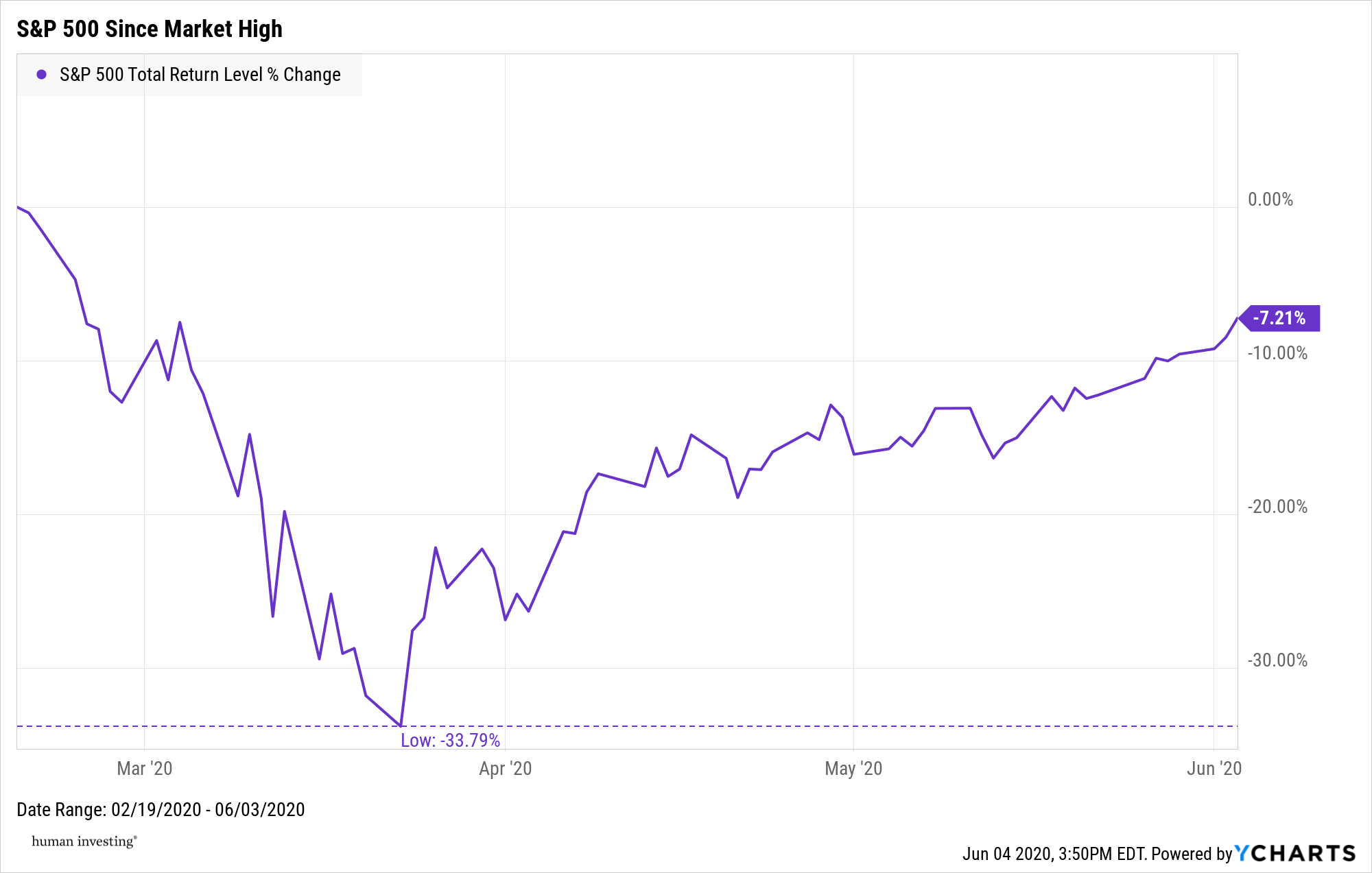

In March, we were inundated with updates about the coronavirus and the unknown ramifications to follow. In the same month that the NBA was postponed, children were sent home from school, toilet paper fled the grocery store shelves, the US stock market had three of the worst days in US history.

Behind the scenes

Unlike the year 2020, your 401(k) account is routine and emotionless. If there is no user interference (yes, that is you), your account will continue to invest in the stock market every paycheck. A 401(k) account can help alleviate market-timing decisions by adopting an investment strategy called dollar-cost averaging. Instead of waking up in the morning and deciding “is today a good day to buy some stock?”, your 401(k) systematically makes those timing decisions for you.

To review the ease of these timing decisions, I wanted to show investors what happened if you made a $50.00 contribution to your 401(k) account every paycheck during 2020. In this scenario, we assume employees were paid every two-weeks (starting on January 3, 2020) and invested in the Vanguard Target Retirement 2055 (VVFVX) fund.

Slowly building a foundation

These dollars represent the trading value of the Vanguard Target Retirement 2055 (VVFVX) on specific days. In this exercise, the lowest trading price was $31.16 on March 20th, and the highest trading price was $48.55 on November 27th.

Thank you, automation.

As you can see, the best time to invest in the stock market this year (March) was also arguably the most uncertain and scary time to be an individual investor. From a February 21st paycheck to a March 6th paycheck, the price of this target date fund dropped 9%. From a March 6th paycheck to a March 20th paycheck, the price dropped 21%.

When prices were falling, your 401(k) account bought shares at a lower price without panicking, consulting the news, or making impulsive decisions. For that reason, we should give 401(k) accounts a standing ovation for being a reliable, unemotional investment vehicle this year.

Let 2020 be a reminder that if your boxes are checked, outsourcing and automating your account is one way to ease your emotions.