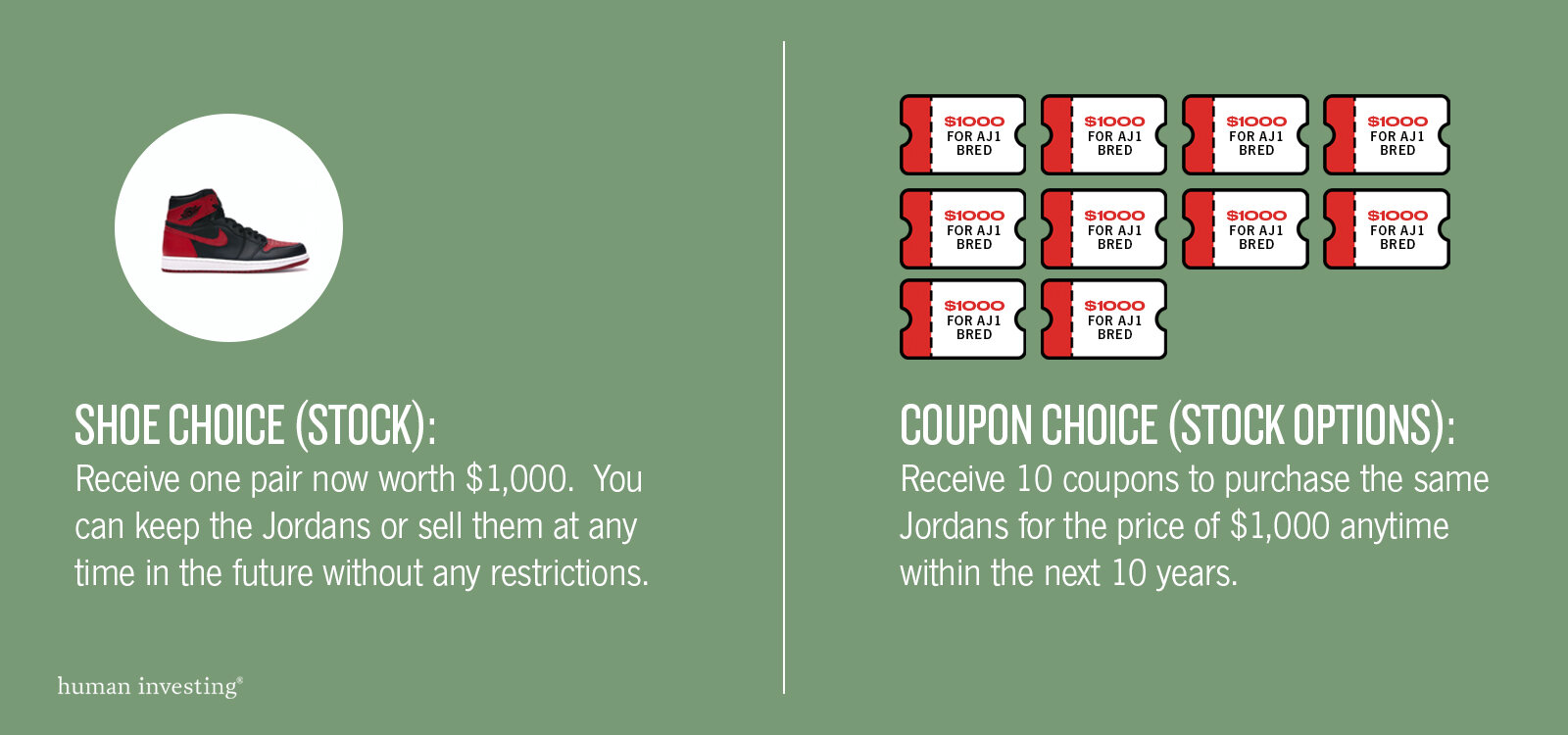

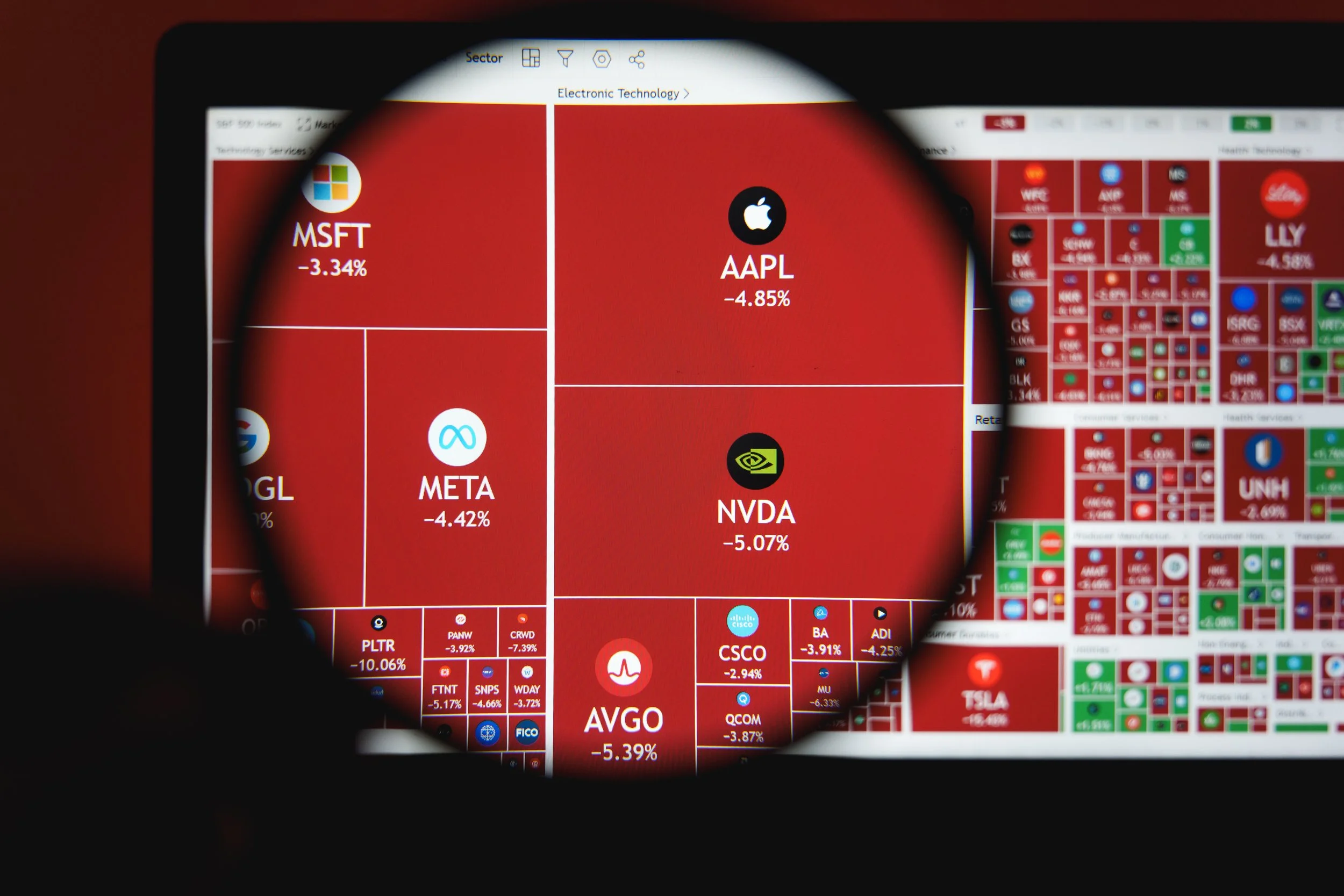

If you examine the outlined bars, you will note that a 15% increase in Nike Stock price would result in a 101% increase in the value of that Stock Option. At the same time, a 15% decrease would drop this Stock Option value by -101%. The owner of Nike Stock Options should be prepared and ready to experience significant short-term declines like the ones shown in the chart above.

The key to capturing the upside potential of Nike Stock Options is having a long enough time horizon. Stock prices can quickly move up and down in the short-term but have a history of growth over the long-term (10+ years). If you own Stock Options and can wait long enough before you exercise and sell them, that will give you the best probability of maximizing the value.

WHAT HAPPENS WHEN YOU LEAVE NIKE?

Since a longer time horizon is one of the most important components for success with Stock Options, what can disrupt that opportunity?

If you leave (voluntarily or involuntarily) Nike, you typically have up to 90 days to exercise your vested stock options and all unvested stock options are forfeited. While it is uncommon, there have been some exceptions where the 90-day time period is extended.

In addition, if you meet specific “retirement” criteria, you can receive more favorable vesting for your unvested options. There are two “retirement” benefits that are unique to Nike stock options:

1) Early Retirement: Age 55-59 with 5 years of Service

Unvested Stock Options (less than one year prior to separation) will be forfeited.

All other unvested Stock Options will continue per the original vesting schedule.

After your retirement date, you will have up to 4 years to exercise your options.

2) Normal Retirement: Age 60+ with 5 years of Service

Unvested Stock Options (less than one year prior to separation) will be forfeited.

All other unvested Stock Options will become fully vested as of the retirement date.

After your retirement date, you will have up to 4 years to exercise your options.

The special retirement vesting options described above can be an extremely valuable benefit to plan for and take advantage of if you are close to or at age 55+.

HOW ARE STOCK OPTIONS TAXED?

As Stock Options vest and grow in value, there is no tax along the way. Tax is only recognized when you exercise your options. The dollars are taxed in the same way as your salary, at ordinary income tax rates, which can be as high as 55.45% since it includes federal, state, Social Security, and Medicare taxes. This can push you into a higher income tax bracket and often disrupts your tax liability if not adequately planned for throughout the year.

TAX & PLANNING STRATEGIES

Strategy #1 – Spread Option Exercises Over Multiple Years

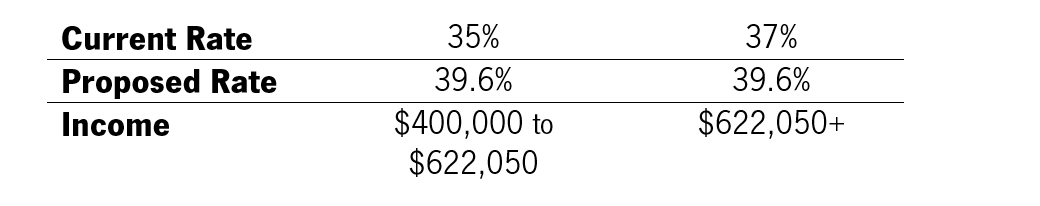

Since exercising Stock Options creates additional taxable income, carefully exercising the right amount and dividing it over more than one year can help you lower your overall taxes.

For example, assume you have taxable income is $450,000 and have $350,000 of Stock Options that you want to exercise. Your current income of $450,000 would be in the 35% tax bracket (2021) and you will not move up to the 37% tax bracket until your income exceeds $628,301 (2021). That leaves room for $178,301 worth of stock exercises that would be taxed at 35% before it reaches the 37% bracket. If you spread the $350,000 of exercises over two years ($175,000 per year) instead of exercising the entire amount in one year, you could avoid the 37% bracket and save about $3,500 in Federal taxes.

Strategy #2 – Coordinate Option Exercises with the Nike Deferred Compensation Plan

Another strategy is to coordinate the timing of your Stock Option exercise with the contribution of a similar amount of salary and/or bonus into the Nike Deferred Compensation plan. This strategy requires the following steps:

Step 1: Determine the amount of Stock Options you wish to exercise. As an example, we picked $300,000 of stock options to exercise.

Step 2: Elect to defer the same amount ($300,000) into the Nike Deferred Compensation plan from your salary during Open Enrollment.

Step 3: Exercise and sell $300,000 of Stock Options in the same tax year as you are contributing $300,000 to the Nike Deferred Compensation Plan

Step 4: Use the proceeds from the $300,000 of Stock Option exercises to replace your salary and support your living needs.

In the end, you would have essentially funneled your Stock Option proceeds into the Deferred Compensation plan and avoided paying any additional taxes.

Learn more about the Nike Deferred Compensation Plan.

Nike stock options are an incredible opportunity

Although Nike Stock Options are often misunderstood, they can provide an incredible opportunity to generate wealth. To really maximize of the opportunity, we recommend that you are prepared to navigate the volatility, complexities, and tax strategy.

If you have any questions or want to know more about how to handle your Nike Stock Options, please get in touch.

You can schedule time with me on Calendly below, e-mail me at marc@humanvesting.com, or call or text me at (503) 608-2968.