“Isn’t financial planning a dying profession?”

A first-year undergraduate student majoring in Financial Planning approached me after class one day and asked what he thought was a very simple question – “What’s the difference between a financial planner and a financial advisor?” Simple answer? Not really.

As I was working to establish a CFP Board Registered Program at a university, an administrator asked me the following few questions as part of his vetting process: “Isn’t financial planning a dying profession?” “Don’t robots already do financial planning?” “Who is going to hire a 23- year-old financial planner to help them with their finances?” These came from a smart individual who had a strong record of professional success. What was he talking about?

I was speaking with a long-distance friend the other day who told me, “I’m sure glad that my financial planner doesn’t charge me a fee each time we meet but, instead, she only takes a very small percentage from returns on the investments I have with her.” Did this financial planner appropriately disclose compensation methods? I am sure she did. Did this friend understand the true cost of what he was paying for financial planning services? Obviously not.

“We don’t trust you.”

Several years ago, I was at an annual conference for a large financial planning organization. The conference organizers planned an innovative and unique keynote session where they invited a panel of strangers gathered randomly and spontaneously from off the streets outside of the meeting venue. This group of individuals was diverse and clearly represented many demographic and socioeconomic classes. They were asked a variety of questions about their need for financial advice and desire for help with the money management tasks of life. It was evident that this group was readily willing to admit their lack of financial knowledge and self-efficacy when it came to money-related topics and behaviors.

Then came the curve ball. The panel was told that the room of people (nearly one thousand) who were in front of them were all financial professionals. They were asked another simple question – “Would you hire any of these individuals to help you with your personal finances?” Every one of the panelists said “no!” When asked why, they all said in their own words a message that sounded like “we don’t trust you.” Did these individuals need help managing their financial decisions? You bet. Were they looking to the financial planning industry to fill that role? No. Before you dismiss this as a case of non-target-audience identity for financial planning services, let me introduce you to another conversation.

“I can’t get objective advice anywhere!”

Recently, I found myself in a conversation with the leader of a local company. He had come to our financial planning firm as a prospective client for planning services. Given the fact that he had been affluent for a significant number of years and was nearing the latter part of his working years, I inquired about his experiences with financial planning in the past and what brought him to our company. His answer was firm and without deliberation – “I can’t get objective advice anywhere!” Was this individual the ideal financial planning client? Pretty much. Why is it so hard to get objective advice?

So, what is the difference between a financial planner and a financial advisor?

Do you know? Could you explain it to this young and eager student? Is there a difference? We would argue that it does not matter. The core issue is about substance and structure – not semantics. People are looking for a service and not a job or profession title. Why do we continually encounter situations like the ones we have described? Why all the confusion around the discipline of financial planning and why the lack of trust and objectivity? Why is this not a prevailing theme of most other professions (think doctors, lawyers, architects, teachers, pharmacists, engineers, etc.)? It does not take much more than a quick look at the culture and system of the industry to find the dilemma.

There is a long list of systemic factors that have impaired financial planning outcomes and distorted the way in which financial planning is done. Here are a few:

Products over services

Business models of financial planning firms and compensation structure for planners

Career status and prestige based solely on sales achievements

Role of incentives (Charlie Munger was right when he said “Show me the incentive and I’ll show you the outcome”)

Conflicts of interest that are not transparent

The need for and confusion surrounding “fiduciary”

Measures of success and effectiveness tied to a book of business

Academic preparation/credentialing/pathway to profession

Focus on money content and education while overlooking behavior

Technology/Machine learning and the loss of the human

Investment services silo instead of comprehensive financial planning

Individual planner model instead of team approach

Restoring confidence in all of us

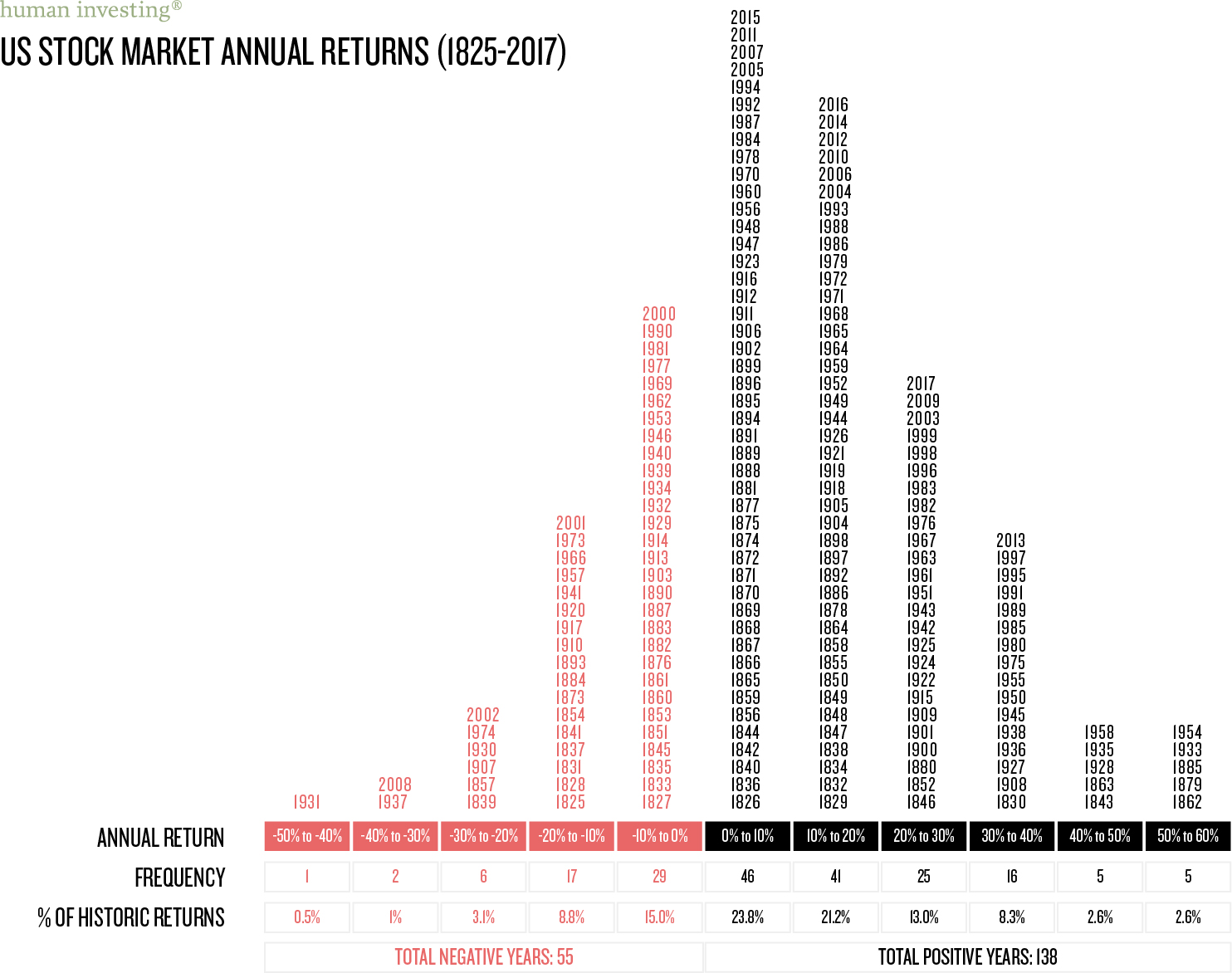

We are going to be publishing a series of blog posts that highlight and elaborate on these dynamics that have contributed to the rationale for the questions that are mentioned above and the current state of the financial planning profession. In other words, we are going to define what we see as wrong. See, it is not any one thing. Nothing big is wrong. Big things tend to be addressed with swift action through market response or regulation. It is smaller pieces that are broken and those small pieces accumulate into a perception of confusion and mistrust and suboptimal financial planning outcomes.

We will not stop at identifying problems but, instead, will share what we believe are solutions to these obstacles. We will elaborate on how we do financial planning and define its effectiveness by addressing these challenges to offer our clients the most comprehensive and purest form of human-centered financial planning. It is exactly why our core purpose is to faithfully serve the financial pursuits of all people. That is a big ambition, but it is precisely what individuals and families need, and it is our highest ideal for financial planning. We believe it is a mission worth pursuing.

Ryan Halley, Ph.D., CFP® is Director of Planning Practices and Research at Human Investing. He holds a doctorate in Personal Financial Planning from Texas Tech University and an MBA with a concentration in Finance from The Ohio State University. Ryan has his CERTIFIED FINANCIAL PLANNER™ certification. Dr. Halley is also a Professor of Finance and Financial Planning at George Fox University, where he directs a CFP® Registered Program located near Portland, Oregon. He has co-authored a book and has numerous peer-reviewed journal articles. Additionally, he has been an invited professor and lecturer at various universities in the United States, Canada and China.

Related Articles