Traditional, SEP IRA, or SIMPLE IRA

Option 1: Transfer the assets to your own IRA

Benefits

Next steps

When is the money available?

You can access funds at any time, but a penalty will apply to distributions made before 59 ½.

After 70 ½ your account will be subject to normal required minimum distributions.

This might make sense when

If you are over age 59 ½ this option often can make sense because it provides flexibility on beneficiaries you can designate, you have the full ability to access funds. Additionally, if you are between 59 ½ and 70 ½ you might be taking yourself out of a Required Minimum Distribution (RMD) scenario.

Option 2: Transfer the assets to an Inherited IRA

Benefits

Dollars can continue to grow tax-deferred.

You will not have to pay a 10% early withdrawal penalty.

You can designate your own beneficiaries.

Next steps

You can transfer assets into Inherited IRA in your name.

If there are multiple beneficiaries you must establish a separate account by December 31st following the year of death in order to use your own life expectancy. If you miss this deadline RMD’s will based off of oldest beneficiary.

When is the money available?

If the original account holder was under 70

This might make sense when

You have the option to withdrawal funds penalty free based on your life expectancy. So if you would like the money over time this is a great choice.

You also have the choice to start RMD’s based on when your deceased spouse would have turned 70 ½.

If you are hoping to use all of the funds in the next 5 years there is a provision called the “5-year method” that allows for distribution of all funds without paying penalties over the first 5 years of the account being open.

Option 3: Lump Sum Distribution

Benefits

Next steps

When is the money available?

This might make sense when

Qualified Retirement Plan (401(k), 403(b), etc.)

Option 1: Leave it in Plan (this is dependent upon plan rules)

Benefits

Dollars can continue to grow tax-deferred.

You will not have to pay a 10% early withdrawal penalty.

You can designate your own beneficiaries.

Next steps

You can transfer assets into Inherited IRA in your name.

If there are multiple beneficiaries you must establish a separate account by December 31st following the year of death in order to use your own life expectancy. If you miss this deadline RMD’s will based off of oldest beneficiary.

When is the money available?

If the original account holder was under 70

This might make sense when

Option 2: Transfer the assets to your own IRA

Benefits

Next steps

When is the money available?

You can access funds at any time, but a penalty will apply to distributions made before 59 ½.

After 70 ½ your account will be subject to normal required minimum distributions.

This might make sense when

If you are over age 59 ½ this option often can make sense because it provides flexibility on beneficiaries you can designate, you have the full ability to access funds. Additionally, if you are between 59 ½ and 70 ½ you might be taking yourself out of a Required Minimum Distribution (RMD) scenario.

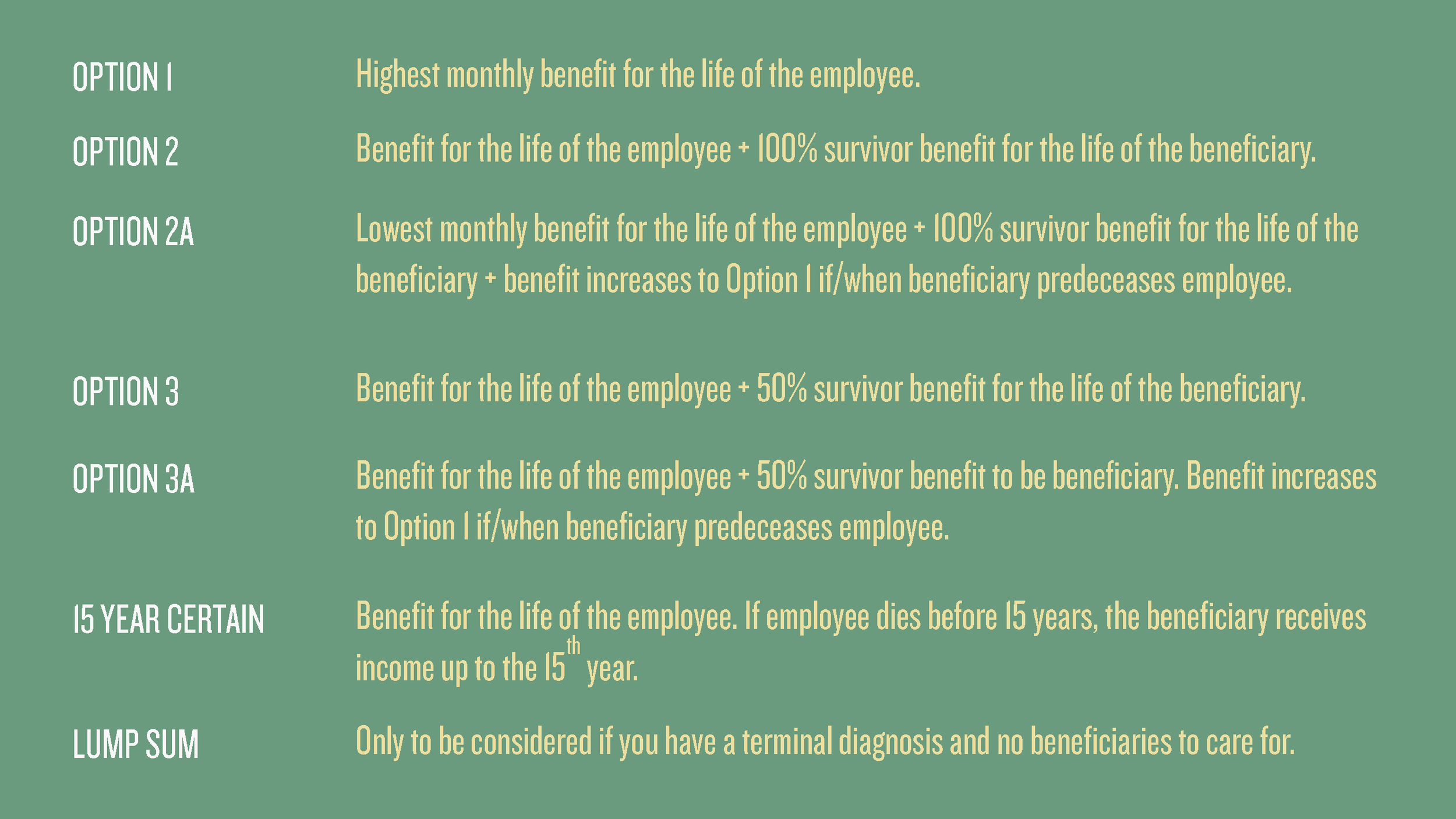

Option 3: Lump Sum Distribution

Benefits

Next steps

When is the money available?

This might make sense when

ROTH IRA

Option 1: Transfer the assets to your own IRA

Benefits

Next steps

If you are the sole beneficiary you can transfer funds into your existing or new ROTH IRA.

If you are one of multiple beneficiaries, you must take your share as a distribution and roll into a ROTH IRA within 60 days.

When is the money available?

You can access funds at any time.

Distributions are generally tax and penalty free if you are over 59 ½ or qualify for a penalty free exception and have met the five-year holding period. Schwab provides guidance if you are looking for what rules apply to you if you are looking to distribute funds.

This might make sense when

Option 2: Transfer the assets to an Inherited ROTH IRA

Benefits

Next steps

Transfer assets into Inherited ROTH IRA held in your name.

If there are multiple beneficiaries, separate accounts must be established by December 31st following the year of death in order to use your own life expectancy; otherwise RMDs will be based on the life expectancy of the oldest beneficiary.

When is the money available?

You can access funds at any time.

Any earnings are generally tax free if the five-year holding period has been met.

Your life expectancy may be used to calculate RMDs.

Annual distribution (RMDs) must begin by the later of:

You may also follow the five-year rule under which the account must be fully distributed by December 31 of the fifth year following the year of death.

Option 3: Take a lump sum distribution

Benefits

Next steps

When is the money available?

This might make sense when