Planning for your child's education in Oregon

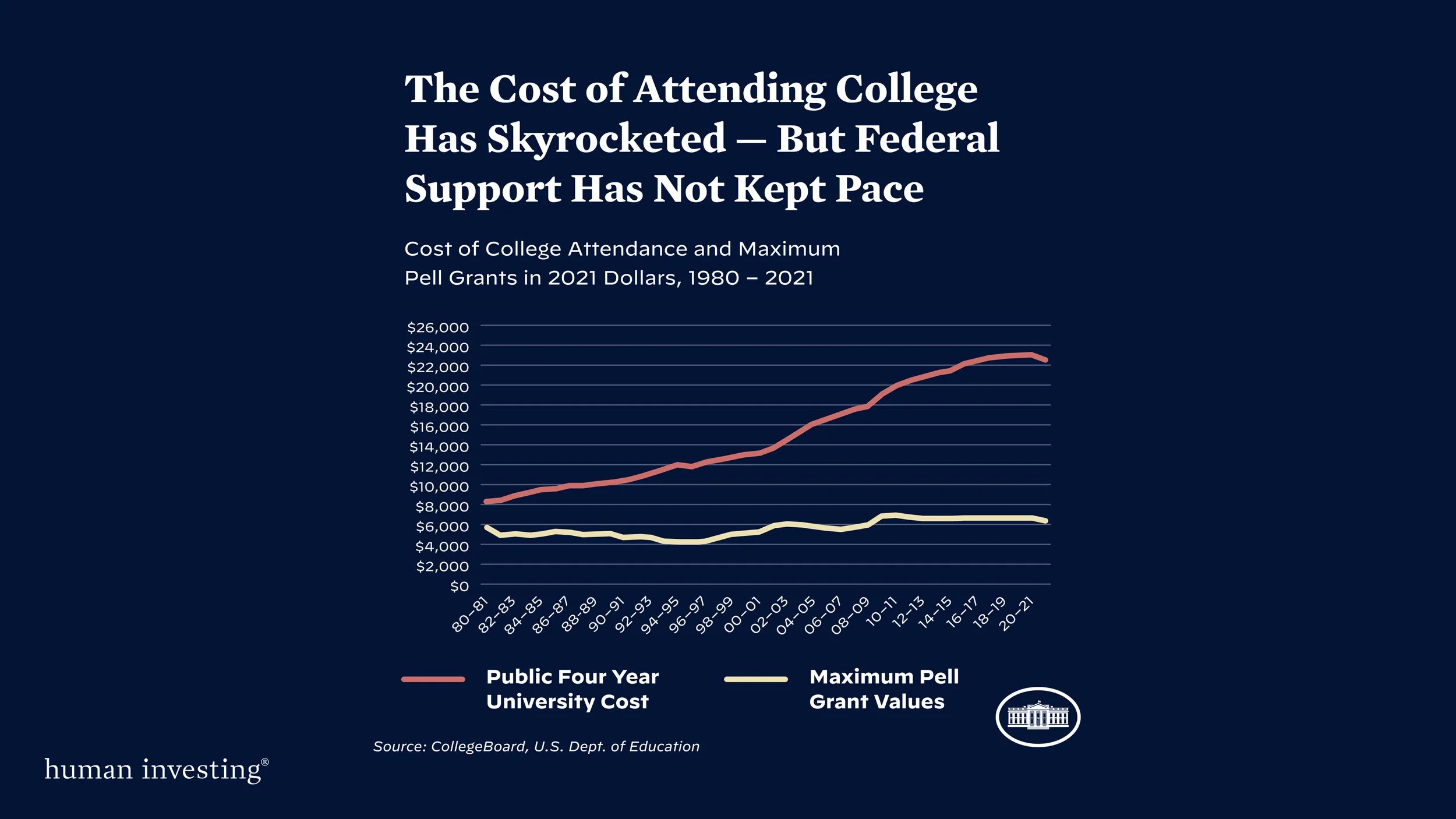

The cost of education, especially 4-year accredited university programs, continues to rise. The graphic below shows the average annual cost of college nationwide from 1980-2021 far outpacing the maximum Federal Pell Grants offered over the same time period.

If there is an ability to pre-fund college, in whole or part, it will have lasting financial implications. Funding college early at the birth of a child or grandchild to a college savings account could reduce the future funding liability by six figures.

In this article, we will discuss some ways you can start saving for your child’s education.

The most popular option, the 529 Savings Plan

A 529 College Savings Plan is one of the most popular options when saving for college. Not only does the money you contribute to a 529 plan grow tax-free but any distributions used for qualifying education expenses (tuition, room & board, books, computer, etc.), are tax-free as well. In the past, qualified expenses were limited to just tuition and boarding but recently the government has expanded this list. Beneficiaries of a 529 plan can also use the money to pay for trade school, community college, or even a 3-month certificate program.

Oregon has a state-sponsored 529 Plan that allows residents to receive tax benefits for contributions they make to a plan in the state. This gives you a triple-tax benefit. Contributions to fund the account have a tax benefit, growth is tax-free, and qualified expenses are tax-free. There are also private plans that qualify under Oregon-state law. As of 2023, contributors can receive up to $300 in tax credits depending on their filing status and household income. As of 2023, families can contribute up to $17,000 annually in a 529 account. Anything after that is considered a “taxable gift” and subject to gift tax laws.

Another feature about 529s starting in 2024 and beyond is that any leftover money up to a lifetime amount of $35,000 can be rolled over into the beneficiary’s Roth IRA.. For example, let’s look at two parents who invested $50,000 into a 529. Their child received a full scholarship to the college of their choice. The child ends up only spending $10,000 to cover other expenses during their time in college. That student can then roll over a lifetime amount of $35,000 into their Roth IRA account, as long as they have earned income and the 529 account has been established for 15 years.

Coverdell ESAs act very similarly to 529 plans due to the withdrawals being tax-free for qualifying expenses. However, contributions are limited to $2,000 per child annually and are only available to families below certain income thresholds.

Special accounts: Uniform Gifts TO Minors Acts (UGMA) or Uniform Transfers to Minors Acts (UTMA)

UGMA or UTMA accounts can help you save for college but aren’t just reserved for education. These accounts are savings accounts that are controlled by a parent or guardian, known as a “custodian.” You can gift up to $17,000 per year (as of 2023) in assets that are held in a custodial account until the child turns the age of majority (Age 18 or 21 depending on the state). In Oregon, the dependent cannot take over the account until they are 21.

The custodian of the account can use this money only for the benefit of the minor to pay for things like food, education, and living situations.

Pre-pay for college tuition and tuition discounts

Unfortunately, in Oregon, there is no State-sponsored pre-payment plan for college tuition. There may be some private ones, but they are expensive. Some people do this in other states to pay for the full tuition during the current year rather than wait 17-18 years when prices go up even more. For your reference, here are states that offer pre-payment programs.

There is also a program known as the State and Regional College Tuition Discounts. Oregon has several schools that are members of the Western Interstate Commission for Higher Education.

For more information about this make sure to research the WICHE site and Oregon’s student aid site.

Alternatives to college that can fast track career development

Despite the rising costs of college, there are other options to consider. College is not for everyone and you may decide not to send your student to college right away if you cannot afford to do so.

Many high-paying and rewarding career paths do not involve a college degree like:

Computer programming and coding

Loan officers

Pilots

Plant operators and managers

Graphic designers

Trades like plumbers, welders, carpenters, farmers, etc.

Sales reps

Business owners and managers

Community colleges, trade schools, and certificate programs are a fraction of the cost of a 4-year college program and in most cases pay well with little to no debt. Plus, 529 Plans cover these types of education programs too (certain restrictions may apply).

Some 17-year-olds may not know what they want to do yet. They can work a job, apprentice under an expert, or even start their own business and find their passion before committing to a major program in college.

If you need more advice, financial planners and advisors can assist you with planning for your student’s future. These laws vary from state to state so talking with a team of experts who are knowledgeable in this area is a wise choice.

If you are looking to hire an advisor, please connect with us.