Rolling a 401(K) Account Into an IRA: Why You Shouldn’t Abandon Your Old Companies’ Retirement Plans (Updated for 2025)

How many retirement accounts do you have?

The typical baby boomer will have an average of 13 jobs over their working career, according to the Bureau of Labor Statistics. While job moves are practically unavoidable, there are both internal and external challenges to navigate. A common mistake that many investors make is abandoning their old company’s retirement plan with the hopes of figuring it out later. If this is you, you’re not alone! According to USA Today, Americans have more than $1.65 trillion worth of lost or forgotten 401(k) accounts.

Consolidate them into one account

Working with a trusted partner like Human Investing to consolidate your old 401k’s (or 403b) into a single IRA is the best choice. This article outlines the three key benefits of rolling over your old employer retirement plans into an IRA. Consolidating accounts can help you track your hard-earned dollars and simplify your financial household. One account. One Statement. One password. One clear Retirement goal.

Take advantage of the universe of investment options with an IRA

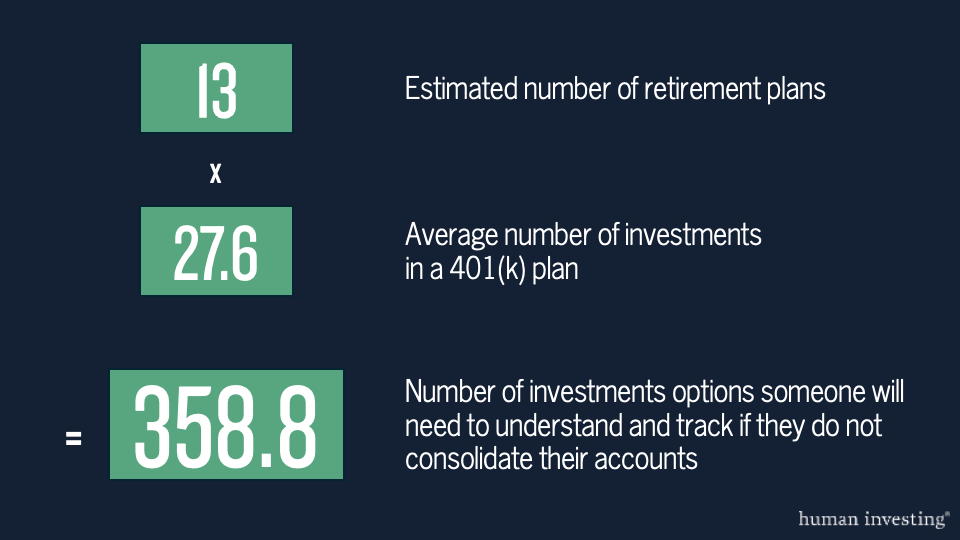

The investment options in a 401k can be limited. According to Vanguard, the average 401k plan has 27.6 investment options for employees to choose from. The graphic below demonstrates how your investment plan may get out of hand quickly as your list of ex-employers grows. Consolidating your 401k into an IRA can give you access to a greater universe of investment options tailored to your needs.

Build a retirement income plan

Saving money in a retirement account is not a means to an end. There is a purpose to it, and for most the goal is retirement. You put money into a retirement account so that you may withdraw it someday when you are no longer receiving a paycheck. Our Human Investing advisors are specialists when it comes to building a retirement income plan.

When converting hard-earned savings into retirement income, an IRA is superior to a 401k. An IRA affords a retiree the ability to do two crucial things:

1) Increase the tax-efficiency of their withdrawals; and

2) Strategize how they will withdraw money to not violate the first rule of investing: buy low, sell high.

Which account type is right for you as you plan for retirement? For most, an IRA makes sense. An IRA can provide consolidation, more investment options, and efficiencies in retirement.

Start your rollover

Deciphering what to do with your old retirement account can be intimidating and we want to be here to help. If you worked for a publicly traded company and owned shares in your 401k, there are other rollover rules that apply. If you have more questions or would like to discuss your retirement plan with an advisor, schedule an appointment below.

Sources:

[1] U.S. Bureau of Labor Statistics. "Number of Jobs, Labor Market Experience, and Earnings Growth: Results From a National Longitudinal Survey." Accessed August, 2025.

[2] USA Today, July 30, 2025

[3] The Vanguard Group, How America Saves Report - 2025.

Disclosure: This material is for informational and educational purposes only and is not intended as personalized tax, legal, or investment advice. You should consult your own tax, legal, and financial professionals before making any decisions based on the information provided. Tax laws and regulations are subject to change, and their application can vary based on your individual circumstances. While the strategies discussed may be appropriate for some individuals, there is no guarantee that any specific tax outcome or investment result will be achieved. Any examples, scenarios, or case studies are hypothetical and for illustrative purposes only. They do not represent actual client situations and should not be relied upon to predict or project results. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. All investments and tax strategies carry certain risks and may not be suitable for all investors. Advisory services offered through Human Investing, LLC, an SEC registered investment adviser.