Recent developments in the Middle East have once again drawn attention to oil markets. When tensions rise in regions responsible for a meaningful share of global energy production, investors naturally begin to ask how higher oil prices might influence the broader economy and financial markets.

Before discussing the financial implications, it is important to acknowledge the human side of these events. Conflicts like this affect families and communities around the world in ways that extend far beyond markets and economics.

Still, it’s natural for investors to wonder how disruptions in energy markets might affect their investments. Our aim is to provide context that can help frame those concerns.

Why do oil prices matter so much?

Energy plays a central role in the global economy because oil sits near the beginning of the production chain for many industries. It powers transportation networks, supports manufacturing, and is embedded in the production of everyday goods ranging from food to plastics and chemicals. When oil prices rise quickly, those higher costs move through supply chains and eventually reach businesses and households in the form of higher prices.

History shows that sharp oil spikes have often coincided with periods of economic stress, though they are rarely the sole cause.

It is understandable that headlines often focus on oil during geopolitical conflicts. When energy costs rise quickly, pressure on the broader economy can follow.

Geopolitical conflicts often bring uncertainty to both energy markets and financial markets. We explored how markets historically respond to war and global conflict in a previous piece, which you can read here: War and the Market: What Does History Teach Us?.

Why today’s energy landscape is more resilient

Looking at several decades of data provides helpful perspective when considering why the economy may respond differently to oil shocks today.

There is useful context when looking at global oil supply. The United States now produces roughly 20% of the world’s oil, while Iran accounts for about 3–5%. That balance looked different during earlier oil shocks. In 1979, Iran produced close to 10% of global supply, while the United States accounted for roughly 15%. This shift means the global energy system is more diversified and less dependent on any single region than it was during past crises.

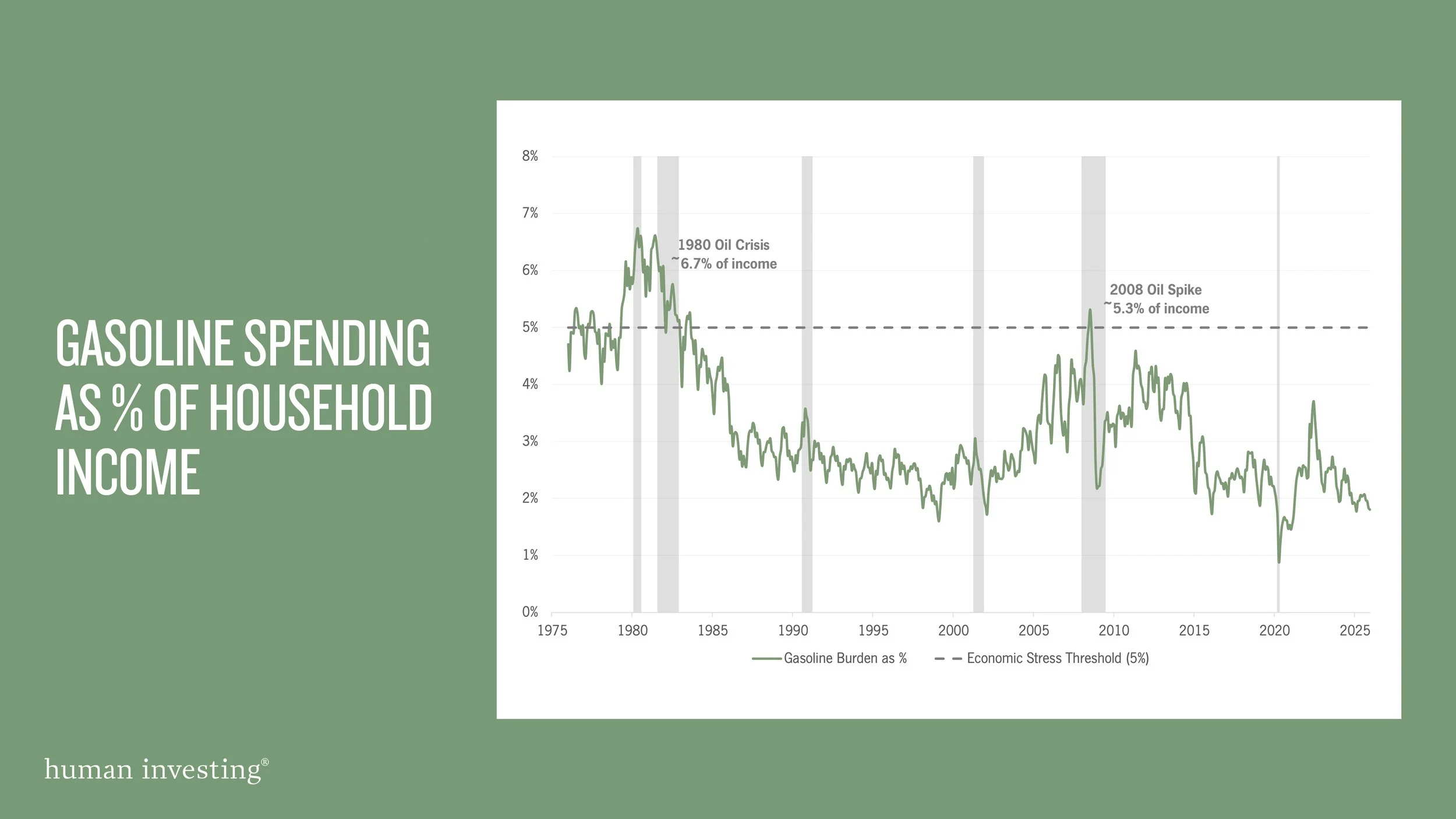

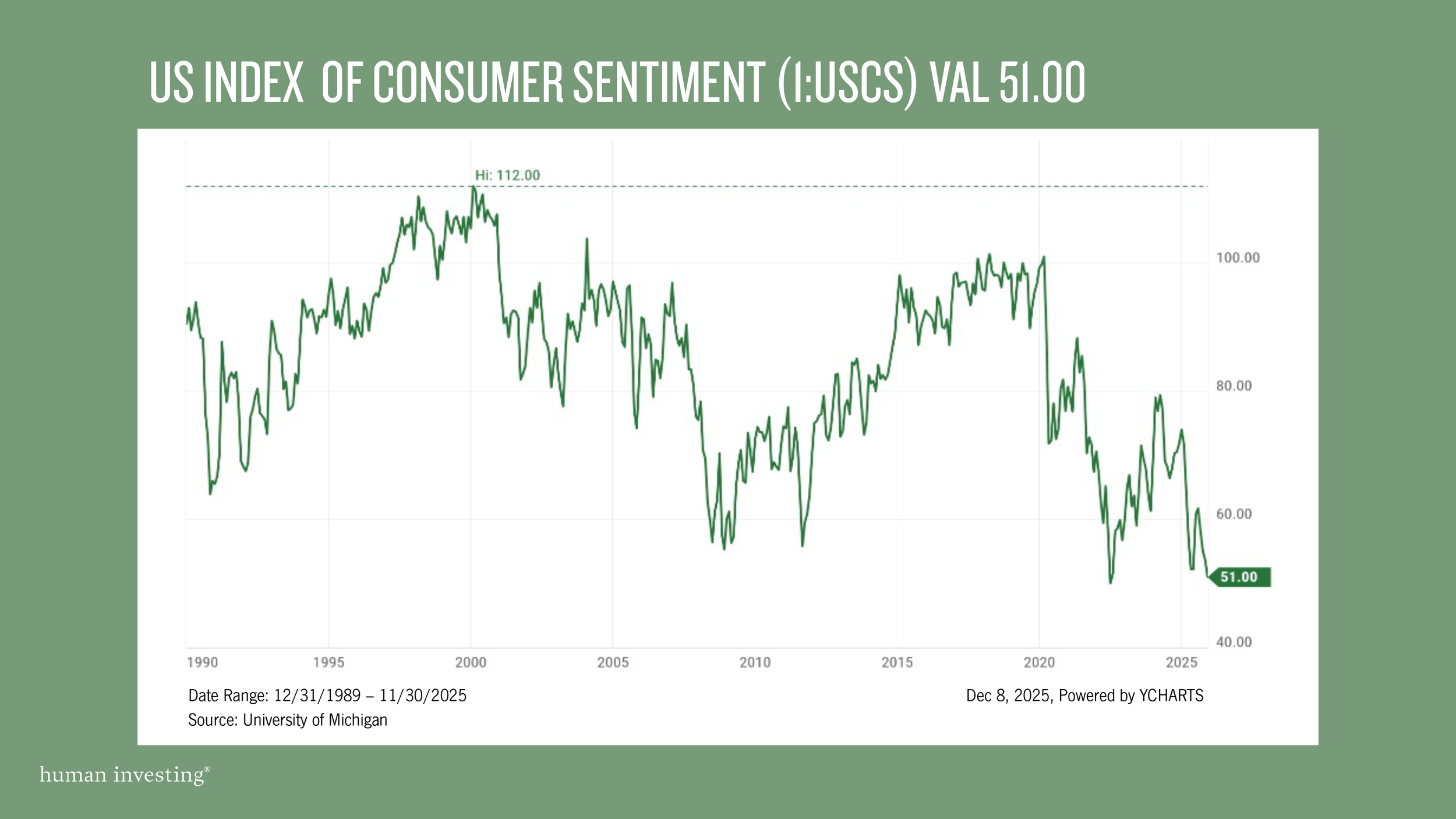

Households also appear to have more buffer against rising fuel prices than in earlier periods. One measure economist often watch is how much households spend on gasoline relative to their income.

Historically, economic stress has tended to increase when gasoline spending rises above about 5% of household income. Today that figure sits closer to 2–3%, suggesting households, broadly, have more room to absorb fluctuations in energy prices than during past oil shocks.

The chart below illustrates how gasoline spending as a percentage of household income has changed over time and why economists often watch this measure during periods of rising oil prices.

Shaded areas indicate U.S. recessions.

Source: U.S. Energy Information Administration, Bureau of Economic Analysis, Federal Reserve Bank of St. Louis

Finding Your Footing During Energy Market Volatility

Periods of geopolitical uncertainty often bring volatility to both energy markets and financial markets. Oil prices can move quickly as investors react to changing expectations about supply and demand.

For investors, the more relevant question is how these developments influence their financial plan.

At Human Investing, portfolios are designed with a range of economic environments in mind. Energy price shocks, while disruptive in the short term, represent only one of many forces that influence markets over time. Diversified portfolios allow different parts of the market to respond differently as economic conditions change.

For example, companies that rely heavily on fuel may face higher costs when energy prices rise, while energy producers may benefit from stronger prices. These adjustments tend to occur within the market rather than outside it.

Because of this, our focus for investors remain on their broader financial plan, investment timeline, and overall diversification.

Oil markets may move quickly in response to geopolitical events, yet long-term investment outcomes are shaped by many forces over time.

Disclosure:

This material is for informational and educational purposes only and is not investment, legal, or tax advice. References to historical events or market trends are illustrative and do not guarantee future results. Investing involves risk, including possible loss of principal. This commentary does not constitute a recommendation to buy or sell any security or adopt any investment strategy. Human Investing, LLC is a registered investment adviser; registration does not imply a certain level of skill or training.

Sources

Energy Institute. (2024). Statistical review of world energy 2024.

Graefe, L. (n.d.). Oil shock of 1978–79. Federal Reserve History.

U.S. Bureau of Economic Analysis. (2026). Disposable personal income (DSPI). Retrieved from FRED, Federal Reserve Bank of St. Louis.

U.S. Bureau of Labor Statistics. (n.d.). U.S. Bureau of Labor Statistics.

U.S. Energy Information Administration. (2026).U.S. product supplied of finished motor gasoline (thousand barrels per day).