This past week I went on what has turned into a weekly running date with a buddy of mine. In addition to discussing our anticipation for the 2nd season of Stranger Things and who was going to binge the show fastest, my friend brought up an article he saw in The Wall Street Journal a few weeks ago. Knowing that I work at Human Investing, he asked: “I read something about how Morningstar Fund Rating are kind of bogus. Have you heard anything about that?”

Oh I had heard about it and I had many thoughts. Selecting a fund for investors has turned into murky waters over the past few years as it seems like many organizations are pushing their own agendas - explaining why their fund or fund process is best. In response to my friend and to the Wall Street Journal’s Article on Morningstar’s fund rating process

"https://www.wsj.com/articles/the-morningstar-mirage-1508946687" I wanted to do a quick Q&A on a prudent process for selecting a fund or funds that fit into your portfolio.

These are the types of questions that are essential to ask yourself when selecting a fund:

Q: I haven’t read the WSJ article about Morningstar and it’s very long, can you summarize it for me?

A: Sure! In short multiple reporters did a yearlong investigation asking the question, “Is the Morningstar rating system a good guide for investors when looking to invest capital?” Their takeaway was that it is not and in my estimation they are somewhat right.

Q: Did Morningstar Respond to the article?

A: Yes. Morningstar took this article very seriously and gave multiple responses including this one http://news.morningstar.com/articlenet/article.aspx?id=831740. I really enjoyed this paragraph and believe that it represents how investors should use Morningstar ratings:

“The star rating system has been a useful starting point for research that tilts the odds of success in investors favor.”

Q: In a nutshell should I use the star rating as my only means for choosing a fund?

A: No

Q: Okay so if star ratings aren’t the best way to judge a fund, then what should I do?

A: Now you are asking the right questions! As a fiduciary (someone who by law must act in the best interest of another) for many 401k plans here are a few bullet points that our firm typically recommends when selecting a fund:

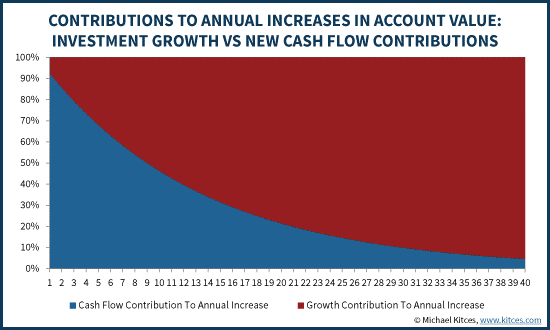

Regression to the Mean: Just because a fund or an asset class has recently outperformed its peers it doesn’t mean that trend will continue. More times than not it means the opposite is more likely. If you are currently selecting your funds based on short-term past performance, it might have worked out recently but you are playing a losing game in the long term.

Passive over Active: By selecting a passive (index fund) over an active manager you are often accomplishing two things.

First you are reducing your overall investment costs which is an immediate savings to you.

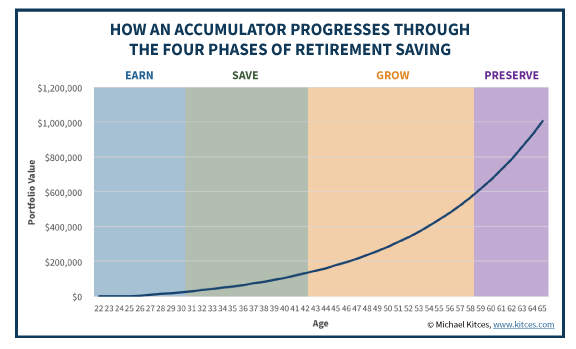

Second you are subscribing to the idea that indexes historically outperform active managers. Historically this has been a true statement. The chart below speaks to indexes beating active managers in their respective asset classes 85% of the time over a 15-year period!!!! There are active managers who have outperformed their benchmark, however the deck is stacked against investors when trying to determine who that manager is.

Behavior Management: You can do everything right when investing in a fund, but if an investor panics and sells out of an investment at the wrong time all of their good decisions are immediately lost by their behavior. Understanding the rocky road of long term investing is essential to selecting a fund(s) that fits your needs

Risk Management: In line with behavior management is also understanding your risk and the risk of the fund you are investing in. If you knew there was the potential of your fund losing half its value how would that affect your decision to invest in the fund?

Solution

Whether you’re investing through your employer’s retirement plan or outside that plan, often a great solution is to use an age based target date fund or a risk based constant risk model (i.e. aggressive, moderate or conservative allocation fund). Both fund types look to take holistic approach to diversify risk and create an allocation either based on your age or risk profile. It’s important to check if these options use index funds as the component parts to ensure you are aligning with the aforementioned investment strategy.

Our team recognizes that tracking your investments may not be your full-time job. If this blog post or the WSJ article sparks any questions, please don’t hesitate to reach out as we would welcome talking through your investment selection process and make sure you are maximizing your investable dollars!