Earnings season is coming

With the recent struggles of Nike stock over the past couple of years, many Nike employees are wondering what to do with their stock. Whether it is to diversify into another investment or to fund expenses like vacation, remodels, or tuition for their kids, the current price has made those decisions more difficult. A common question we hear is “Should I sell my NKE now or wait?”

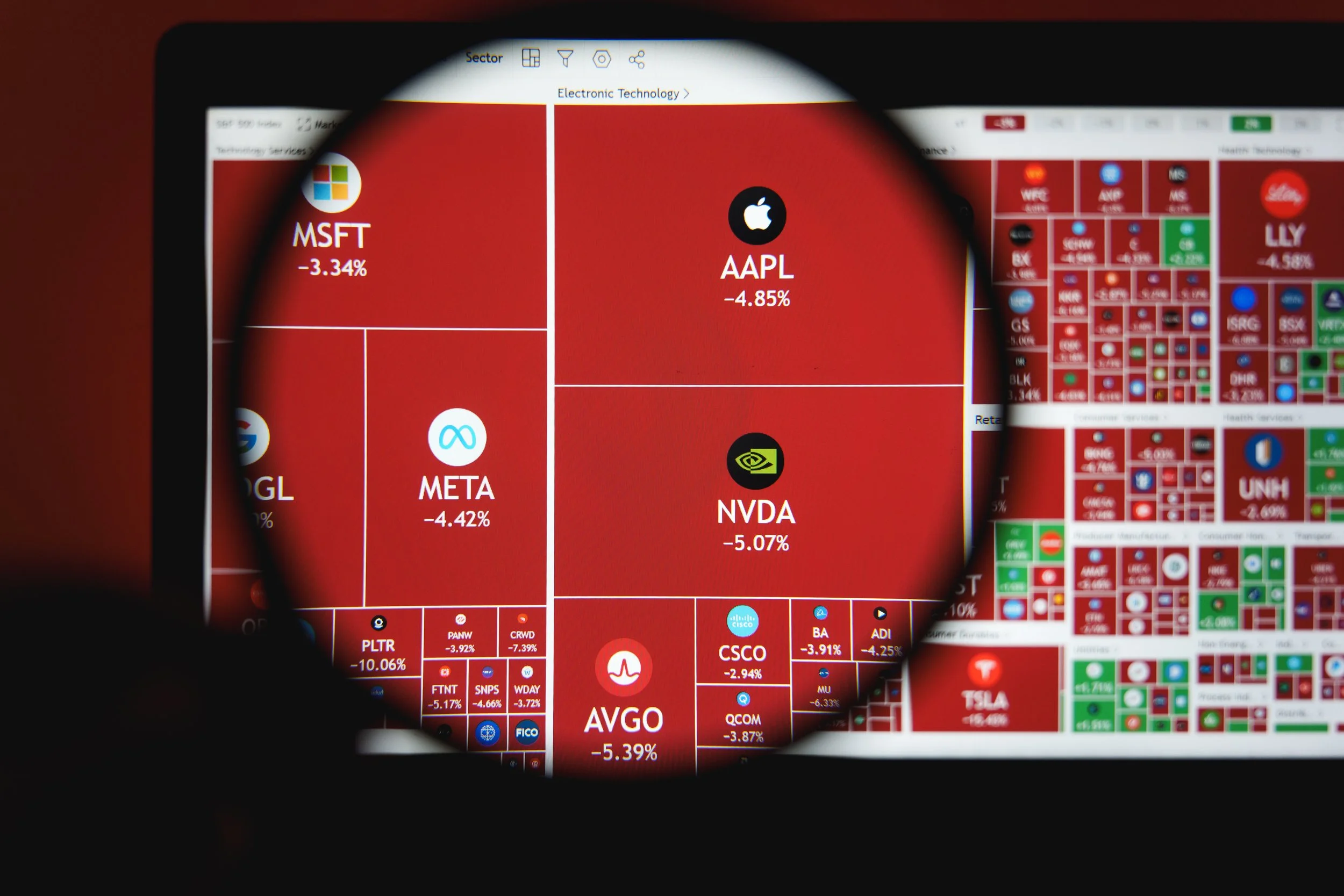

NKE has recently experienced declines. From Sep 2022 to August 2023, NKE fell -4.49% while the S&P 500 has risen 15.58%. Nike had a great run of outperforming the S&P 500 for 10 out of 12 years prior to 2021 but has been on a losing streak since.

Is Nike poised to make a comeback? Predicting the future of any stock, or the market overall, is a difficult task. Nike is the industry leader in athletic apparel, particularly in footwear. If Nike can maintain their brand and industry leadership, they are poised to be successful. Achieving outperformance relative to the S&P 500 is not guaranteed.

Let’s look at a few different ways to approach valuing a stock to get a sense of if NKE appears over or undervalued.

🍰 Price / Earnings (P/E) ratio - how much are you paying for each dollar of earnings:

Pros: Earnings are the profits of the company, and those profits are ultimately what is available for shareholders as dividends

Cons: Easily manipulated or adjusted by many line items on the income statement, can vary greatly year to year

Current P/E: 29.84

3 year median P/E: 36.26

Implied Valuation based on $3.23 Earnings Per Share = $117.12

Verdict: Undervalued, hold your NKE for now

💰 Price / Sales (P/S) ratio – how much are you paying for each dollar of revenue:

Pros: Less subject to manipulation or fluctuation

Cons: Doesn’t consider efficiency (i.e. costs necessary to generate the revenues)

Current P/S: 2.95

3 year median P/S: 4.62

Implied Valued based on $32.63 revenue per share = $150.70

Verdict: Undervalued, hold your NKE for now

🔄 Price / Free Cash Flow (P/FCF) ratio - How much are you paying for each dollar of operating cash:

Pros: Shows cash actually available to investors for dividends or stock buybacks, ignores non-cash expenses (i.e. depreciation)

Cons: Still subject to manipulation based on accounting practices, can vary greatly year to year

Currentl P/FCF: 31.06

3 year median P/FCF: 43.98

Implied value based on $3.10 free cash flow per share = $136.50

Verdict: Undervalued, hold your NKE for now

🥣 Average of all ratios:

Take the average of the implied values for P/E, P/S, and P/FCF

Implied Value = $134.77

Verdict: Undervalued, hold your NKE for now

🚀 Price / Earnings Growth (PEG) ratio = P/E ratio / Earning Growth – measure P/E in context of company’s growth rate

PEG < 1 implies undervalued, PEG > 1 implies overvalued.

Currently: 29.89 / -16.46 = -1.81

Decrease in EPS results in negative value.

Forward 1 year: 1.775

Verdict: Overvalued (sell your NKE now).

Based on historical averages, NKE currently appears undervalued

You can also take different time periods for the median of these valuations, to see what Nike’s valuation has been like over a longer period of time.

Note: All data courtesy of YCharts as of: 9/15/2023

While Nike may appear severely undervalued on a 3-year basis, the difference is smaller over 5-year and 10-year medians. If you’re thinking about selling, these valuations may give you some guideline thresholds to re-evaluate at.

Based on historical averages for NKE, the stock currently appears undervalued. The decline in NKE’s price in recent years is a big reason for that. Whether the decline will continue, or NKE will return to its historical valuation norms nobody knows. Looking at the basic fundamentals, NKE appears healthy overall.

Earnings & revenue have continued to grow.

NKE has consistently sold its products above the cost of those goods.

NKE can cover both its current and longer-term debt needs based on existing cash and future expected earnings.

NKE has not missed a dividend in the past 10 years.

These metrics are by no means the only way to approach whether now is a good time to sell your NKE stock. Other factors to consider:

The amount of time you think you will work at Nike.

How much of your Net Worth is tied to NKE?

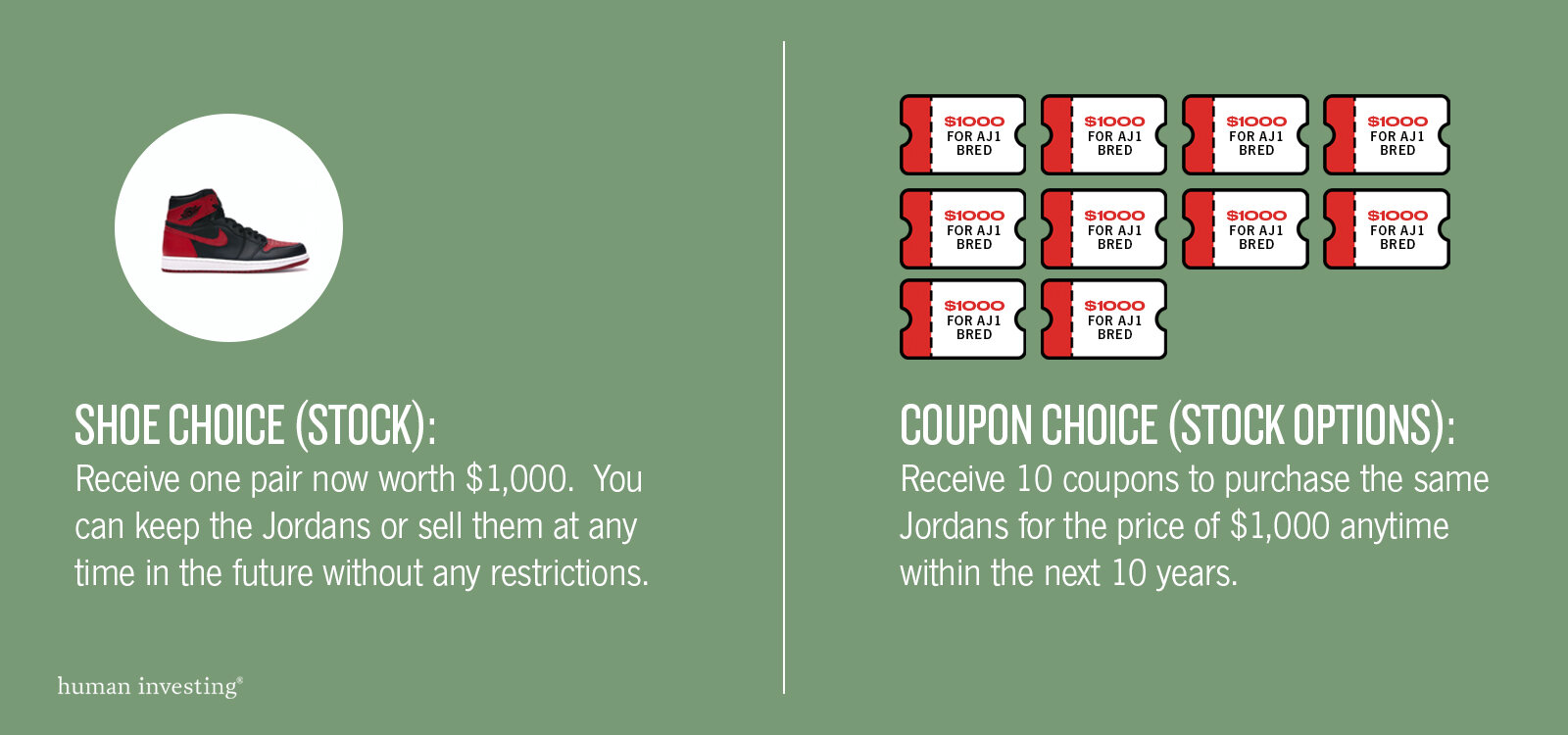

When do your Stock Options expire (if applicable)?

Your comfort level with the ups and downs over time.

Do you have any major expenses coming up? i.e. house purchase, funding college, etc.

We’re here to help

Beyond these factors and metrics, it is important to integrate your Nike stock decisions within the context of a comprehensive financial plan. If you have questions or would like to discuss whether to hold or sell your NKE stock, please reach out to us at nike@humaninvesting.com.