After a great run, what should investors expect next?

Every year starts the same way. A fresh set of market forecasts arrives, confidently predicting what stocks will do next. And every year, markets remind us how unreliable those predictions can be.

Even professionals struggle to get it right. In both 2023 and 2024, most Wall Street forecasts underestimated the actual returns of the S&P 500. Markets have a long track record of defying expectations.

This is why long-term investors shouldn’t build portfolios around short-term predictions. Markets move faster than forecasts can adapt. Instead, focus on building portfolios that can compound through a wide range of environments. Still, expectations matter. When investors have a reasonable sense of what outcomes are possible, it’s easier to stay invested when markets don’t behave the way headlines suggest they should.

So as we look ahead to 2026, the useful question isn’t “Will the market keep rallying?”, It’s “What’s reasonable to expect after a strong run?”

The last few years were not normal

It’s hard to overstate how unusual the period from 2020 through 2025 has been.

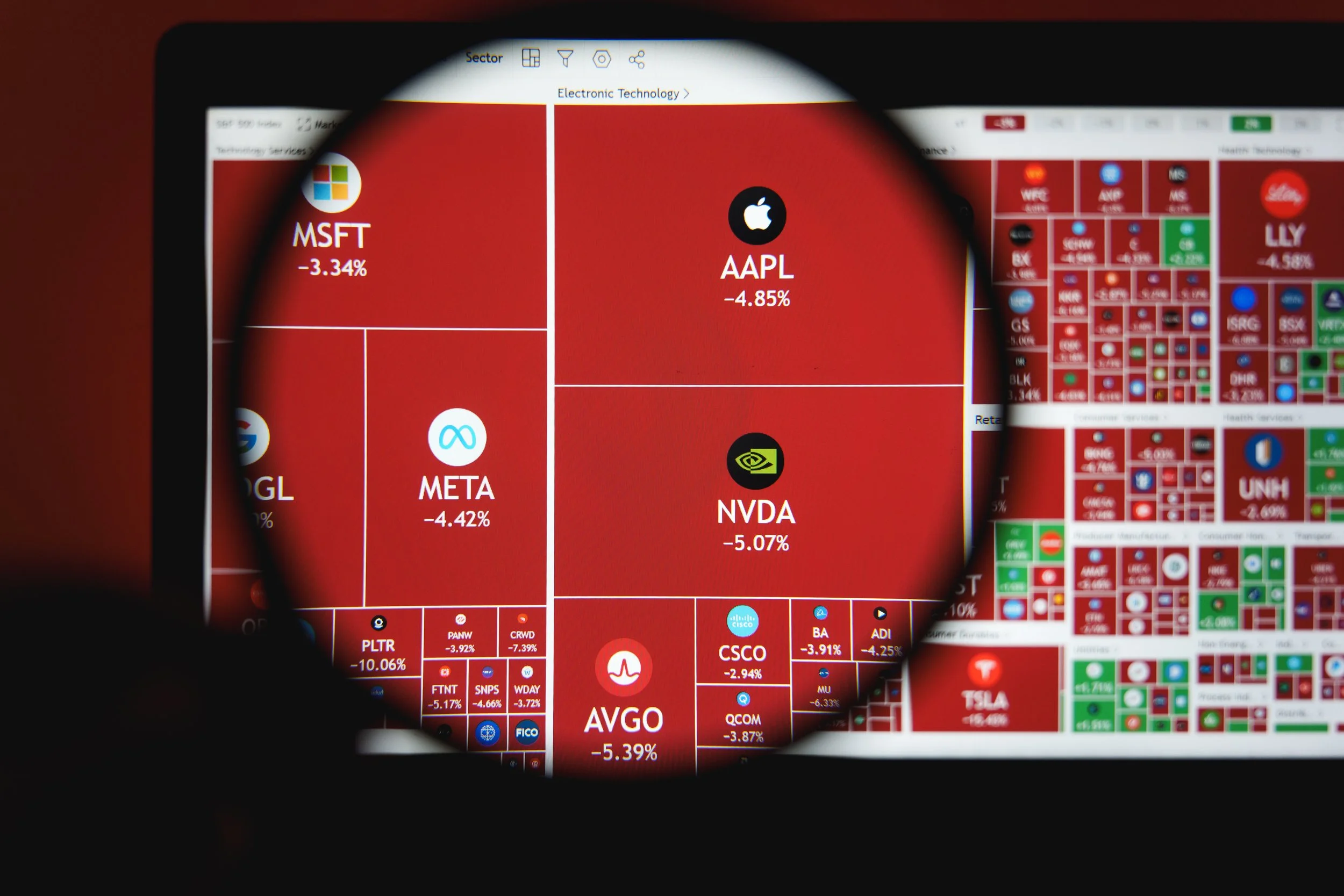

A global pandemic shut down large parts of the economy. Inflation surged to levels not seen since the early 1980s. The S&P 500 suffered its worst calendar year since 2008 in 2022. Trade policy and geopolitics added ongoing uncertainty.

And yet, by the end of 2025, the S&P 500 was up nearly 18% for the year.

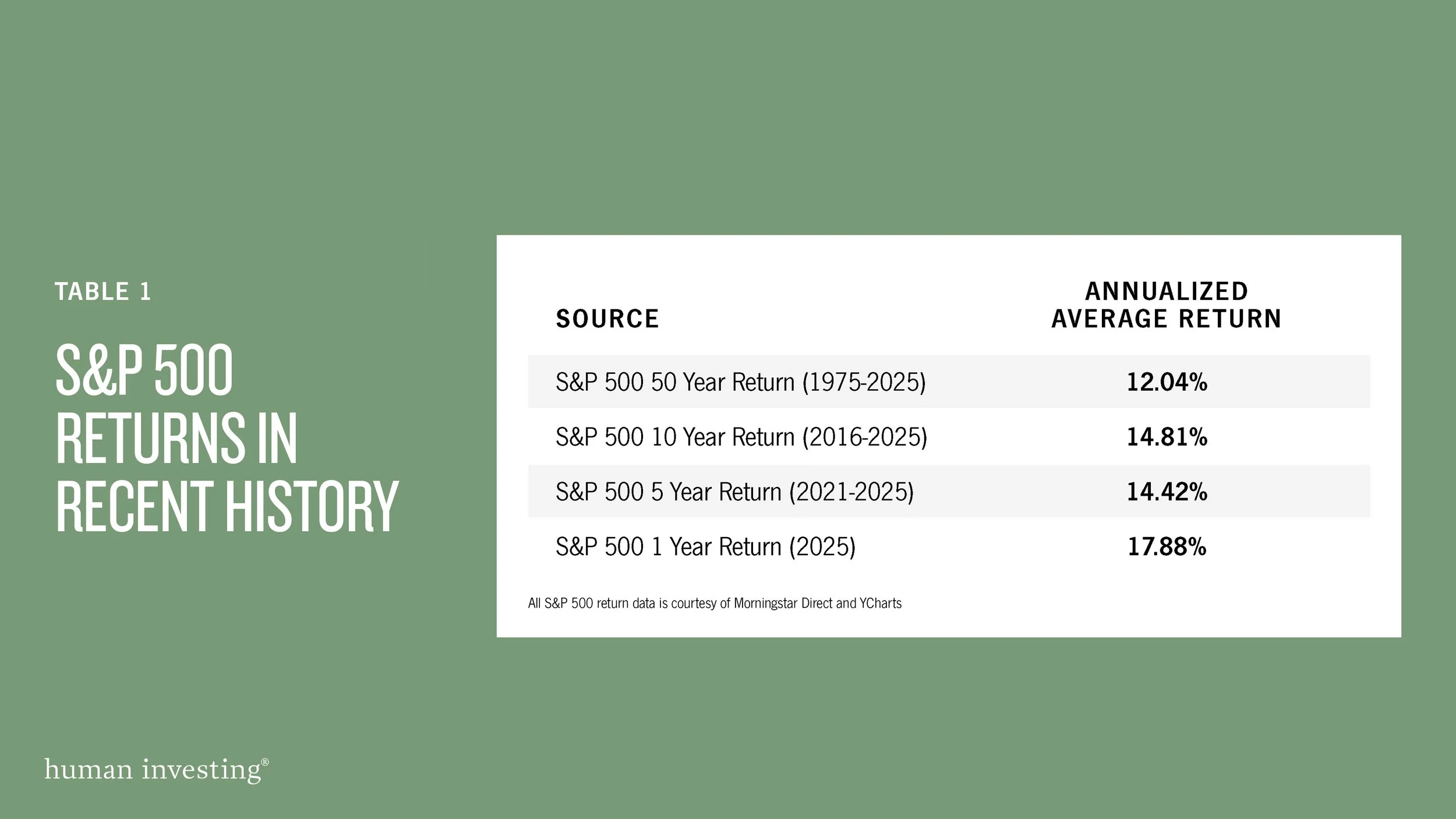

When you zoom out, recent returns stand well above long-term averages. Over the past 1, 5, and 10 years, the market has delivered results that are meaningfully better than its 50-year history.

That’s great news for investors. But it also creates a subtle challenge. Strong recent returns have a way of adjusting expectations. What was once exceptional can start to feel normal, even when it isn’t.

Historically, periods of above-average returns are often followed by more moderate ones. Not because markets “owe” us anything, but because starting valuations matter. After a great run, future returns tend to look more ordinary.

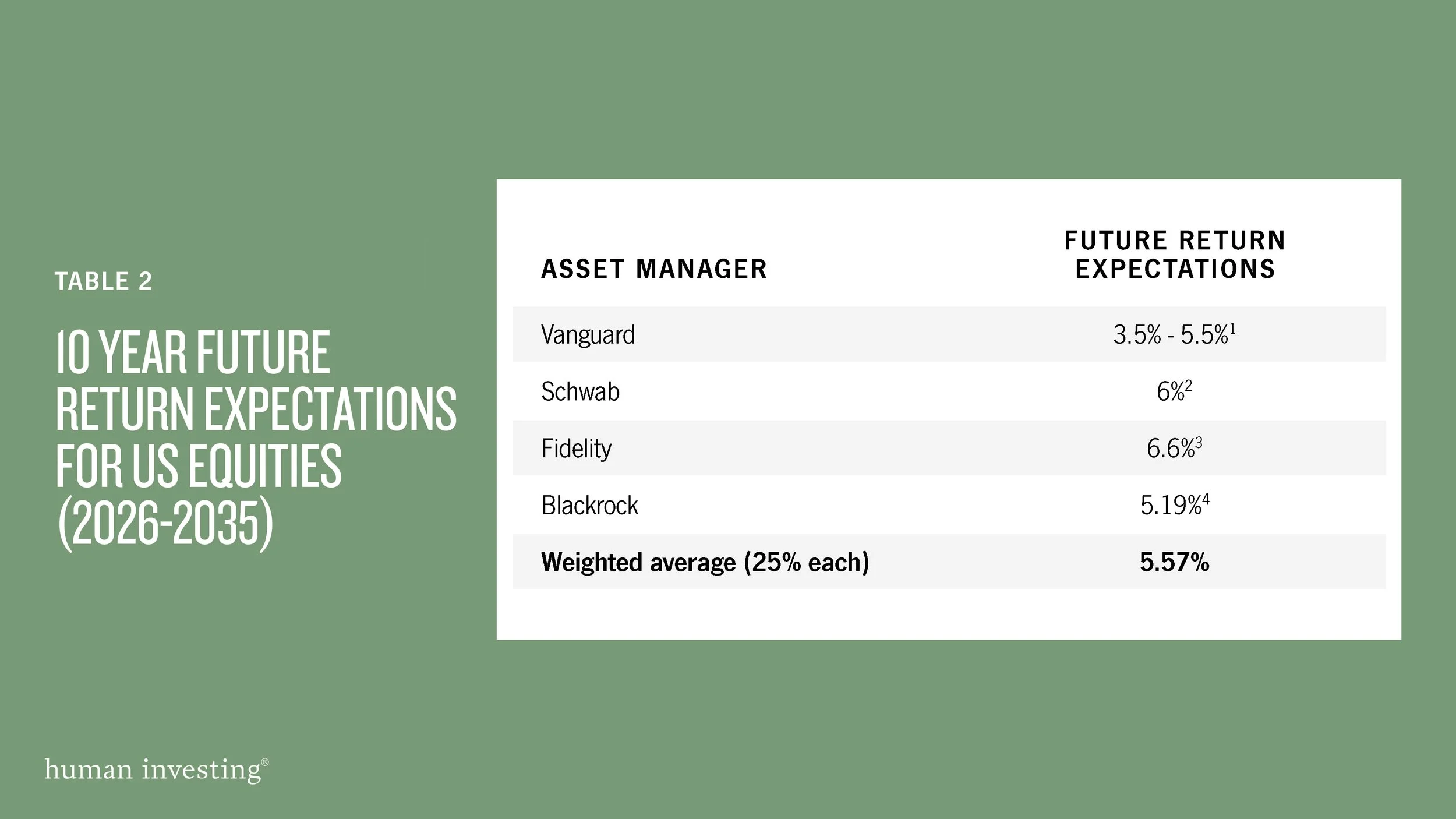

The return expectations shown above are derived from publicly available third-party capital market outlooks and represent long-term estimates, not predictions or guarantees. These assumptions are not specific to any individual investor, do not reflect advisory fees, taxes, or other costs, and may differ materially from actual future market results.

[1] Vanguard, Vanguard Capital Markets Model Forecasts, January 22, 2026

[2] Schwab, What’s the 10-Year Outlook for Major Asset Classes?, June 6, 2025

[3] Fidelity, Capital Market Assumptions: A Comprehensive Global Approach for the Next 20 Years, August 2023

[4} BlackRock, Capital Market Assumptions, November 13, 2025

Why “lower” returns aren’t a bad outcome

Many long-term forecasts for U.S. stocks over the next decade fall in the mid–single-digit range. Compared to recent experience, that sounds disappointing. Compared to history, it’s typical.

This is an important distinction. Lower-than-exceptional returns are not the same thing as poor returns. Compounding still works at 5%–6% per year. It just doesn’t feel as exciting when you’re coming off a stretch of double-digit gains.

Experiencing more typical equity returns isn’t inherently an issue. It’s planning as though the unusually strong results of the past decade will repeat that can cause problems.

Why planning matters more than forecasting

For investors saving toward retirement or already retired, expectations matter because small differences compound over time. When returns are more typical, the margin for error narrows. This is exactly where comprehensive planning becomes most valuable.

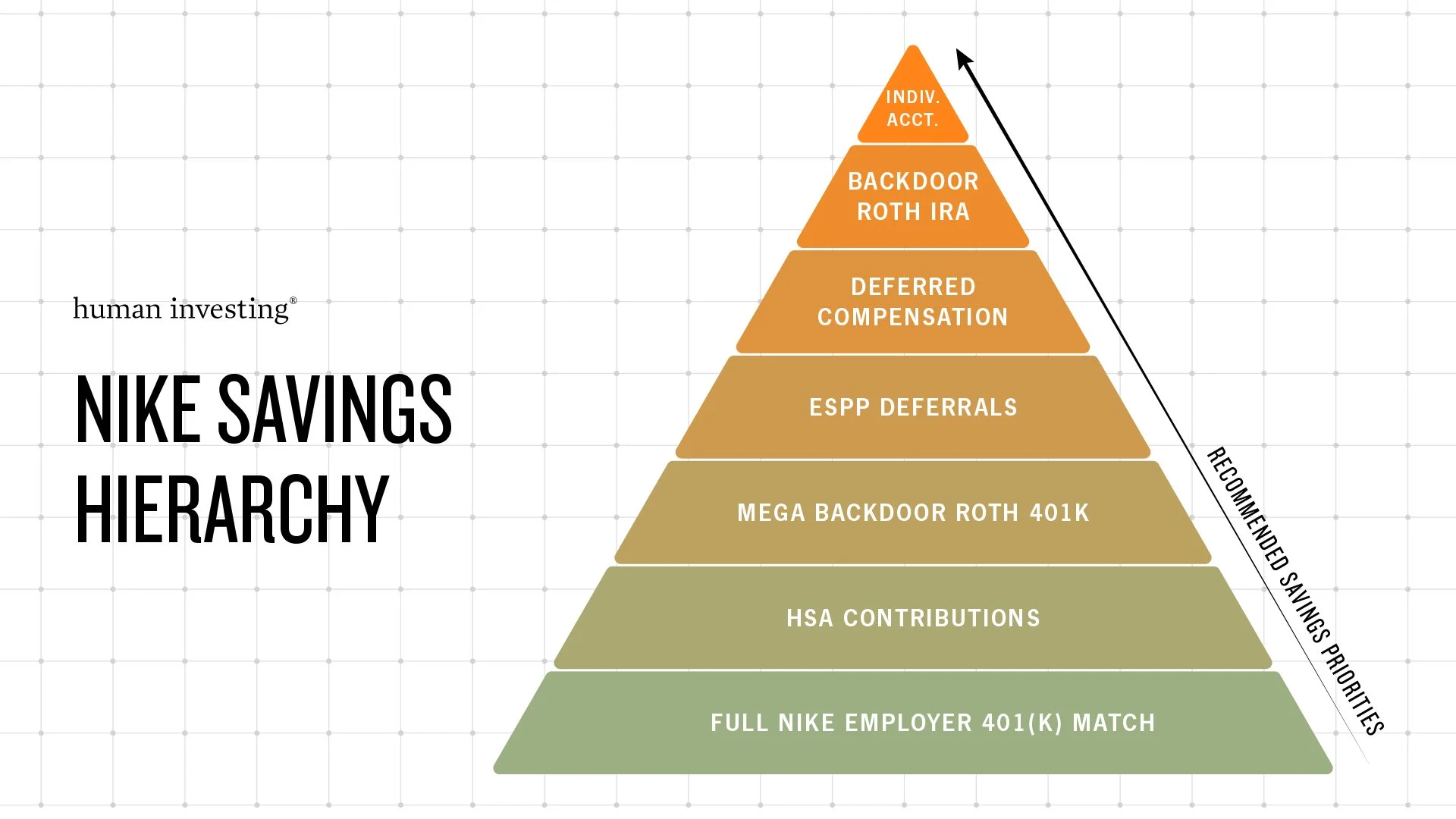

At Human Investing, we don’t try to outguess markets or build portfolios around forecasts. That means emphasizing diversification, discipline, and resilience rather than reacting to short-term narratives. Our focus is helping clients make better decisions around the things they can control, including how investments interact with taxes, cash flow, retirement timing, and spending choices.

When returns are strong, almost any strategy can feel successful. A well-built financial plan shows which levers impact results, how much flexibility you have, and what adjustments are worth making if conditions change.

Markets will always surprise us. A good plan is designed so those surprises don’t derail long-term goals. That’s the role planning plays in our work, not as a prediction tool, but as a framework for making sound decisions across many possible market outcomes.

Sometimes having a sense of what may be coming can help stay calm during tumultuous times. Lets take some time to review some of the major topics that could cause investors stress in 2026. Good or bad, some version of these topics and the uncertainty around them is reflected in the market today. As more information comes out as time passes, that uncertainty converting into knowledge will cause prices to update. It’s unlikely these will be unforeseen surprises that cause major market movement.

Major 2026 topics we’re watching

Can The Fed maintain its independence?

The Federal Reserve (aka “The Fed”) is in interesting territory. With the attempted dismissal of Fed Governor Lisa Cook, and Department of Justice Investigation, The Fed’s independence is being challenged in new ways. The administration has made their desire for lower rates faster clear. The Fed’s challenge is ensuring rates don’t get too low and stoke inflation.

As unpleasant as it can feel at times, an Independent Fed is a healthy influence on the US economy in the long run. Being willing to raise rates to slow economic activity in the short term to control inflation is an important and painful process. The great challenge of high inflation is it makes any cost today for gains in the future incredibly difficult to make feasible. The lowered investment eventually drags on an economy’s long term growth prospects.

What will AI do to the economy?

No matter where you look, the biggest question for markets and the economy all center around AI. We recently wrote about why the AI boom is different than the dot-com bubble. We do know the upfront costs to build the infrastructure necessary for AI are large. The big concern for investors is the payoff of these AI related investments. If the costs are never fully recovered by increased revenue, companies that are booming today because of their AI investments may end up falling.

What does a modern workplace look like?

Another theme looking at 2026 forecasts: The labor market is going to be an area to watch. With immigration slowing and the aging of the baby boomer generation into retirement, the workforce size is expected to hold relatively steady. The uncertainty of the tariff environment has made long-term decisions outside of AI difficult for companies to navigate. The promise of AI is to enable workers to do more, and so in theory a given company will need fewer people to accomplish a similar amount of work. All this has led to employers generally being less motivated to hire. There aren’t necessarily large layoffs incoming, but hiring may slow enough to increase unemployment slightly.

Staying invested still matters most

The past several years have been exceptionally good for investors. After a run like that, it’s reasonable to expect a more typical environment going forward.

There will always be reasons to sell. There will always be headlines that make staying invested feel uncomfortable. But investing has never required perfect conditions to work.

If you’ve stayed invested through the last 5 to 10 years, you’ve already benefited from an unusually strong period. The next chapter may look different, but the discipline required doesn’t change.

The goal isn’t to predict what 2026 will bring. It’s to own a portfolio that doesn’t need predictions to succeed.

Disclosure: This material is provided for informational and educational purposes only. It should not be construed as investment, legal, or tax advice, nor does it constitute a recommendation or solicitation to buy or sell any security. Any market commentary, forward-looking statements, projections, or return expectations discussed are based on assumptions and current information and may not materialize. Investors should consult with a qualified financial professional before making any investment decisions. There is no guarantee that any investment strategy will achieve its objectives, and investing involves risk, including the potential loss of principal. References to market indexes, historical returns, projections, or economic conditions are illustrative only and should not be considered indicative of future results. Past performance is not a guarantee of future outcomes. Advisory services offered through Human Investing, an SEC-registered investment adviser.