A financial plan is a structured approach to managing one’s financial life. It is not merely a spreadsheet or a collection of investment products—it is a comprehensive framework that organizes income, expenses, savings, risk management, taxes, and long-term goals into a cohesive, actionable strategy. When constructed properly, a financial plan enhances decision-making, reduces uncertainty, and improves financial outcomes (Nissenbaum, Raasch, & Ratner, 2004).

Yet if financial planning is so powerful, why do so few follow through?

The answer often lies not in math, but in mindset. Research shows that even financially literate individuals struggle to plan for the future when they lack self-control, future orientation, or supportive social norms (Tomar, Baker, Kumar, & Hoffmann, 2021). A well-designed plan must account not just for assets and liabilities—but for human behavior. That’s why the best financial plans are often paired with an accredited fiduciary advisor, who offers a simple, visual, and tailored approach to help you make decisions.

At its core, a financial plan helps individuals clarify what matters most and align their resources accordingly. Whether navigating early adulthood, managing a growing family, or preparing for retirement, individuals benefit from a written plan that reflects financial priorities and personal values. In my work as a financial advisor and educator, I have seen that the most significant breakthroughs often come not from more money, but from more clarity.

the purpose of a financial plan

The purpose of a financial plan is twofold: to organize current financial resources and to make informed decisions about the future. This may sound straightforward, but the complexity of modern financial life often makes it difficult for individuals to answer even basic questions such as, "Can I afford this?" or "Am I on track?" A financial plan provides a framework to answer these questions thoughtfully and methodically.

More than a static document, a financial plan is a living tool. It should evolve alongside an individual's life stages, economic conditions, and shifting priorities. According to Nissenbaum, Raasch, and Ratner (2004), regularly reviewed and updated plans yield significantly better financial outcomes over time.

It starts with defining your goals

Goal-setting is the anchor of any financial plan. Without clear goals, even the most sophisticated strategies can lose direction. Goals give context to numbers and bring meaning to saving and investing. They can be short-term (saving for a vacation), mid-term (purchasing a home), or long-term (funding retirement or creating a legacy).

One of the most effective frameworks for goal setting is the SMART method—specific, Measurable, Achievable, Relevant, and Time-bound. Goals should inspire and direct behavior. In my experience, clients who articulate their goals clearly are far more likely to follow through on their plans.

components of a comprehensive plan

A thorough financial plan includes several interdependent elements, each of which contributes to the individual's or household's overall financial health. According to Ernst & Young’s Personal Financial Planning Guide (Nissenbaum et al., 2004), the five essential components are:

Cash Flow and Budgeting

Understanding income and expenses is the foundation of any financial plan. A clear cash flow picture allows individuals to make informed decisions about saving, spending, and giving. Budgeting is not about restriction; it is about intentionality. When individuals budget effectively, they begin to control their money rather than letting money control them.Risk Management and Insurance

Life is unpredictable. A good financial plan includes appropriate insurance coverage to protect against major disruptions—including illness, disability, death, or property loss. While not exciting, insurance serves as a financial firewall. Emergency savings also fall into this category, with most professionals recommending a reserve of 3 to 6 months of essential expenses.Tax Planning

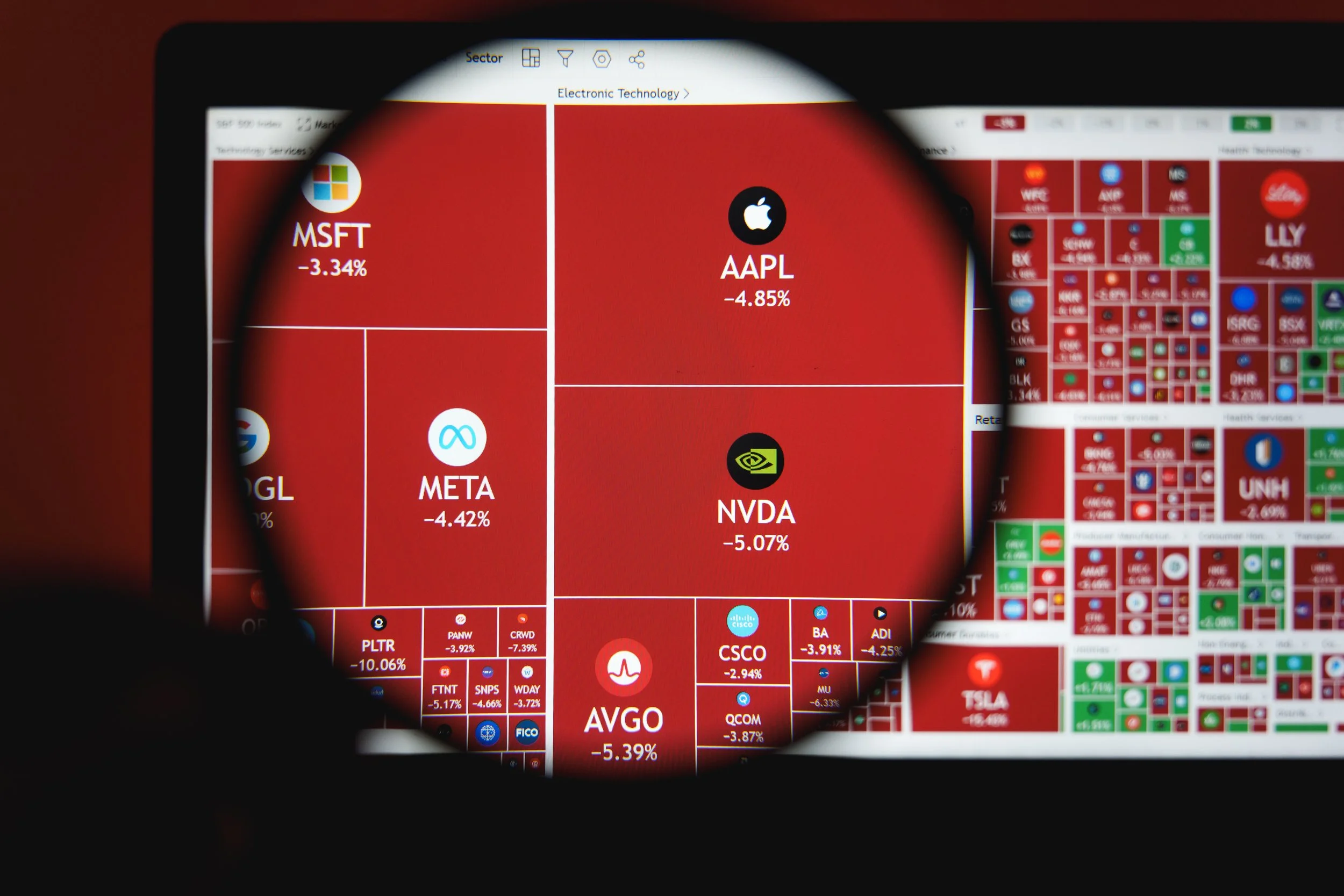

Tax efficiency is a core pillar of financial planning. Smart planning reduces unnecessary tax burdens and aligns financial decisions with long-term goals. This includes strategic use of tax-advantaged accounts, such as IRAs and 401(k)s, as well as decisions around capital gains, charitable giving, and income timing.Investment Planning

Investments must serve the plan—not the other way around. A financial plan defines the purpose, time horizon, and risk tolerance for each investment goal. This helps investors avoid emotional decisions and focus on long-term strategies. Diversification, asset allocation, and periodic rebalancing are all part of this disciplined approach.Retirement and Estate Planning

A financial plan must consider the future. This includes projecting future income needs, optimizing Social Security benefits, managing required minimum distributions (RMDs), and crafting an estate plan that reflects one’s legacy goals. Planning ahead ensures that wealth is transferred intentionally and tax-efficiently.

Building a financial plan: a step-by-step process

While the components of a financial plan are well-established, the process of creating one can be deeply personal. Below is a common approach used by both individuals and professionals:

Establish Goals and Priorities

Start by asking what matters most. What do you want your money to do for you? What are your non-negotiables? Apply the SMART method in making them more attainable. Writing these goals down is a powerful first step.Gather Data

Collect all relevant financial information, including income, expenses, debts, assets, insurance policies, and legal documents. The accuracy of your plan depends on the quality of your data.Analyze and Diagnose

Identify gaps, inefficiencies, or risks. This includes assessing debt levels, reviewing savings rates, stress-testing for emergencies, and evaluating investment alignment.Develop Strategies

Design strategies that address the specific needs uncovered in your analysis. This might include refinancing high-interest debt, increasing retirement contributions, or adjusting your investment allocation.Implement the Plan

Execution is where many plans fall apart. Automate good behavior when possible—automated savings, investment contributions, and bill payments reduce reliance on willpower.Monitor and Review

Plans should be reviewed at least annually, and anytime there is a significant life event (e.g., marriage, new job, birth of a child). Adjustments should be proactive, not reactive.

Behavioral considerations in financial planning

Financial planning is as much about psychology as it is about math. Behavioral finance has shown that individuals often act irrationally with money due to cognitive biases, emotional reactions, and social pressures. A written financial plan serves as a behavioral anchor—a tool that reduces the likelihood of impulsive decisions.

Recent research reinforces the role of psychology in retirement financial planning. Tomar, Baker, Kumar, and Hoffmann (2021) identify several psychological determinants that significantly impact whether individuals engage in effective planning. These include future time perspective (the ability to think long-term), self-control, planning attitudes, and financial knowledge. In other words, it is not enough to know what to do; one must also be inclined to do it. Social norms and perceived behavioral control also play an influential role, suggesting that a supportive environment enhances financial planning behavior.

Research has shown that investors with written plans are more likely to stay invested during market volatility, rebalance their portfolios regularly, and avoid the pitfalls of market timing. A plan brings structure, and structure supports discipline.

common mistakes and how to avoid them

Even well-intentioned individuals fall prey to common planning mistakes. These include:

Neglecting emergency savings

Underestimating expenses in retirement

Taking on too much investment risk

Failing to review insurance coverage

Overlooking tax implications of financial decisions

Not discussing financial goals with a spouse or partner

Avoiding these mistakes begins with awareness and regularly revisiting the plan. A good advisor doesn’t just build a plan—they help you adapt it.

the value of working with an advisor

While many individuals can build a basic plan on their own, the guidance of a fiduciary financial advisor can add significant value. Advisors provide objectivity, technical expertise, and behavioral coaching. At Human Investing, we believe our highest calling is to serve as guides—helping clients navigate complexity with wisdom and clarity.

Importantly, not all financial advisors are held to the same standard. A fiduciary advisor is legally obligated to act in your best interest. Yet even among those who use the fiduciary label, fewer than five percent operate without receiving any form of commission (Fisher, 2025). That’s why the true fiduciary standard—free from all commissions—should be the baseline, not the exception.

turn intention into action

A financial plan is not just a document—it’s a decision. It reflects your willingness to take control of your future instead of drifting into it. The most successful outcomes aren’t reserved for the wealthiest or the most analytical—they’re earned by those who start, stay consistent, and make adjustments along the way.

If you’ve made it this far, you already care about your financial future. The next step is simple, but powerful: act. Whether it’s writing down your goals, scheduling time to review your budget, or meeting with a fiduciary advisor, do one thing today that your future self will thank you for.

Your money needs a plan. And now, you have the framework to build one that works.

References

Fisher, P. (2025, February 14). Only 4.92% of advisors are true fiduciaries. Is yours? Human Investing. https://www.humaninvesting.com/450-journal/only-5-percent-of-advisors-are-true-fiduciaries

Nissenbaum, M., Raasch, B. J., & Ratner, C. L. (2004). Ernst & Young's personal financial planning guide. John Wiley & Sons.

Tomar, S., Baker, H. K., Kumar, S., & Hoffmann, A. O. (2021). Psychological determinants of retirement financial planning behavior. Journal of Business Research, 133, 432–449.

Disclosures: Human Investing is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). Registration with the SEC does not imply a certain level of skill or training. This article is provided for informational and educational purposes only and should not be construed as personalized investment advice. The information contained herein is believed to be accurate as of the publication date but is subject to change without notice. Past performance is not indicative of future results. Investing involves risk, including the potential loss of principal. Readers should consult with a qualified financial advisor to assess their individual circumstances before making any financial decisions.