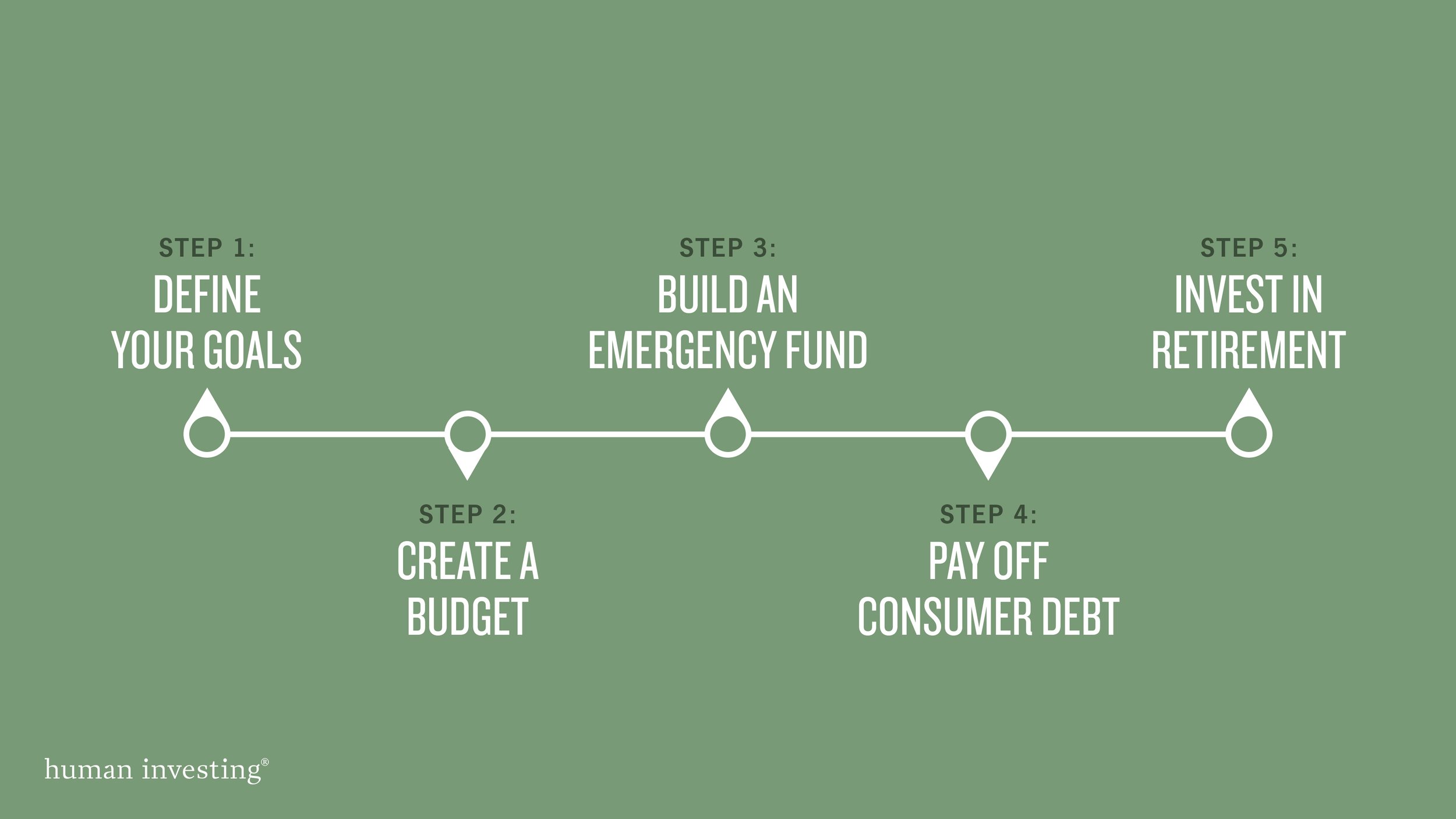

STEP 1: Define your Goals

A financial plan is centered on your financial goals. You may categorize your goals into short-term, medium-term, and long-term periods.

Short-term goals can range from a few months to 1 year time. This could be things like going on a trip, buying a car, or paying off debt.

Mid-term goals range from 1-5 years. These goals may include paying off debt, pursuing higher education, saving up for a down payment on a house, planning a wedding, or starting a business.

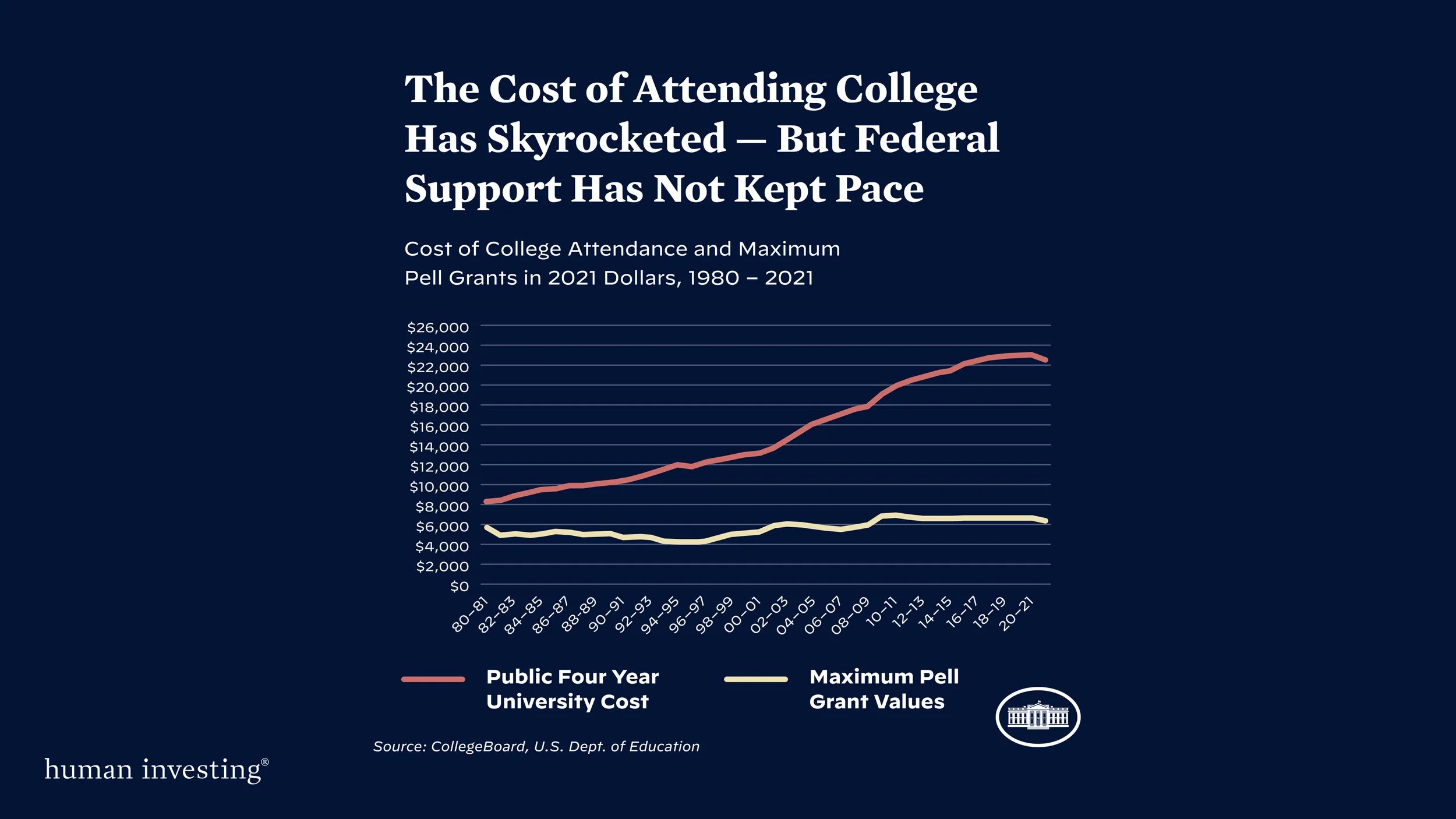

Long-term goals are goals with periods from 5+ years. Usually, these goals are stretched even further from 10, 20, or 30+ years. Here are some common long-term examples: investing in college for a dependent, retirement, or paying off your mortgage.

STEP 2: Create a budget

A solid budget will give you an idea of your monthly cash flow. This means tracking your take-home pay and your expenses every month.

There are many ways to do this like the 50/30/20 budgeting rule, the zero-based method, or the envelop system. The key here is to see where you are overspending and see where you can save more as you work towards your goals.

STEP 3: Build an emergency fund

According to the Federal Reserve, most Americans cannot afford a $400 - $500 emergency bill. As the emergency cost increases, fewer Americans can afford it. As a general rule of thumb, a family should have three to six months of living expenses saved in an emergency fund to protect against the unexpected. We advise that people create a Starter Emergency Fund of $1,000 first.

STEP 4: Pay off consumer debt

This would include credit cards, auto loans, personal loans, and student loans . These debts can often be the most burdensome for Americans and if you find yourself struggling to make ends meet, make an effort to pay these off after you’ve completed the steps above.

STEP 5: Invest in your retirement

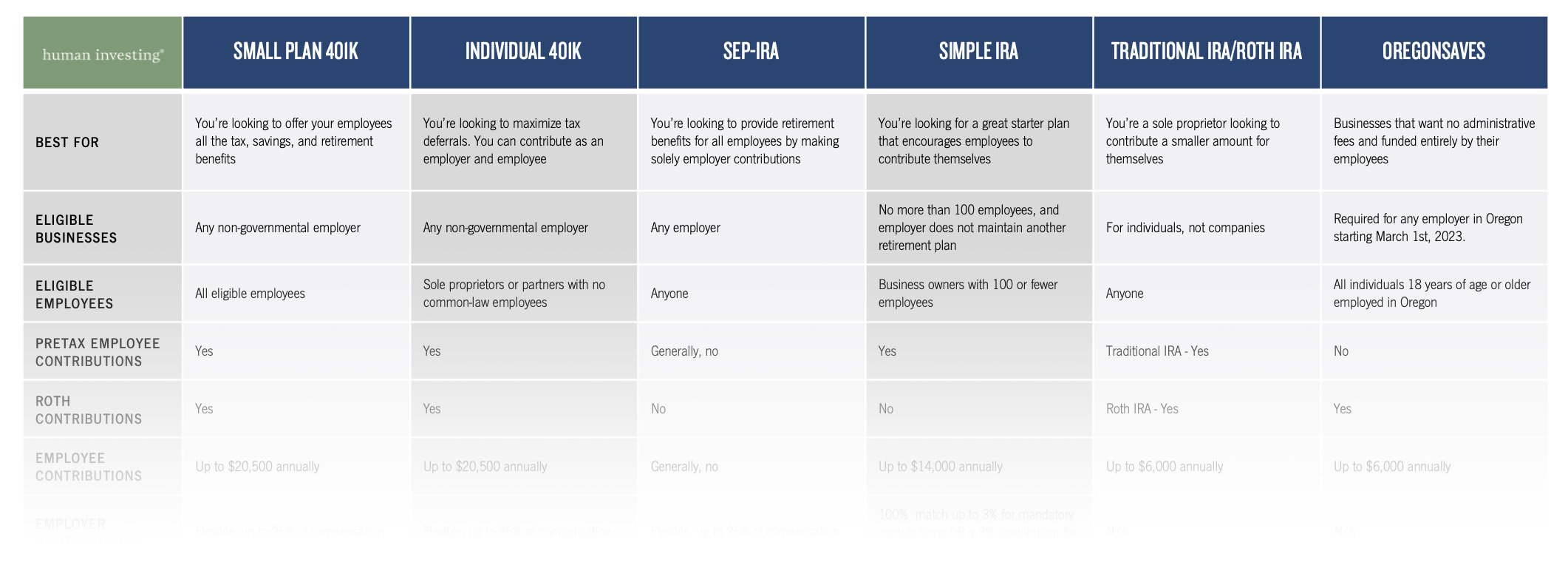

A great place to start is by investing in your company’s 401(k) or 403(b) plan. If they have a match, take advantage of this. Make sure you are getting the match.

Don’t have access to a 401(k) ? Open a Traditional or Roth Individual Retirement Account (IRA). You have 100% control over where the money goes and how it’s invested.

Open a Health Savings Account (HSA) for future medical expenses. Contributions, investment growth, and withdrawals are all tax-free (assuming the withdrawals are used for eligible medical expenses).

Max out contributions to all your accounts if you can. You can have a 401(k) ,IRA, and HSA open at the same time. In 2023, IRA contributions are capped at $6,500.

If this seems like a lot to handle, it can be. We can assure you, It’s worth the work and the extra effort to have a financial advisor help you and your family throughly address these topics. These are some basic steps to help you get started today. If your life grows more complex, it will be important to monitor your plan on a more consistent basis.

Whom should I hire if I need help with my financial plan?

It is wise to seek counsel from experts in any area of life. Financial advisors can help you choose investments that align with your goals, give you a strategy to pay off debt, lower your tax burden, and so much more.

Here at Human Investing, we are fiduciaries which means we are legally bound to always act in our client’s best interest. That means no commissions or selling pressure. Professor Kent Smetters of the Wharton School of Business notes fewer than 2% of all financial advisors are fiduciaries.

Fee structures and fiduciary standards

Before you hire a financial advisor, make sure to ask for their fee structure.

Some advisors charge hourly or a flat rate depending on the service. Many advisors will charge a percentage of all of your assets under management (AUM) and others still will get paid a commission depending on the product you purchase from them. You will want to ensure that the firm you choose to go with is working in your best interest and you are getting the most out of what you are paying them for.

Financial planners and advisors that abide by a fiduciary standard look out for your best interests first. Financial managers that are not fiduciaries may be highly experienced and skillful, but they can put the interests of their company over the interests of their client. The National Association of Personal Financial Advisors (NAPFA) or Broker Check are great places to start researching Financial Advisors in your area.

If you are interested in learning more about Human Investing and our financial planning services, check out our website.