Looking to go on a “once in a lifetime” trip to Fiji? Remodel your kitchen? Buy a new car? If your employer plan allows it, you may be tempted to take out a loan from your 401(k) to help fund that major expense.

Before you do, let’s talk through what a 401k loan looks like today and why borrowing from your future self can cost far more than you expect.

The Details

If your 401(k) plan allows loans, you can technically borrow up to $50,000 or 50% of your owned retirement savings (vested balance), whichever is less. There’s no credit check, and repayments are automatically taken from your paycheck.

For 2025, the interest rate on a 401k loan is roughly 9.50% (Rate of Prime + 1%). That’s a high rate for borrowing from yourself, and it can add up quickly. While the interest you pay goes back into your account, it’s still your retirement money being used, which could slow long-term growth.

Even though it’s allowed, taking a loan from your 401(k) isn’t usually recommended: about 1 in 5 people with a 401(k) have a loan at any given time, but doing so can put your future financial security at risk.

The Dangerous Reality

Still sounds pretty good, right? Well… not so fast.

A 401(k) loan can come at a real cost and not just the money you pull out today. It’s the potential long-term growth and retirement dollars you lose out on by stepping out of the market and halting contributions.

Here’s what you need to understand:

You lose tax-advantaged growth

Loan repayments are made with after-tax dollars. Then you’ll likely pay tax again when withdrawing the funds in retirement. That double-tax effect makes the math harder to win.

You could face a tax bill and penalty if you change jobs

If you leave your employer before the loan is repaid, the remaining balance typically must be paid back by tax filing time. If not, the balance becomes taxable and if you are under 59½, you may face a 10% early withdrawal penalty.

Stopping contributions

Many borrowers pause contributions while repaying the loan. If your plan gives an employer match, that means you may miss out on free money.

Dollars stop compounding

The money you borrow no longer participates in the market. In periods of growth, missing out on compounding has long-term consequences.

A Real-Life Example

Say you make $75,000 a year and want to borrow $15,000 from your 401(k) to fund a big trip or home project. To make the loan payments easier, you pause your 401(k) contributions while you pay it back.

Let’s also assume you already have $50,000 saved in your 401(k) when you take this loan.

Here’s what happens:

You normally save 7% of your pay ($5,250/year)

Your employer matches another 3% ($2,250/year)

By stopping contributions for three years, you miss:

$15,750 you would have put in

$6,750 your employer would have matched

That’s $22,500 total that never gets invested.

Now let’s look at the long-term impact.

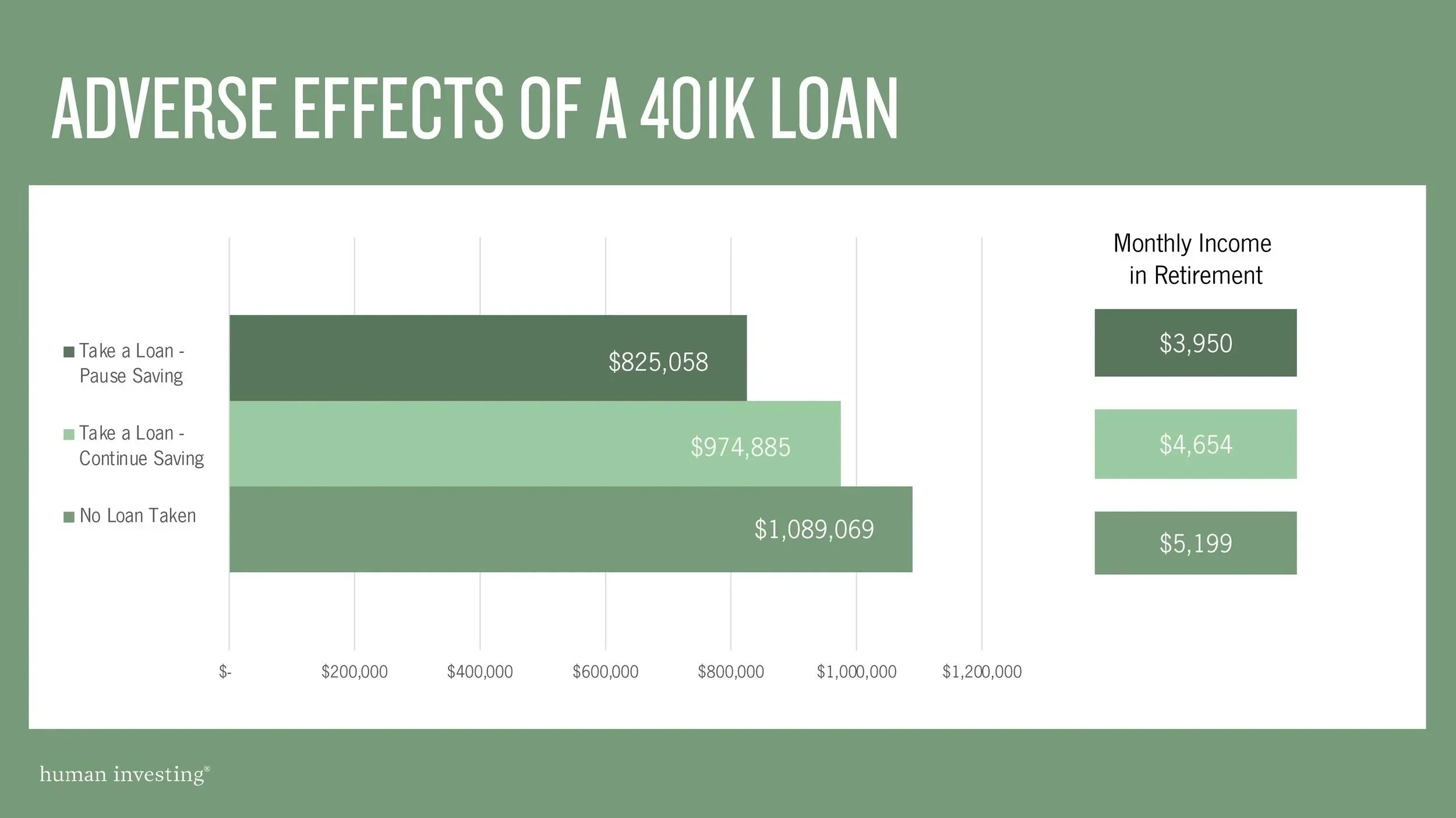

This graph is for illustration purposes only. It highlights the impact a loan has on an individual’s retirement balance and monthly retirement income after 30 years of investment growth during working years (assuming 7% annual market return and annual contributions of $7,500) and 30 years of income through retirement (assuming 4% rate of return). In this example an individual takes a $15k 401(k) loan from a $50k balance to pay down some bills and a finance a vacation.

If that $22,500 had been invested and grew at a reasonable long-term rate of 7% per year over 30 years it could grow to roughly $265,000 by retirement age.

That also means potentially $1,250 less per month during retirement all to fund something that might only last a week or two, today.

Options to Consider

For some people, a 401(k) loan may be a necessary tool for true emergencies. But for vacations, renovations, or lifestyle upgrades, think twice.

Here’s what to do instead:

Build a dedicated savings fund for big trips or purchases

Maintain an emergency reserve (3–6 months of expenses)

Continue contributions if a loan is taken, especially if employer match is available

Talk with your plan administrator or financial advisor to understand your plan’s rules

Borrowing from your retirement plan may feel easy, but the long-term cost can be steep. Give your future self the chance to enjoy a comfortable retirement without sacrificing peace of mind today.

Disclosure: This material is for informational purposes only and is not intended to provide investment, tax, or legal advice. The examples provided are hypothetical and for illustration only. Actual results will vary. Retirement plan loans and withdrawals may have long-term effects on your savings and tax situation. Consider consulting a qualified financial professional before making decisions about your 401(k) or other retirement accounts.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. Human Investing is an SEC-registered investment adviser. Registration does not imply any level of skill or training.