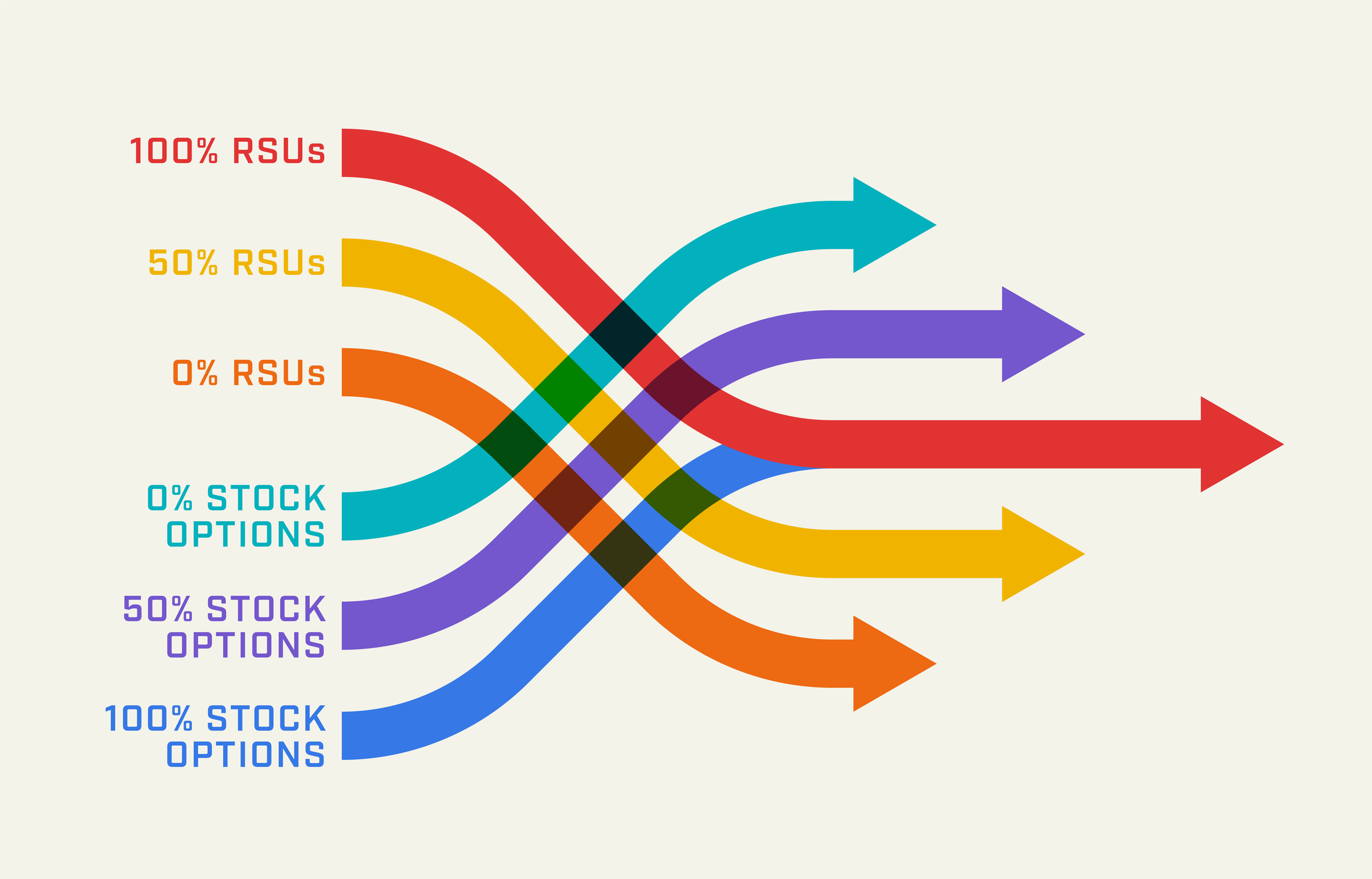

The Nike stock choice window is just around the corner. While this may seem like a straightforward decision, it’s an important time to consider all aspects of your financial plan to make an informed decision that will best suit your needs. Through reflection and thoughtful planning, we often collaborate with Nike clients to walk them through this choice which serves their life goals best.

As we have worked with individuals in various life stages, we have seen a variety of needs and preferences emerge. Different people are trying to meet a diverse set of needs for themselves and their families.

We’d like to share a few stories of people in different life stages in hopes that one (or more) will resonate with you. We believe that each person has a unique story, and needs advice tailored to their specific situation. We like to know our clients by building a trusted and genuine human connection so we can serve them as a fiduciary.

The personas profiled below are not reflective of any particular client or person. They are generalities based on years of experience working with Nike employees.

Meet John, 31, Director at Nike:

John, 31-years-old, was recently promoted to a Director role at Nike. He has been with the company for about two years and proudly considers himself a “lifer” at Nike. He believes in Nike’s long-term potential as a company and is excited about the opportunity to participate in its future growth. John likes to branch out in his investing by purchasing cryptocurrency and considers himself a risk-taker. He has a high-risk tolerance, not just in investing, but also in his love of extreme mountain biking. He is now entering his first year of participating in the annual stock choice, and is enthusiastic to partake in the future success of a company he truly believes in.

John is married with no kids, currently has little expenses and saves most of his paycheck. He is in a strong position and mindset to take more risk with his stock choices.

Our recommendation: By choosing stock options over restricted stock units (RSUs), John has the opportunity to benefit from Nike’s long-term growth. This choice provides him an approach that aligns with both his financial philosophy and comfort as well as his commitment to Nike’s future.

Meet Rachel, 42, Senior Director at Nike:

Married with young children in public school, Rachel, 42 years old, is focused on financial stability and meeting her family’s ongoing expenses. She has been at Nike for four years and currently excels in her role as a Senior Director. She has enjoyed her time at the company but is currently considering roles elsewhere. Rachel’s uncertainty about long-term tenure influences how she approaches financial decisions—particularly those tied to equity compensation.

Rachel is a conservative investor who doesn’t want to put all her eggs in one basket. Rachel tends to avoid risk and prefers stability over speculation.

Our recommendation: RSUs are a reliable source of income for Rachel. Her risk-averse mindset and need for cash have led her to select RSUs as her Nike stock choice decision in the past and sell them upon vesting. Continuing to choose RSUs allows Rachel to obtain a steady cash flow and participate in Nike’s equity program in a way that supports her personal and professional needs best.

Meet Matt, 53, VP at Nike:

Matt, a 53-year-old Vice President at Nike, has been with the company for a decade and is approaching a key transition point in his career. With plans to retire within the next one to two years, he has been closely reviewing his overall financial plan to adequately prepare for the future. Matt is uncertain about Nike in the long-term and doesn’t want to rely on his stock awards to fund all his personal goals and dreams.

Matt is nearing eligibility age for a special retirement vesting treatment. If Matt remains with Nike at age 55 this rule would extend his window to hold onto his unvested stock options (grants held for at least one year) beyond the typical 90 days.

However, with college-age children and education expenses creeping up, he also has immediate cash needs to consider.

Our recommendation: While RSUs offer a more reliable payout, options could become a strategic tool if the stock grows before the options expire. Ultimately, Matt must strike a balance of these two stock choices that fits his needs. His decision will likely be a mix of both options and RSUs to support his family and the opportunity for long-term growth.

How the Stock Choice Can Serve You

As these examples illustrate, there's no single approach that works for everyone. These stories are here to serve as a starting point for discussion around your personalized plan.

The Nike stock choice window is more than just an annual selection. It’s an opportunity to reflect on your broader financial goals and personal values. Whether you're early in your career like John, balancing family needs like Rachel, or preparing for retirement like Matt, your decision should align with where you are now and where you want to go.

Each individual’s situation is unique, and should factor in timing, risk tolerance, behavioral, and quantitative analysis. We’re here to help you think through those variables with clarity and confidence.

If you have questions or want to dive into an analysis of your own situation, take our survey below.

TAKE OUR ANNUAL STOCK CHOICE SURVEY

Get a customized score to help you make your stock choice this year.

Disclosures: The information provided in this communication is for informational and educational purposes only and should not be construed as investment advice, a recommendation, or an offer to buy or sell any securities. Market conditions can change at any time, and there is no assurance that any investment strategy will be successful. Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results.

Diversification does not guarantee a profit or protect against a loss in declining markets. Asset allocation and portfolio strategies do not ensure a profit or guarantee against loss.

Scenarios discussed are hypothetical and for illustrative purposes only. They do not represent actual clients or outcomes and should not be interpreted as guarantees of future results.

The opinions expressed in this communication reflect our best judgment at the time of publication and are subject to change without notice. Any references to specific securities, asset classes, or financial strategies are for illustrative purposes only and should not be considered individualized recommendations.

Human Investing is a SEC Registered Investment Adviser. Registration as an investment adviser does not imply any level of skill or training and does not constitute an endorsement by the Commission. Please consult with your financial advisor to determine the appropriateness of any investment strategy based on your individual circumstances.