As a financial advisor, something that I consistently run into when meeting with individuals (I am of course guilty of this too at times) is when people use tidbits of information they hear on the news (which is never biased) as fact. I’ve noticed that as we get closer to the election, I’ve begun hearing things like: “The market always goes down in an election year” or “If [fill in the blank] president is elected I’m going to cash because they are going to run our country into the ground.” When it comes to politics (regardless of which side of the political aisle you sit) a website I use to help settle the dust of campaign speeches, conventions, MSNBC, FOX News, and everything in-between is http://www.factcheck.org/. This site does a nice job taking the information candidates and their supporters use and asking the question: “Is this true?” It is a simple concept but one that is important for determining if a candidate is A.) telling the truth and B.) if the stats they use to back their initiatives are accurate.

With factcheck.org as inspiration I wanted to dive into some statements I’ve heard from people over the last month and hopefully provide some insight as to how best invest going into this election.

Quote #1: “The stock market is always down in an election year”

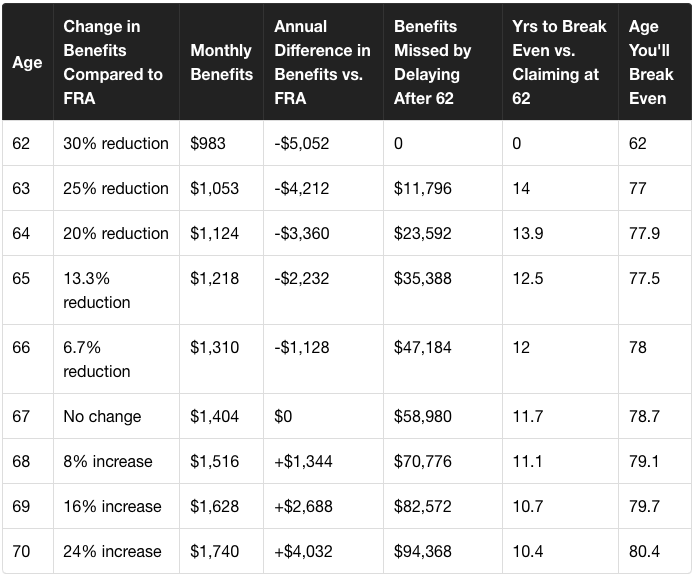

Fact check: As you may have guessed anytime a person speaks in absolutes they are often times wrong. Based on this article a few pieces of information stood out to me.

“Excluding 2008, presidential election years going back to 1960 have seen an average return of 9.1% versus 8.8% for all years”

“The S&P 500 has tended to gain in 76% of presidential election years, versus 71% of all years since 1948”

Advice: Of course these averages and historical returns are not necessarily indicative of future returns, but unless you are looking to utilize all of your retirement account dollars (which is hopefully not the case), this election should not cause you to drastically change your allocation. However, with the market hovering around all-time highs, this could be a good opportunity to ensure the risk in your portfolio aligns with your timeline.

Quote #2: “If [fill in the blank] president gets elected I’m moving all of my retirement account to cash”

Fact check: This great bar graph shows various combinations of party control of President, Senate and House of Representatives correlated to the average annual returns of the S&P 500 during these periods. Is it coincidence that, additionally, the best years have been with Republican House and Senate? Your guess is as good as mine.

Advice: As an investor, it is easy to get distracted by the media, rumors and political biases. Don’t let these things affect your investment decisions. Often trying to time the market combined with emotionally reactive decisions has the OPPOSITE of the desired outcome. Often times investors shoot themselves in the foot when it comes to timing the market and making emotional decisions.

Final Advice: Control what you can control, stay informed and stay disciplined. If you have questions Human Investing has a team of advisors ready to help. If you have questions on your retirement account and how to financially navigate this election, email or call anytime.