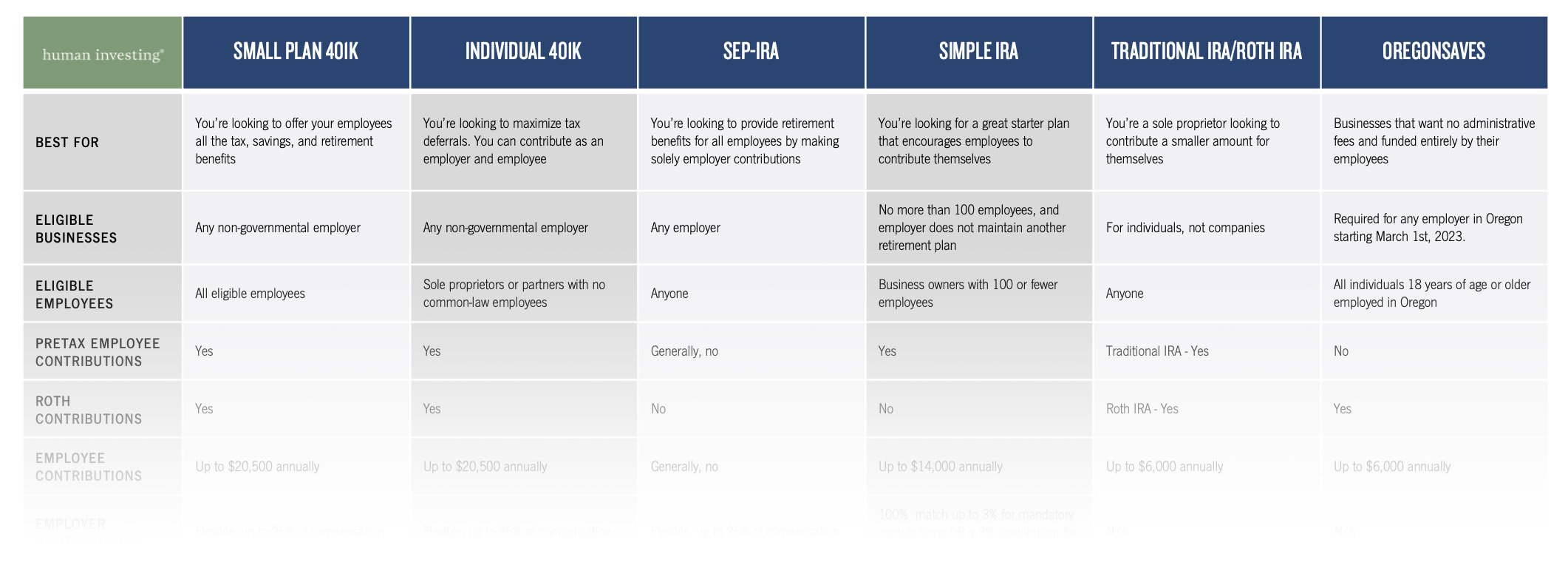

We help our clients organize and implement tax bracket optimization. In your early years of retirement, even if you do not have earned income, there are important tax considerations. I will illustrate two recurring tax planning strategies: Roth Conversions and Capital Gain Realization.

Consider a retired married couple (both age 65) living in Oregon this year.

In this example, this couple has $36,700 of taxable income. This places them in the 12% federal tax bracket and provides $52,750 more room inside the 12% bracket before moving into the 22% bracket.

Considering the wiggle room before the increased tax rate, this client could decide between the following options:

OPTION 1: Realize Capital Gains

Realize (sell and reinvest) up to $52,750 of long-term (held longer than 12 months) capital gains to take advantage of the 0% Federal Capital Gains rate within the 12% bracket. This couple living in Oregon would still pay 9% State. Ideally, they pay less taxes today to avoid realizing those gains at 15% Federal and 9% State later, likely during the required distribution timeframe starting at age 73. They would keep 15% more of the growth on their investments.

Option 2: Conduct Roth Conversions

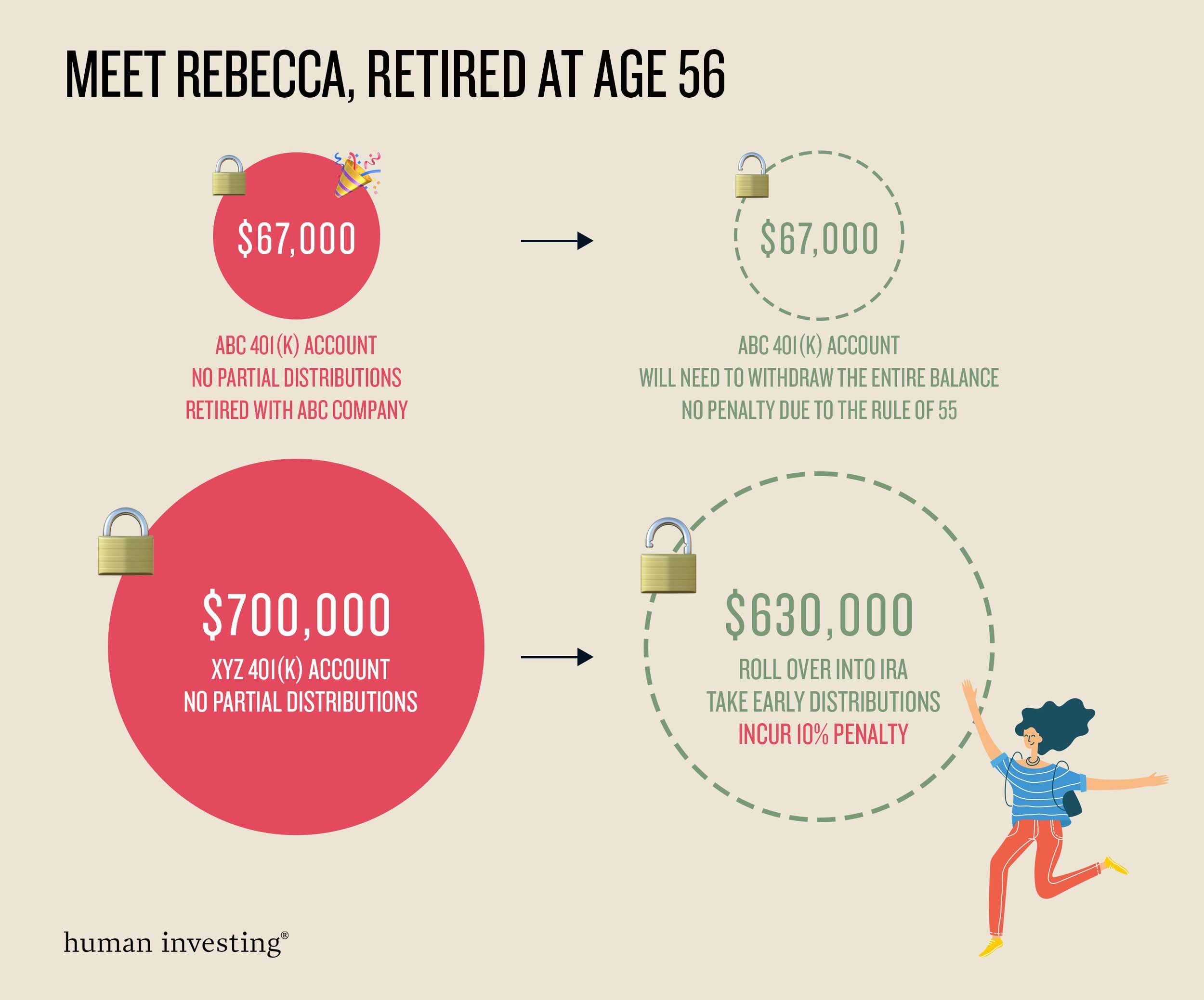

If a client does not have any taxable accounts or unrealized capital gains, they could use the room in the 12% bracket to conduct Roth conversions. This would consist of transferring funds from a traditional IRA, paying the taxes now (12% Federal and 9% State), and putting the net amount into the Roth IRA to grow tax-free overtime. This strategy is helpful to maximize the 12% bracket, since the 12% bracket will revert to the 15% bracket in 2026, when the Tax Cuts and Jobs Act (TCJA) ends. Additionally, when a client turns 73 and is required to take distributions from IRAs, this required distribution amount cannot be converted to a Roth IRA but must be distributed.

Required distributions could also push income from IRAs into the 22% bracket. Another benefit of Roth conversion is that Roth IRAs are not subject to required distribution rules and therefore can continue to grow tax-free for the life of the married couple.

Option 3: Combination of realizing Capital Gains and Roth Conversions

This requires year-by-year income and deductions tracking from all sources to ensure the right amount of money is being realized or converted.

Tax bracket optimization is not an after-thought, but a pivotal component of holistic financial planning offered at Human Investing. If this kind of planning would be helpful to you, please schedule a time to review your situation.