Your bonus is not taxed more than regular income.

Have you ever noticed the discrepancy between the bonus payment that was communicated to you and the actual bonus payout? As an example, let’s say your employer announced that you will get a $5,000 bonus, but the upcoming paycheck is only $3,500. What happened?! The common and incorrect narrative is something along the lines of “Bonuses are taxed more than regular income!”

This is not true. Bonuses are taxed at the same rate as your regular income. Please keep reading if you would like to see an example.

Why do we think that bonuses are taxed more than regular income?

Probably because bonus payments are treated by the IRS as ‘supplemental income’, whereas your regular income is treated as ‘ordinary income’ by the IRS.

Supplement and ordinary income are taxed at the same rate. However, supplemental income (like bonuses, overtime pay, severance, and tips) require employers to withhold more taxes. Due to the tax withholding, it feels like bonuses are taxed more than regular pay. And yes, they do have more taxes withheld up front so it does impact your cash-flow.

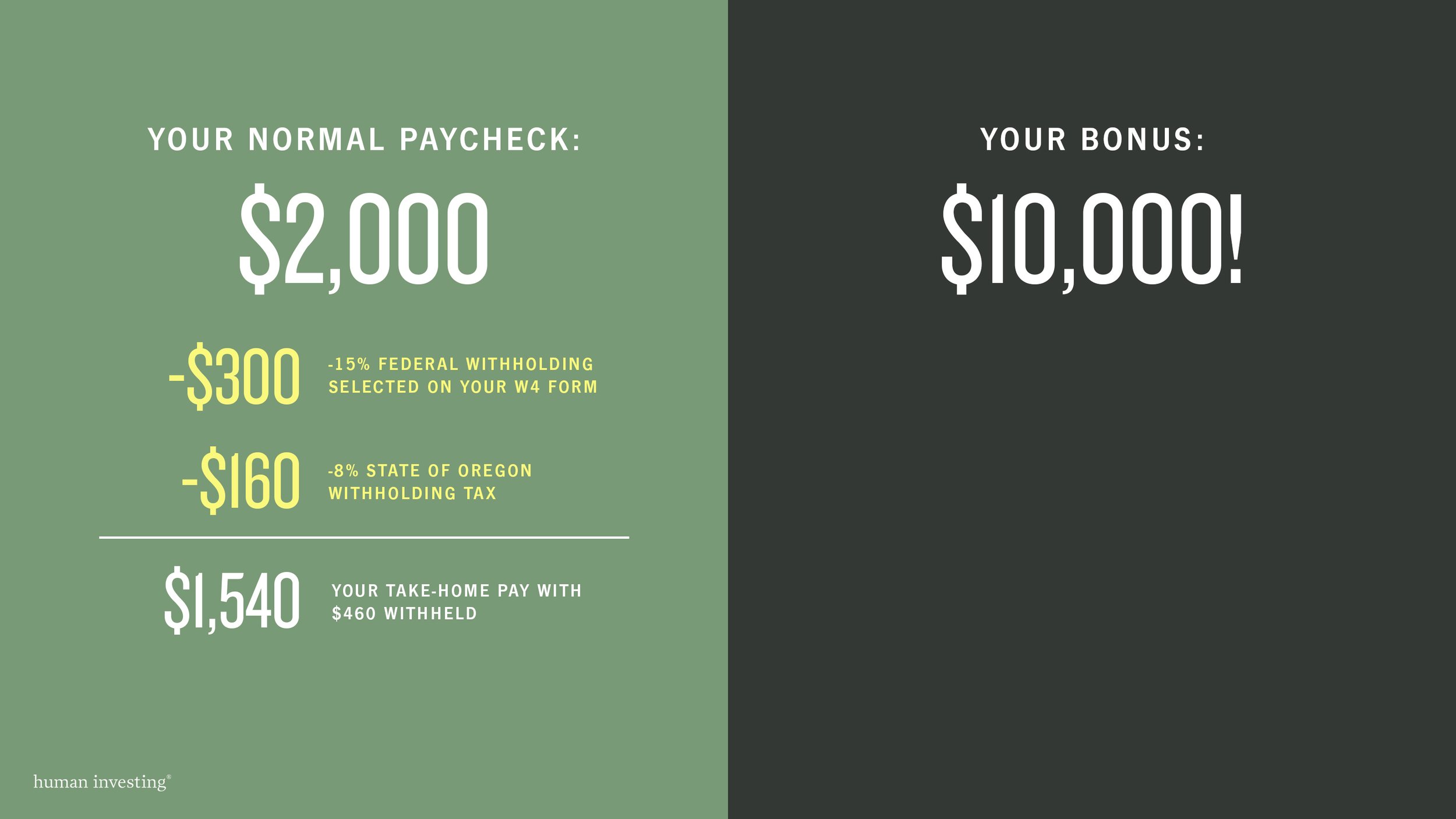

Because we love round numbers, let’s look at an example of for someone that normally receives a $2,000 paycheck and a one-time $10,000 bonus.

$10,000 Example

January 5, 2025: Your employer informs you that you will receive a $10,000 bonus.

January 10, 2025: You receive your paycheck that includes your typical income and the bonus payment.

Your regular income of $2,000 was subject to the following tax withholdings:

15% - federal withholding selected on your W4 Form

8% - state of Oregon withholding tax

23% - total withholding (federal + Oregon)

Your take-home pay is $1,540.

Your bonus paycheck was subject to the following tax withholdings:

22% - federal requirement for ‘supplemental income’

8% - state of Oregon withholding tax

30% - total withholding (federal + Oregon)

Your take-home bonus payment is $7,000. As you can see in this example, the total tax withholding for the bonus payment is greater than the tax withholdings for typical paychecks.

Your tax withholdings are not the same thing as your tax payments.

As shown in the example above, $3,000 was withheld from the bonus payment. This is an upfront payment to the IRS, but it doesn’t mean that this person will actually pay $3,000 in taxes for this bonus At the time of filing their tax return, they may receive some of that money back (a tax refund) or they could end up owing more taxes if they have significant income during the year.

As illustrated above, supplemental income has a 22% tax withholding rate. However, most taxpayers have a lower effective tax rate than that which means they will receive money back from the IRS once they have filed their taxes. We have included an example below to help clarify this concept.

The taxes paid on bonuses are the same as taxes paid on ordinary income.

While tax withholdings are different for regular income and bonus payments, the actual tax rate you pay is the same. Once you file your tax return the actual taxes paid are trued up.

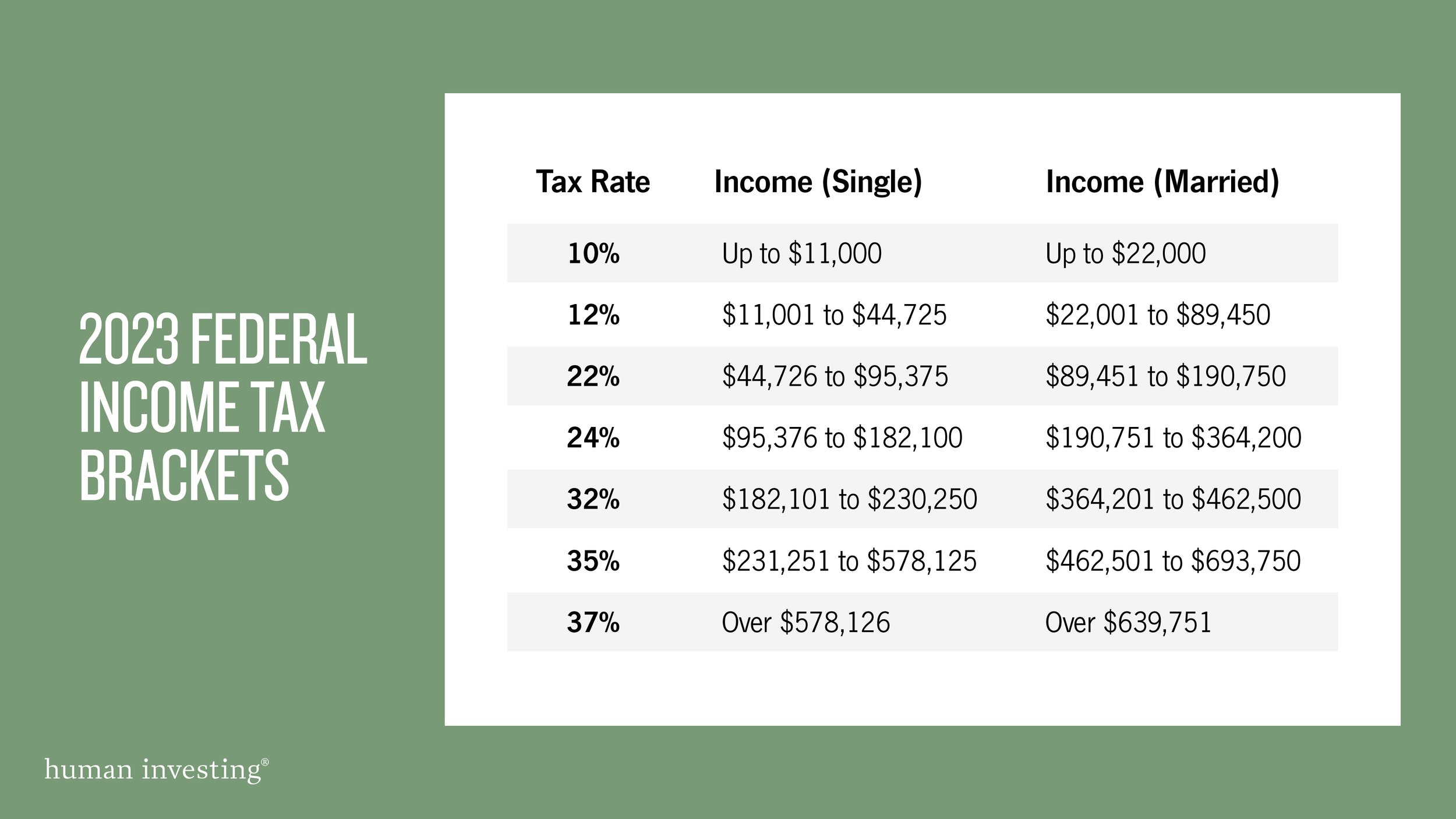

Here is an example of a single tax-payer making a salary of $48,000 a year and a $10,000 bonus. They would see $58,000 appear in box 1 of their W2 Form issued by their employer. The total combined income of $58,000 is then subject to income tax brackets.

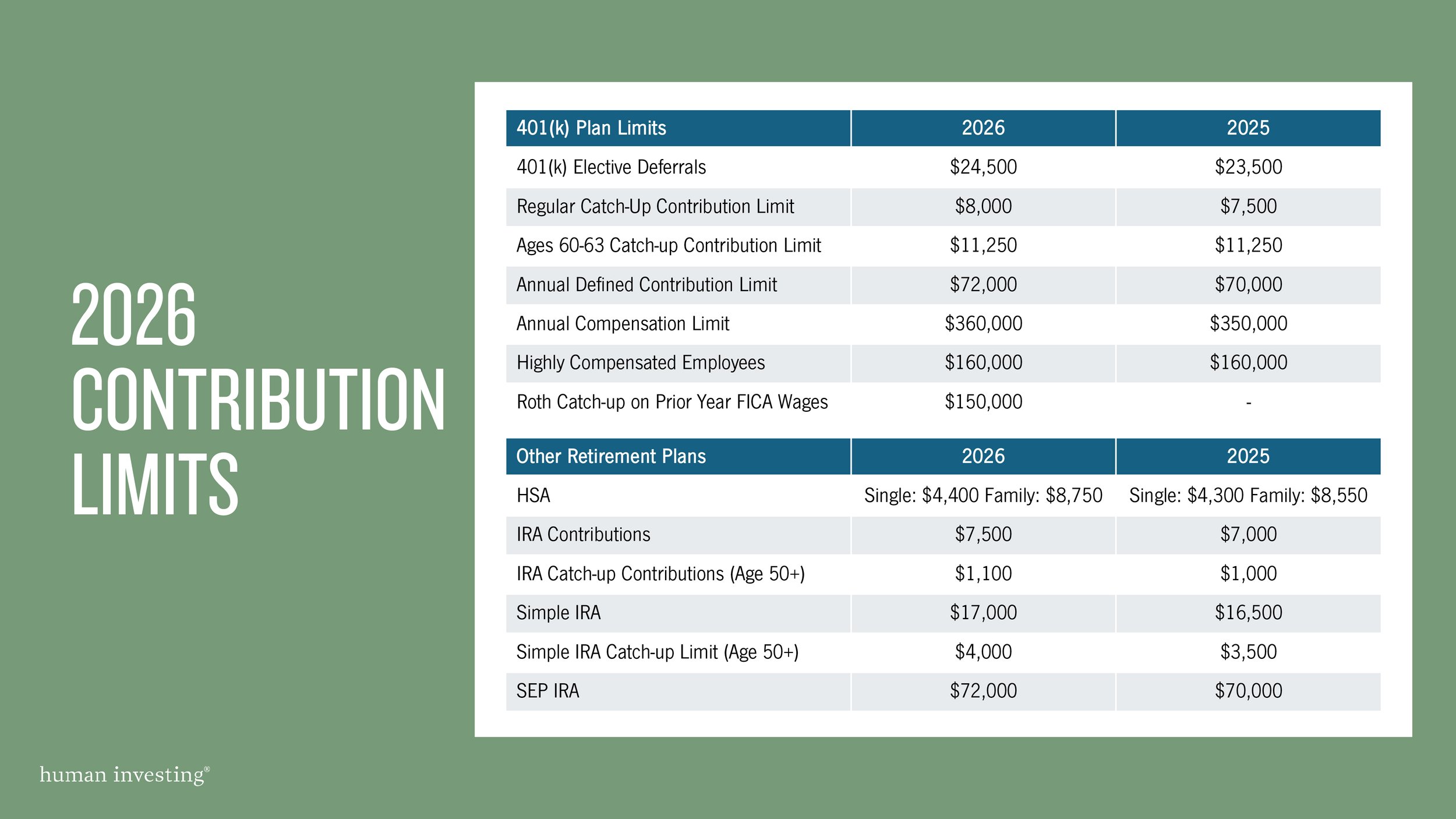

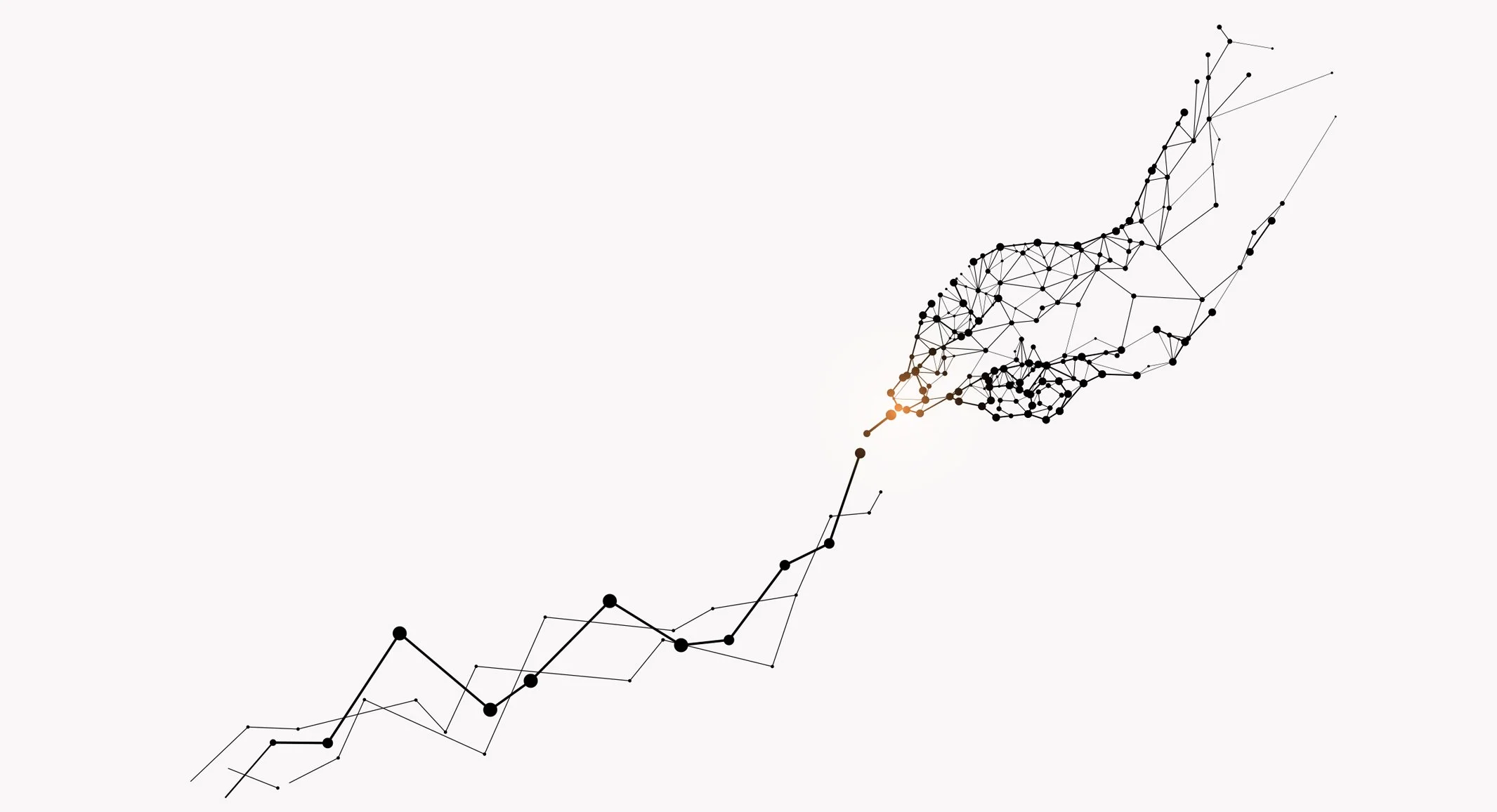

The key point is their entire income of $58,000 is subject to the same income tax brackets and end up with the same tax treatment. The difference is only the amount withheld when the bonus is paid out. We know that the $10,000 bonus had 22% in federal tax withholdings, but we can also infer that this person’s effective tax rate is probably lower based on the progressive tax brackets shown in this image.

To be clear, the first $11,925 gets taxed at 10%. The next $36,550 (range is dollars above $11,926 and below $48,475) get taxed at 12%. The remaining $9,525 is taxed at 22%. We encourage you to read the blog post titled 2025 Tax Updates and A Refresh On How Tax Brackets Work if you want a detailed explanation of our progressive tax brackets.

Whether or not this person will receive a tax refund or owes more taxes at the time of filing their tax return depends on the rest of their financial landscape. We can save that information for another blog post.

Disclosure: This material is for informational and educational purposes only and should not be considered personalized tax, legal, or investment advice. You should consult your own qualified tax, legal, and financial professionals before making any decisions based on this information. Tax laws and regulations, including those related to bonuses and supplemental income, are subject to change and may vary depending on individual circumstances. The examples provided are hypothetical and intended to illustrate general tax concepts; they should not be relied upon to determine your actual tax liability. Investing and financial planning involve risk, including the possible loss of principal. Past performance does not guarantee future results. Advisory services are offered through Human Investing, LLC, an SEC-registered investment adviser.