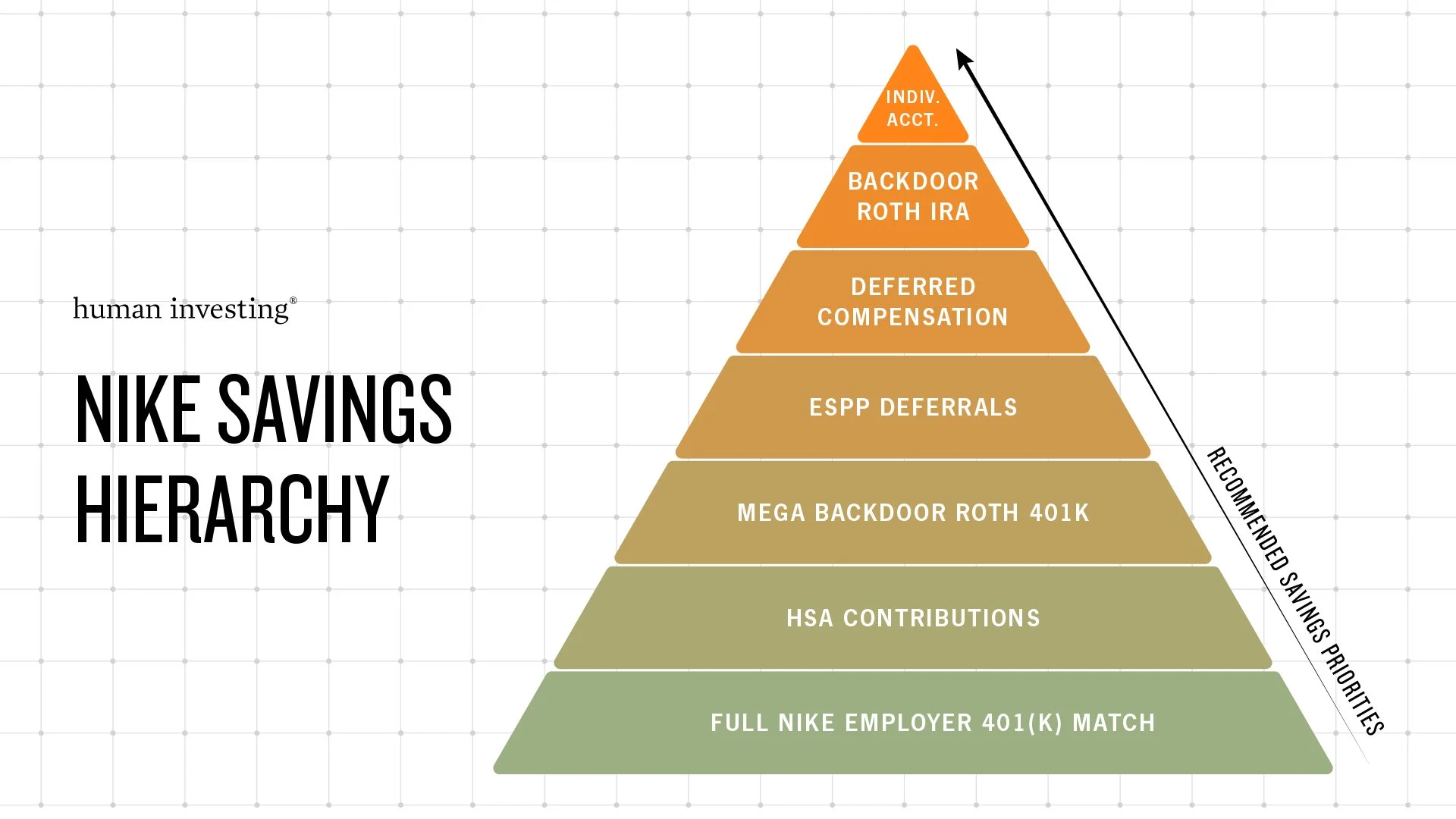

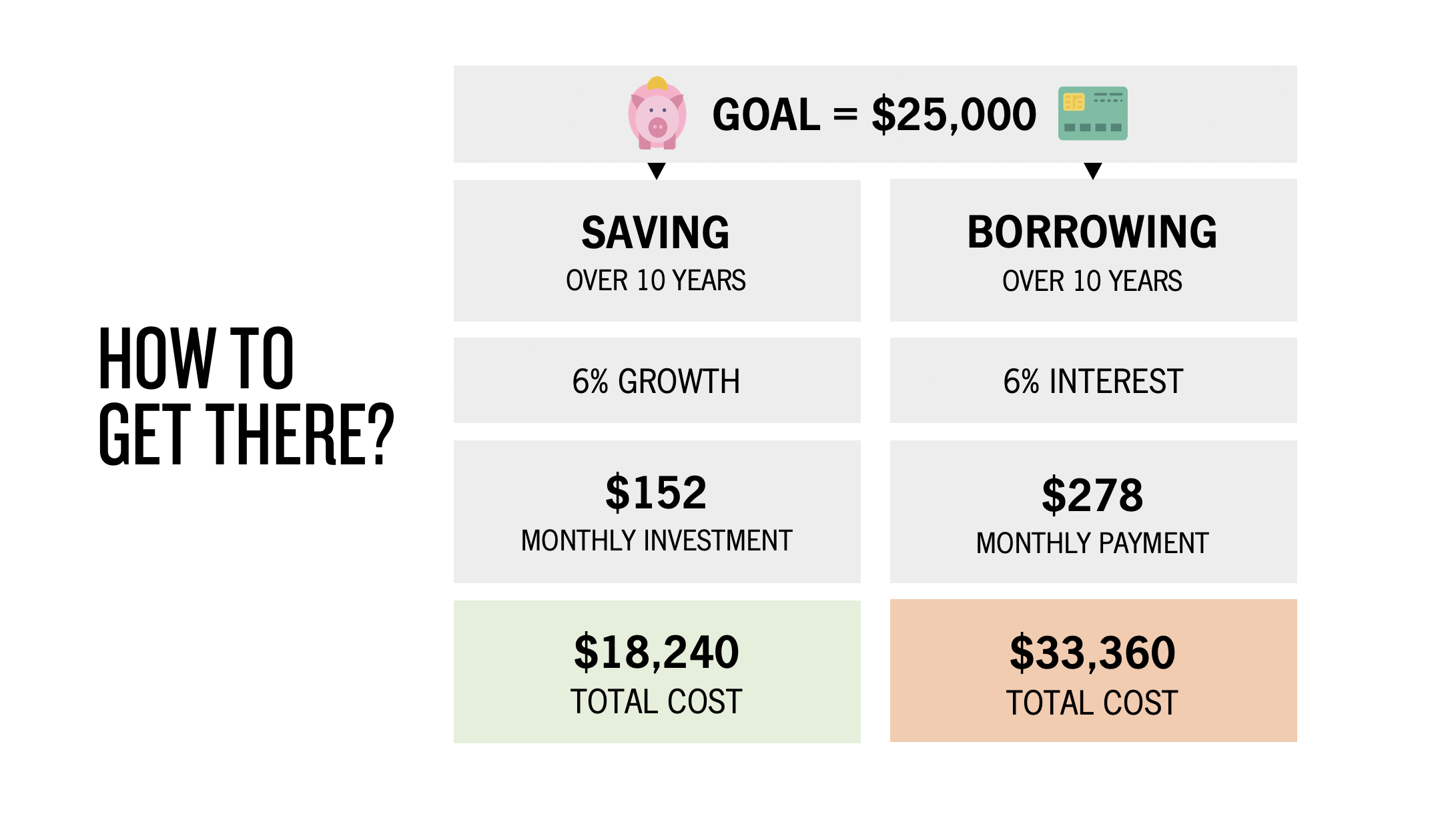

Elite performance isn’t about doing everything at once; it’s about prioritizing the right moves at the right time. Your finances deserve that same level of intentionality. You probably have many competing goals and need to find the best way to prioritize spending, debt pay down, and saving for the future, among other things.

Selecting the optimal avenue for your dollars can be challenging when you have access to Nike’s unique savings avenues. It is important to fill the most beneficial buckets first. The order we have detailed below is not a “one size fits all” approach. Building your financial plan around your goals and unique circumstances will help determine the savings opportunities that will be the most impactful for you.

1. Contribute enough to get your Nike employer match on your 401k

Deferring 5% of your income to your Nike 401k is a strategic way to maximize free dollars. This helps grow your retirement savings and amplifies the long-term benefits of your investment. Additionally, you have the option to save pre-tax dollars or Roth dollars, allowing you to choose when you pay tax on your contributions. Whether to contribute via Roth or pre-tax is best determined by your unique financial plan.

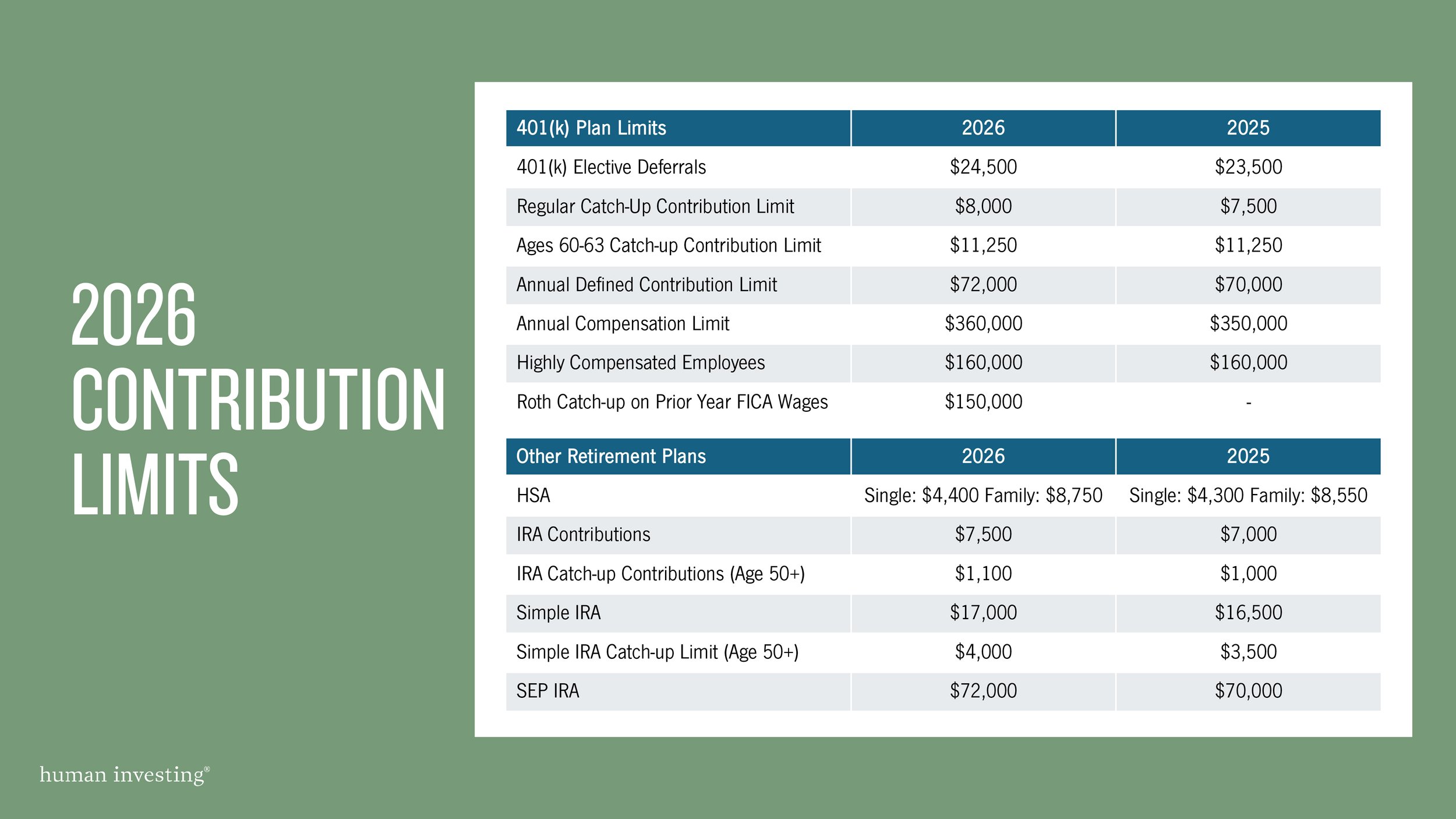

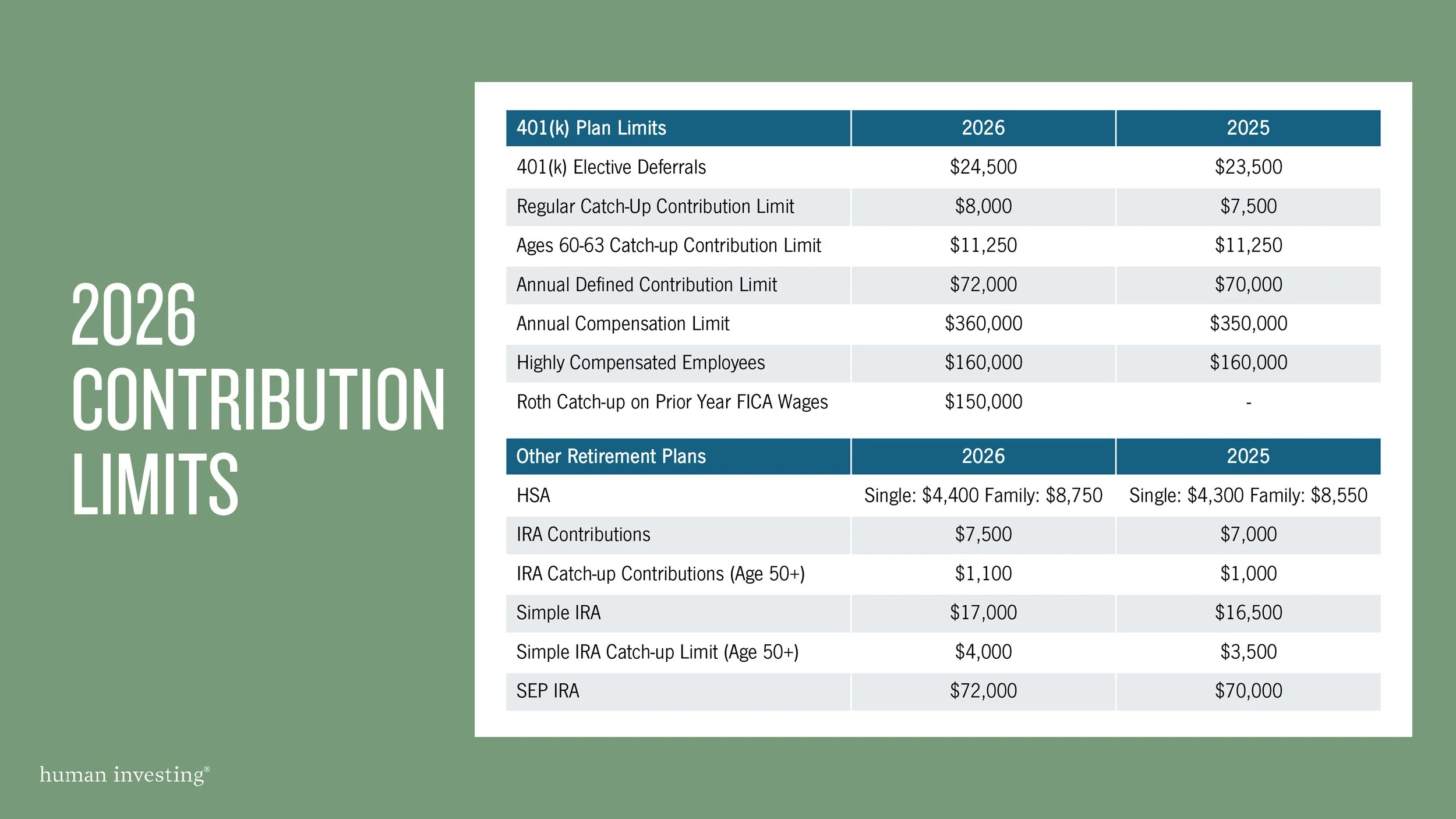

2. Enroll and maximize your HSA contributions

One benefit of participating in Nike’s healthcare coverage is the opportunity to utilize the Health Savings Account (HSA). Those covered by the high-deductible healthcare plan (HDHP) can take advantage of tax-deductible contributions along with tax free earnings and withdrawals when used for qualified medical expenses.

Being covered under the high-deductible health care plan (HDHP) is not for everyone. It depends on your health needs and financial flexibility. Each person is unique and should consult a professional for their specific circumstances.

3. Save extra into your 401k via Mega Backdoor Roth contributions

If you have filled all the prior buckets and still have additional cash flow, consider putting extra money into your 401k through Mega Backdoor Roth contributions. This savings vehicle allows you to go above and beyond traditional 401k contribution limits. You pay taxes on these dollars now and withdraw them tax-free in retirement. Contributions can be made up to 3% of your compensation, limited to a maximum of $360,000 of eligible compensation. This is a great savings opportunity to contribute extra funds, up to $10,800 on top of the standard $24,500 standard deferral limit, to your Nike 401k account.

4. Maximize ESPP Deferrals

Saving into the ESPP bucket is a way to purchase Nike shares at a 15% discount. You can contribute up to $21,250 through salary deferrals. If you have a steady cash flow, saving into your ESPP can feel like instant growth on Nike stock if you sell the shares right after they’re purchased. This strategy to immediately sell allows you to capture the discount and supplement cash flow when the shares are purchased every six months. There are no taxes until the shares are sold, but the taxes on the discount and any gains can be complicated and should be reviewed by a tax or financial professional.

5. Utilize Deferred Compensation savings

If you are eligible for Nike’s deferred compensation plan, utilizing this plan can help reduce your current taxable income while setting aside and investing funds for your retirement. Contributing to the Deferred Compensation plan defers Federal and state taxes and can help keep your taxable income below thresholds for local taxes. This plan requires precision to set up and maintain and will help optimize your retirement savings in your financial plan.

6. Execute a Backdoor Roth IRA Contribution

In 2026, you can contribute up to $7,500 to a traditional IRA, with an additional $1,100 catch-up contribution available for those over age 50. Making a tax-deductible contribution is subject to income phaseouts. If you don’t have an existing IRA balance, you could make a backdoor Roth IRA contribution even if your income is above these phaseout levels or above the income phaseouts for Roth IRA contributions. This is done by contributing after-tax dollars to a traditional IRA and converting those funds into a Roth IRA.

7. Open a taxable brokerage account

If you still have cash flow to save after filling all the previous buckets, using a taxable brokerage account to make additional investments can help fund your future financial goals. Saving into a taxable brokerage account can be especially helpful if funds will be used soon, such as if you are considering a new home purchase or paying for college. These accounts allow you to withdraw funds at tax-advantaged capital gains rates at any time. In particular, the flexibility of this account can be advantageous for those considering retiring early since there is no penalty for withdrawing funds before age 59½.

Want to see this in action?

Building a strong roadmap to reach your goals includes thoughtfully utilizing Nike’s employee benefits and prioritizing ways to save through ways that are the most beneficial for your unique needs. The various options you have available at Nike each have their own unique contribution limits, tax advantages, and benefits. Having a coordinated strategy allows you to create a game plan that suits your unique needs and supports your needs for today and ambitions for tomorrow.

The most effective savings hierarchy is one that is thoughtfully aligned with your broader financial picture. A comprehensive financial plan can help bring clarity to competing priorities and ensure your savings decisions are aligned with your short-term needs and long-term goals. Working with a financial advisor can help you sift through these buckets and determine the best way to optimize each dollar saved to secure a successful financial future.

Disclosure: This content is for informational and educational purposes only and is not intended as investment, legal, or tax advice. The strategies and steps outlined—such as building an emergency fund, contributing to employer-sponsored plans, paying down debt, or using HSAs, IRAs, and taxable accounts—are general in nature and may not be appropriate for every individual. You should consult a qualified financial or tax professional before making decisions based on your personal circumstances. There is no guarantee that following any financial strategy will achieve your goals or protect against loss. References to interest rates, contribution limits, or tax rules reflect information available at the time of publication and may change. Past performance is not indicative of future results. Advisory services are offered through Human Investing, an SEC-registered investment adviser.