The Risk of Holding Cash

Cash has its place in any financial plan. However, holding too much cash or cash-like investments like a CD or a Money Market account can be one of the most overlooked risks when it comes to long-term planning.

Inflation: The Hidden, Permanent Loss

Conventional wisdom says that if you want to preserve your dollars, keep them as cash. That level of caution may reduce short‑term volatility or avoid capital losses. But unbeknownst to many investors, cash is not as risk‑free as it seems. Holding too much cash over the long term can come at a high cost.

Inflation, which the Federal Reserve defines as “the increase in the prices of goods and services over time,”[1] remains the silent killer of purchasing power. In recent years, with supply‑chain disruptions, labor market shifts, and global commodity pressures, inflation’s impact has become more visible, more persistent.

Consider how quickly your money’s real value can erode based on varying inflation rates. While interest rates on many cash vehicles have risen from the near‑zero levels of early 2020s, they often still fail to fully offset the pace of inflation over time.

Table 1

Source: Ycharts

Markets Have Their Ups and Downs, but Cash Just Sits

For investors focused on the long term, the key isn’t only avoiding loss but preserving purchasing power. While the stock market may experience sharp short‑term drawdowns, historically it has not experienced a total and permanent loss of capital. Cash, on the other hand, can deliver a guaranteed negative return in real terms if inflation outpaces nominal returns.

Put another way: cash may feel safe, but it carries a hidden cost that many fail to account for.

Strategic Cash, Yes. Excessive Cash, No.

This is not a call to eliminate cash from your financial plan. A strategic cash cushion absolutely has its place—especially in today’s environment, where interest rates on savings and money‑market accounts have improved relative to recent past years. The right amount of liquid cash depends on your personal circumstances: income stability, stage of life, risk tolerance, liquidity needs. A commonly referenced target remains somewhere between 3 to 12 months of living expenses.

What has changed is the urgency to evaluate how much is “too much.” Because holding large sums of cash for long periods means you're not just missing out on market upside, you're actively losing purchasing power.

Building a Plan that Combats Inflation

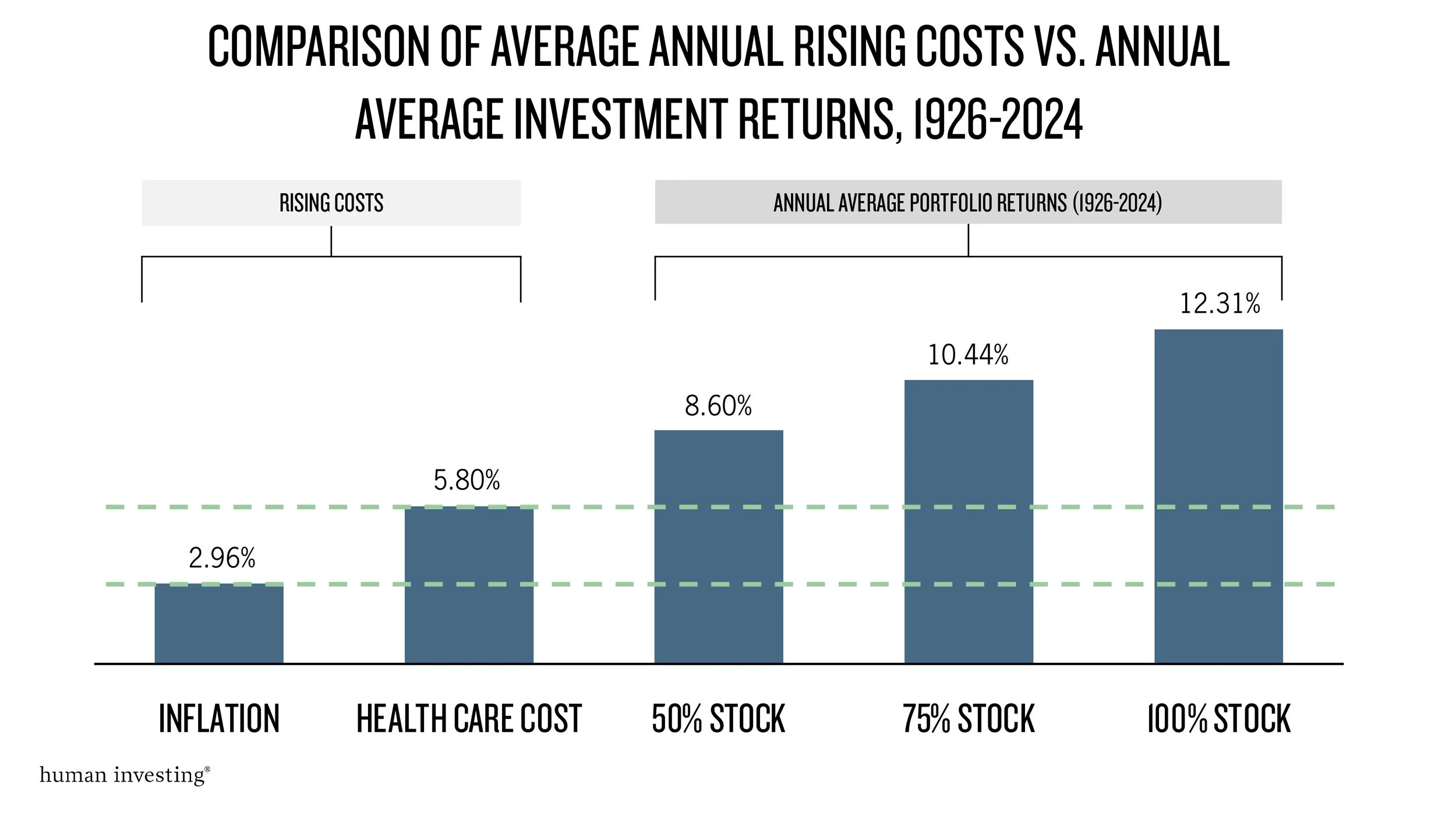

Inflation calls for a long‑term mindset. Building a diversified investment strategy with an appropriate allocation to equities, remains an essential component of any long‑term plan. While stocks bring volatility, they also offer the potential to grow real wealth.

Table 2

This graph is for illustrative purposes only. Past performance is no guarantee of future results. Data sources: Health Care Costs, CMS.gov; Portfolio returns, CFA Institute (SBBI®)

Given the evolving global landscape from geopolitical risks to climate‑related supply disruptions, the need for a resilient plan is greater than ever. That means considering:

How much cash you truly need for near‑term expenses and emergencies.

Where you’re holding that cash (e.g., high‑yield savings, short‑term bonds).

The long‑term erosion of cash power versus incremental risk in growth assets.

A regular review of your plan, as interest rates, inflation, and markets shift.

When Should I Hold Cash?

This is not to say someone ought to avoid holding cash altogether. Strategic cash cushions do have a significant place in a financial plan when considering both short-term and long-term financial decisions (see the barbell approach). There is no one size fits all plan. The amount someone should keep on hand should correspond with their living expenses, instability of income, stage of life, risk tolerance, etc. This amount is typically 3 to 12 months of living expenses. However, the permanent risk associated with holding too much should be evaluated, and if possible, mitigated. This starts with a deliberate and personalized plan concerning how much to hold and where to keep it.

Decisions around cash are just as psychological as they are financial. For this reason, it can be helpful to enlist the help of a trusted partner like Human Investing who has your best interest in mind.

Sources

[1] Federal Reserve (2016). What is inflation and how does the Federal Reserve evaluate changes in the rate of inflation?

[2] Inflation Data source from 1/1/1926-12/31/2021: Ycharts.

[3] U.S. Centers for Medicare & Medicaid Services. “Projected | CMS.”

[4] CFA Institute (2021). Stocks, Bonds, Bills, and Inflation (SSBI®) Data.

Disclosure: Human Investing, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission (SEC). The information provided in this blog is for educational and informational purposes only and does not constitute personalized investment advice. Human Investing does not consider your individual financial situation, investment objectives, or risk tolerance in the preparation of this content. Past performance of any investment, strategy, or market trend discussed herein is not indicative of future results. Readers are strongly encouraged to consult a qualified financial advisor or other professional before making any investment or financial decisions.

1996-2024 Bond Data from Bloomberg US Aggregate TR USD, Courtesy of Ycharts

1926-April 1996 Bond Data from the Ibbotson SBBI® US Intermediate Term Government TR USD, Courtesy of Morningstar Direct

1926-1936 Equity Return Data from the Ibbotson SBBI® US Large Stock TR USD, Courtesy of Morningstar Direct

1937-1989 Equity data from the S&P 500 TR, Courtesy of Morningstar Direct

1989-2024 Equity data from the S&P 500 TR, Courtesy of YchartsInflation Data from Ibbotson SBBI® Inflation Index, Courtesy of Morningstar Direct