Fishing. The cool northwest air, sun peaking over the horizon, the roaring river sweeping in front of me.

Some of my favorite moments are spent in quiet, as I stand on the river bank rod in hand, waiting in anticipation. Moments like these bring me to life.

Yet if I am at all honest with you, I am not a good fisherman. I tend to be too impatient. I cast and by the time my fly lands in the water, I’m already casting in to a different spot. My timing is off. When it comes to investing for retirement, frequently investor’s timing is off. I find that there are many similarities between being a good fisherman and a successful investor. To be a wise investor it takes experience, discipline and sometimes a guide.

Now let’s think of these attributes in light of the current financial markets and the ‘doomsday’ media portrayal. It seems as if the waters of the market match up to a category 3 hurricane which are not typically conducive to catching fish or investing for retirement. So as a thoughtful investor, how should we react in moments like this?

Take into consideration the 3 aforementioned attributes: experience, discipline, and guidance.

Experience- Any experience in investing shows that the market is relentlessly in favor of the investor. Let us take into account the S&P 500. Over the last 20 years despite the “dot com bubble” and the “housing market crisis,” the S&P 500 is up over 300%.

Knowing the big picture statistics can help us understand the tendencies of the financial market.

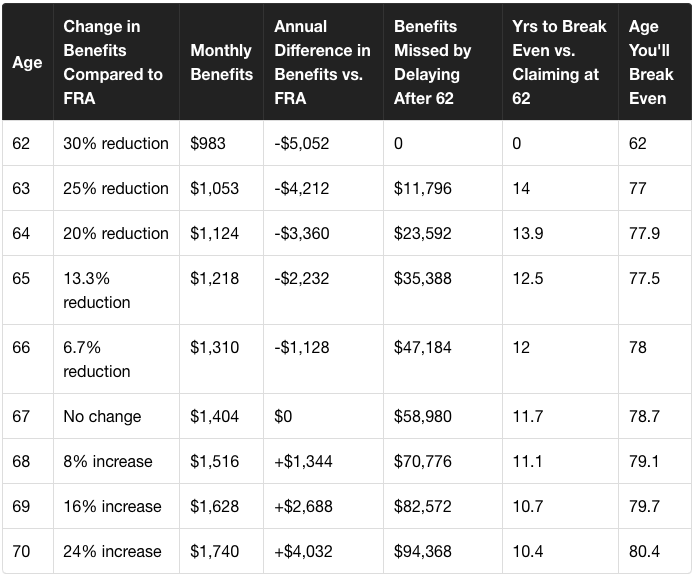

Discipline- Don’t pull your line up! This goes for fishing and investing. When it comes to investing, people often miss out on market gains when they try to time the market. Taking money out of the market when it seems to be doing poorly you often times miss out on the biggest gains. In fact, 6 out of 10 of the market’s best days since 1995 have been within 2 weeks of the market’s worst days. Stay invested! It takes discipline.

‘If an investor stayed fully invested in the S&P 500 from 1995 through 2014, they would've had a 9.85% annualized return. However, if trading resulted in them missing just the ten best days during that same period, then those annualized returns would collapse to 6.1%.” (JP Morgan, 2015 Guide to Retirement)

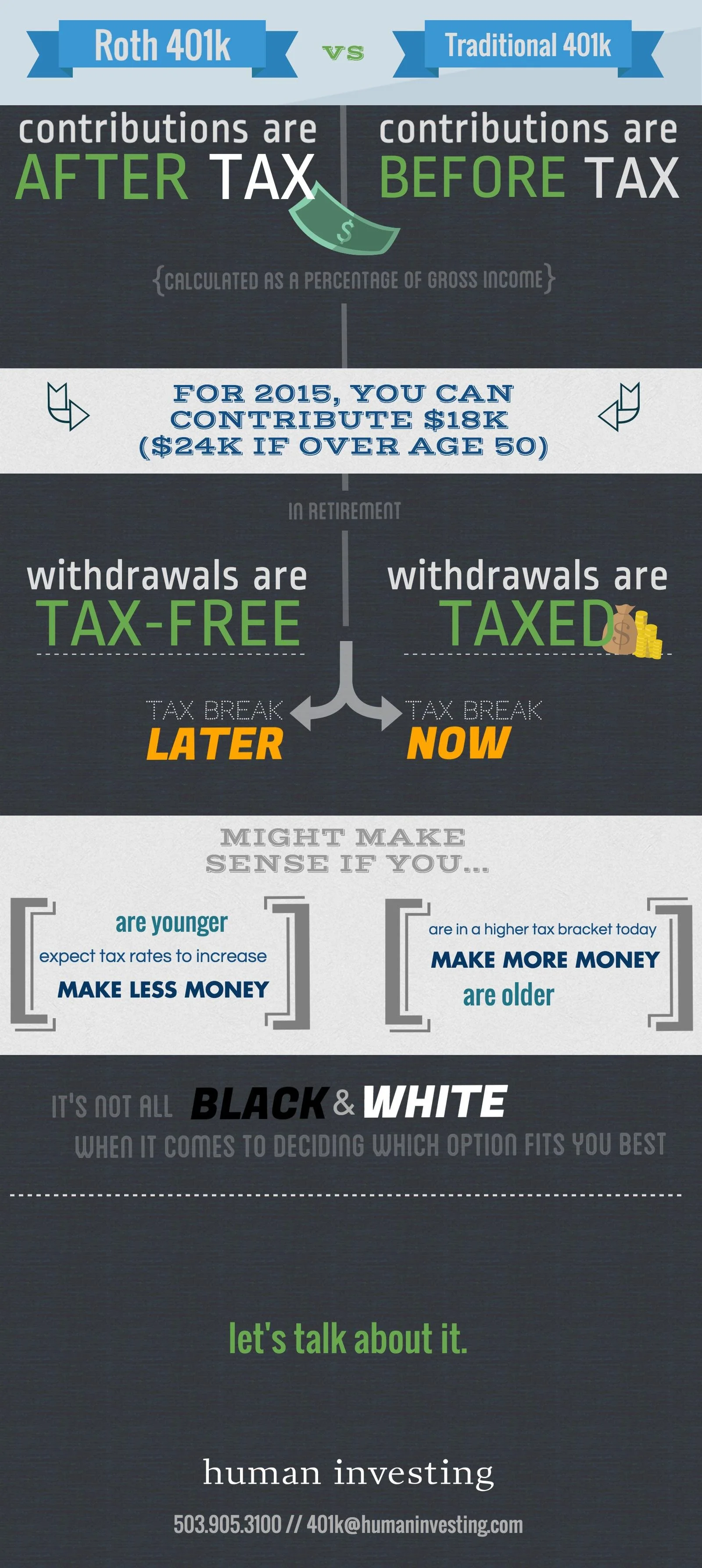

Guidance- Fear of the future can be debilitating, especially when it comes to investing. These thoughts and emotions can prevent us from making wise decisions. When overcome by this uncertainty, it is good to remind ourselves to ask for help.

If you are looking for a guide with your retirement plan, your Human Investing 401k team would love be that just for you. This is one of the many benefits of being a Human Investing 401k client, is to access our 8am-5pm Monday to Friday call line.

Sometimes when the fish aren’t biting and frustration sinks in, emotions get in the way of the true enjoyment of fishing. These are the times when it is important to take a step back and assess what I know to be true. It is important to invite people that know what they are doing to come alongside me. I often times enlist friends who are great fishermen to guide me, stand on the bank alongside me and bring me back to the basics of what I love. I’ve found doing this greatly increases my potential for success.