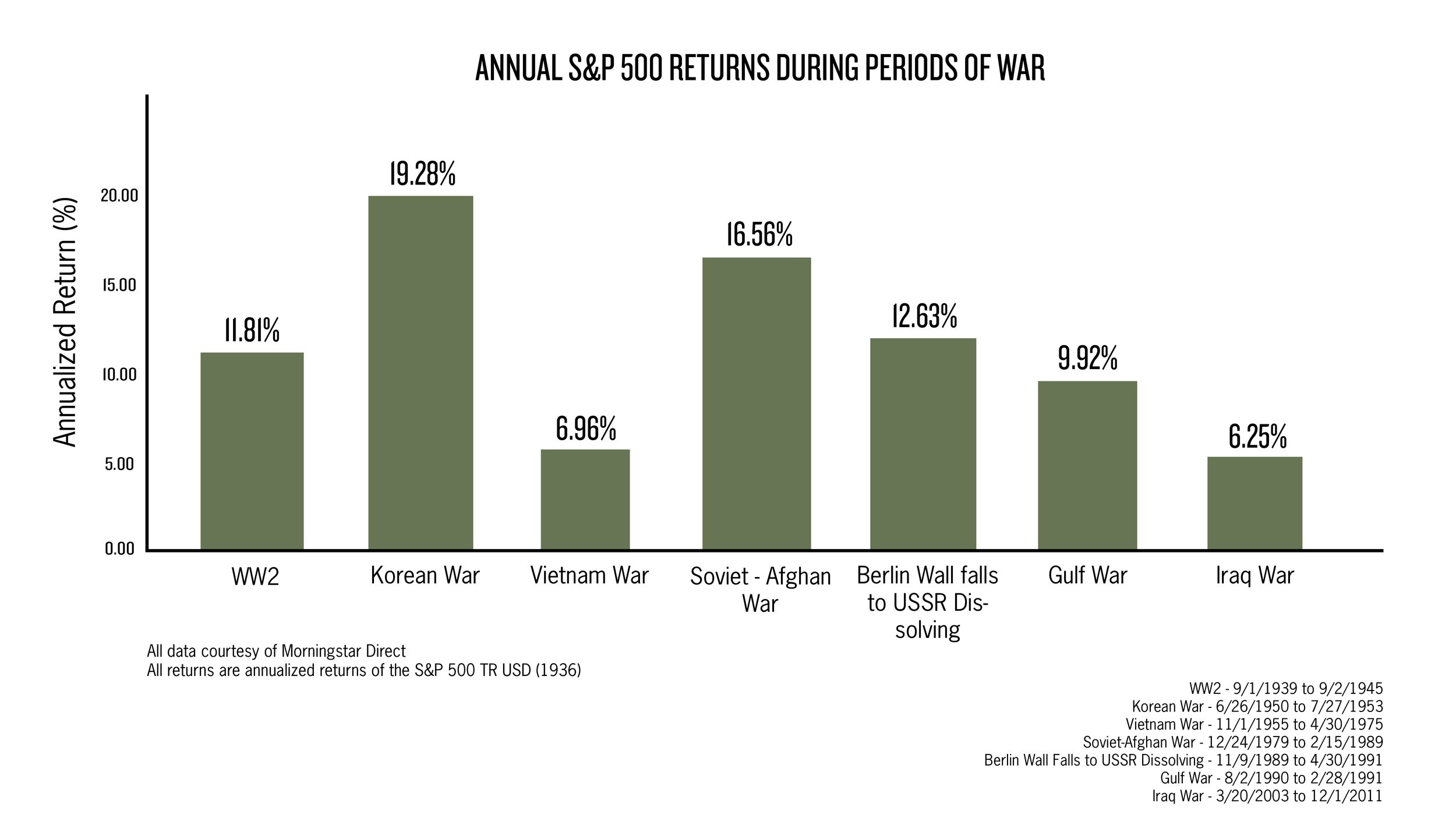

Previous Wars and Invasions Show That Market Reactions can Range Wildly.

For example, in 1990, Iraq invaded Kuwait and immediately the global stock markets declined.[3] In the three days that followed the Iraqi attack on Kuwait, the Dow Jones Index slid over 6%; yet in the first four weeks of Operation Desert Storm, the Dow gained 17%.[4] Additionally, the European Stock market responded positively to the second conflict with Iraq in early 2000. Stock market history has shown divergent reactions to war.

Surely, the economy of Ukraine will be devastated, but no one knows what the financial repercussions from this Eastern Europe conflict are. For example, when the news broke about Russia’s invasion, the European markets went down around 4%, but the US market went up by about 1.5% at the end of the day. We simply can’t predict the future, and the market changes moment-to-moment, day-to-day. The only real certainty is that volatility will resume as individuals and institutions place their bets on future predictions, and because of this, our client financial plans and asset mixes navigate all types of situations.

Finding your Footing in Uncertainty

Market related volatility is an un-welcomed but natural part of the investing journey, so our client portfolios at Human Investing are constructed with a plan and risk tolerance in mind. For example, a client that has cash needs to support their day-to-day expenses (such as a retiree) will often have a portfolio with equities that pay dividends, bonds that pay interest, and ample cash to cover upcoming obligations. On the other hand, investors who rely on equities should understand that stock volatility is the price we pay for the expected premium we receive in the long run over cash and bonds.

Although the headlines of “war” and “invasion” cause anxiety, the questions investors should ask are, “How is my plan working out?” and “Despite the market volatility, am I still on track?” Keep in mind that although the average annualized return of the S&P 500 since 1926 is approximately 10.5%, market swings may increase considerably. [5] Investors should think about their financial plan, investment goals, timelines, and overall diversification to determine how well they are prepared to manage the ups and downs. Adjustments can always be made to ease the concern in the short term, but for most of our clients, their financial plan and current asset allocation take into account market downturns, caused by a myriad of events, including invasions and war. Through it all, we at Human Investing are present in all of life’s ups and downs as we faithfully serve the financial pursuits of all people.

[1] Frazier, L. (2021, February 11). The coronavirus crash of 2020, and the investing lesson it taught us, Forbes. The Coronavirus Crash Of 2020, And The Investing Lesson It Taught Us

[2] Cranna, M. (1994). The true cost of conflict. New York: New Press. The true cost of conflict / | Colorado Christian University

[3] Richter, P. (1990, August 3). Markets react to Kuwait crisis: Stocks: Invasion rocks market; dow slides 34.66, Los Angeles Times. MARKETS REACT TO KUWAIT CRISIS : Stocks : Invasion Rocks Market; Dow Slides

[4] Schneider, G., & Troeger, V. E. (2006). War and the world economy: Stock market reactions to international conflicts. Journal of conflict resolution, 50(5), 623-645. War and the World Economy: Stock Market Reactions to International Conflicts

[5] Maverick, J. B. (2022, January 13). What is the average annual return for the S&P 500? Investopedia. S&P 500 Average Return: Overview, History, and Factors