Starting From Square One (Or $20 in my bank account)

Picture this: You’ve just graduated college and received your first '“big-kid” job. You have about $20 in your name. Although it is a new concept, with a new job comes new responsibility, and you decide you should probably be more mindful about your spending (and saving) habits. But how do you start?

I had the unique privilege of beginning my career at Human Investing shortly after I graduated. As you can imagine, working at a financial advisory firm meant that before I started contributing to the company’s 401(k) plan, I was given a beginner’s course in investing.

AN ENDLESS MAZE OF DECISIONS

Like many people who join corporate America, I opted into its retirement plan because it was a free benefit I received. I knew saving for retirement was important, and the investment options available to me would benefit my long-term financial plan.

When I received my first paycheck, I learned the importance of contributing to my 401(k), but in a way that was compatible with my cash flow.

A common rule of thumb is to contribute 10-15% of your gross salary to your retirement account if you can (this includes the employer contribution/match). After learning this, I was eager to invest 15% into my 401(k). However, I did not consider other key factors that made up a healthy and holistic financial plan, like funding an emergency savings account or considering other short-term goals (ex: continuing education or buying a home). Although I was so eager to contribute as much as I could to my retirement plan, I ended up contributing much less than expected after assessing my current financial situation.

Unpacking where to start

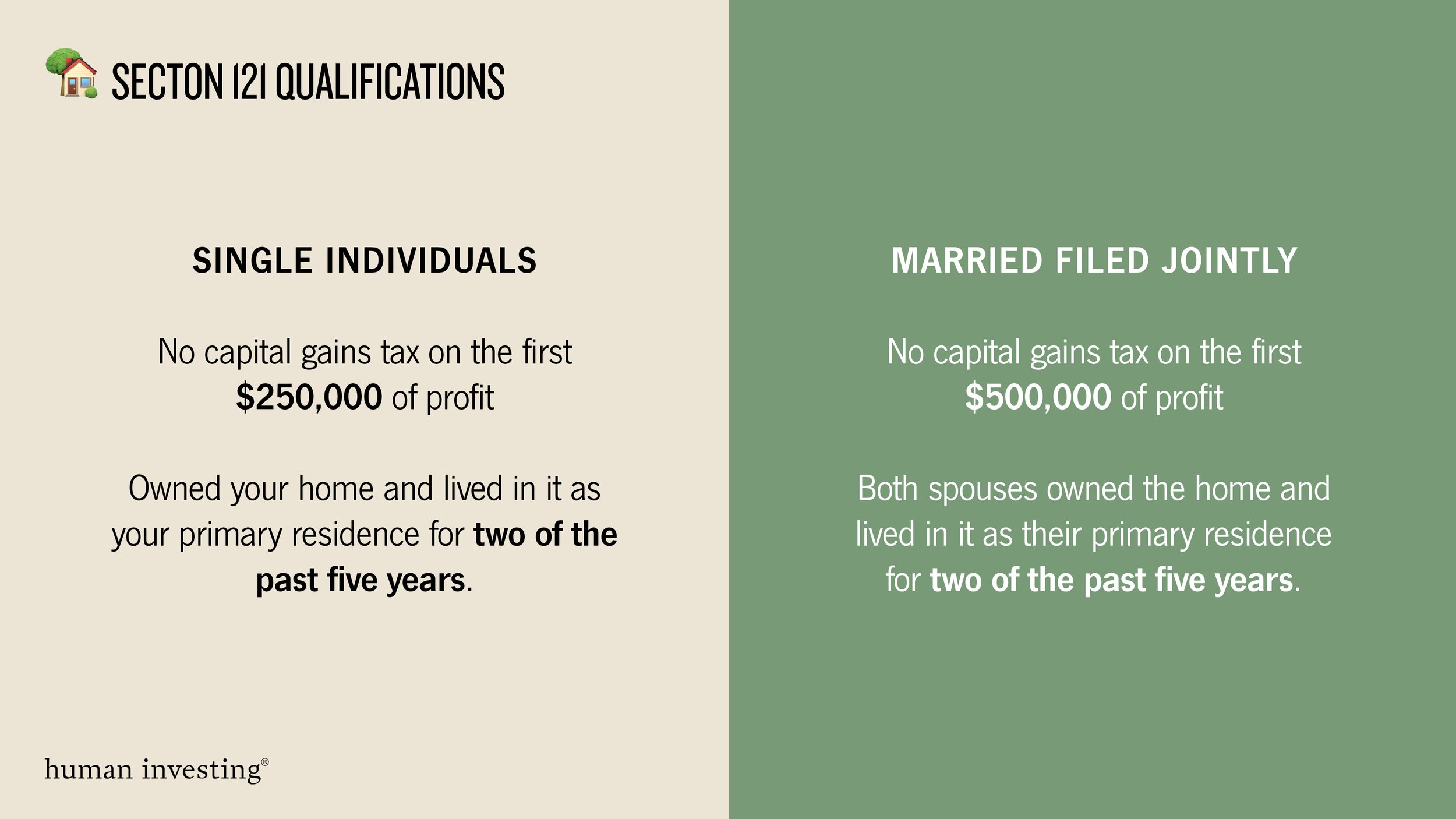

I share this story because, like most people new to the financial scene, I wanted to manage my money well, and I figured investing all of my excess income would equate to successful money management. What I didn’t do was take a step back and assess my entire financial landscape. Thankfully, Human Investing was there to provide some guidance. That’s why we made this visual. We call it “The Pyramid to Financial Wellness.” Use the visual as a map; start at the foundation and then work your way up. Before continuing, please know that we all have unique financial situations, and not every block may apply to your situation.

LEVEL 1: Build a Foundation

Build a Budget to understand your monthly cash flow: If you’re looking to invest dollars from your paycheck, you need to know how much bandwidth you have at the end of each month. If you don’t currently have any excess dollars, try to get creative. Look at your current spending habits and see if you need to minimize spending in a certain area. Don’t be afraid to rely on savings apps for help. We generally recommend Mint or Digit.

Pay off High-Interest Debt: Focus on higher interest, non-deductible loans first, such as credit card loans. Consider refinancing your loans or reconsolidating your debt to make payments more manageable.

Contribute to your Company-Sponsored Retirement Account: If applicable, contribute enough to receive the employer match. For example, if your employer matches up to 6% of your contribution, try to meet the 6% savings rate.

Build an emergency fund: If something unpredictable happens, make sure you’re prepared. Click here to learn how to build an emergency savings fund.

Level 2: Plant Long-term Seeds

Open a Retirement Account for future savings: Based on your age and tax bracket, start contributing to either an IRA or a Roth IRA. Click here to see if a Roth IRA account is the right account for you.

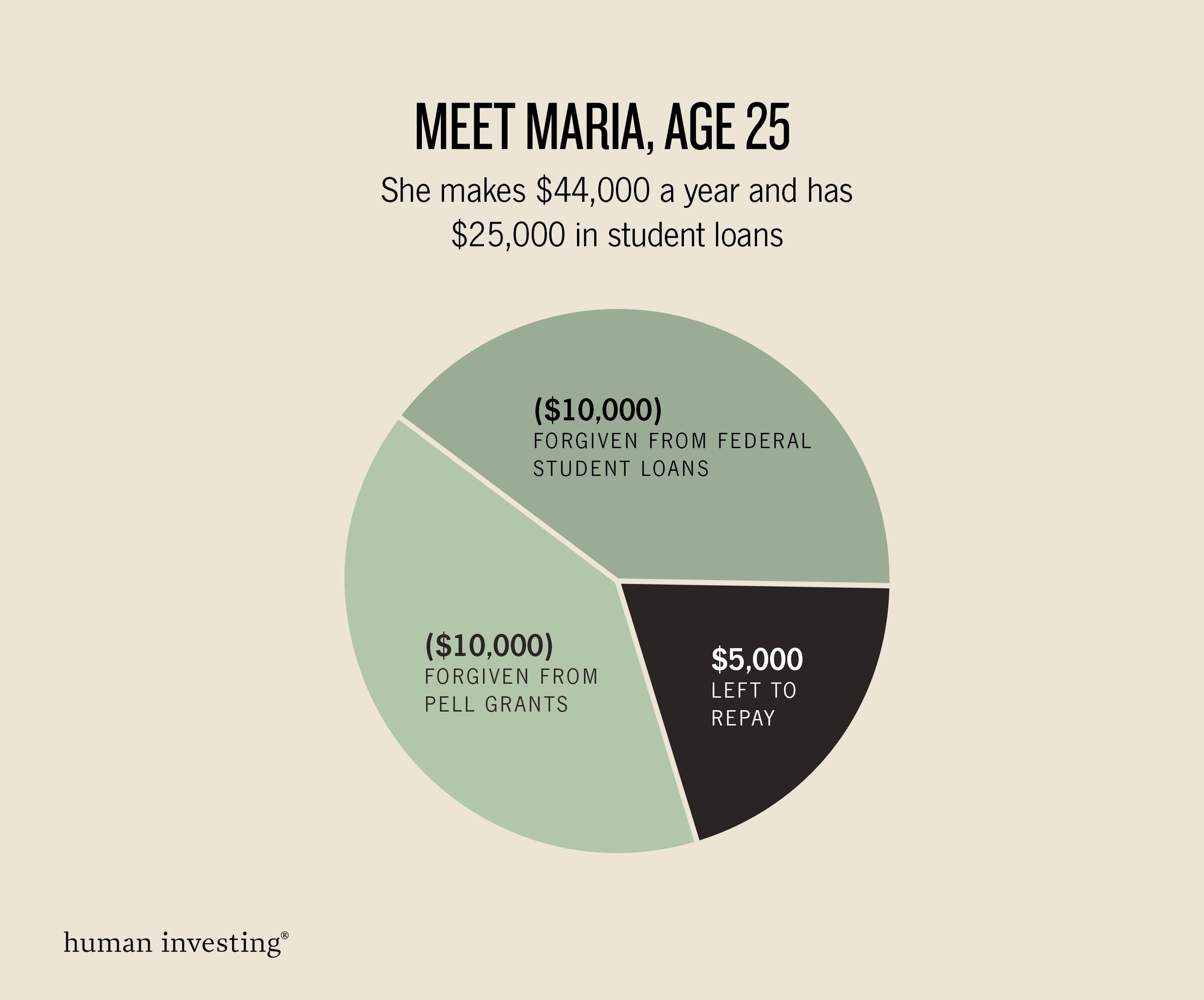

Continue paying down student loans: If student loan payments are on your horizon, don’t delay! Try to pay off what you can now. Consider refinancing your loans in order to make regular payments more manageable.

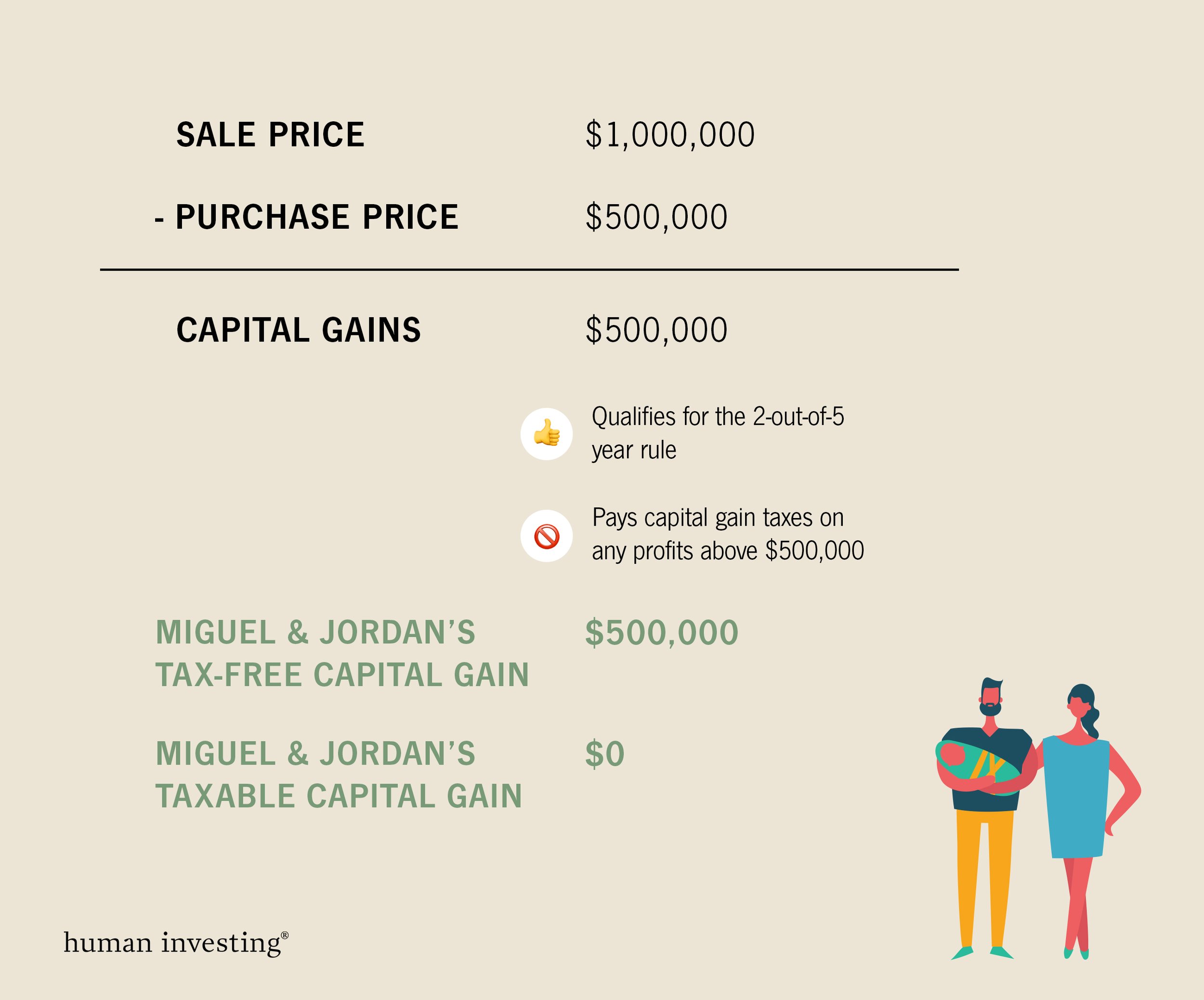

Save for a Home: If this is a goal of yours, start saving. Depending on your timeline, try to save in either a High Yield Savings Account (Short-term goal) or a Roth IRA (Longer-term goal).

Level 3: Hone your Monthly Budget

Open up a 529 account for a child or grandchild: If you are hoping or planning to fund your child’s college education, utilizing a 529 account can protect your purchasing power. The same rules that apply when flying apply here too. Put your mask on before taking care of others.

Pay down your mortgage: Target additional mortgage payments if you are able. Consider refinancing your mortgage to possibly find greater savings with lower interest rates.

Save for Short-term and Mid-term goals: Short-term goals include immediate expenses, paying down debt, having an emergency savings fund, etc. Mid-term goals are big purchases that you plan to make before you retire. This includes saving for a house or a car. Avoid borrowing and start planning to save. If you’ve exhausted other savings vehicles (like your 401K and Roth IRA), consider opening a brokerage account.

If you have any questions about how investing can fit into your financial plan, contact us! We are here for you and are excited to cheer you on as you learn to manage your money well.