One of my favorite market commentators is Dr. David Kelly, an economist whose research focuses on the investment implications of an evolving economic environment. His insights are rooted in theory and application, which help make the work he publishes comprehensive and practical. In his most recent article, he notes the following:

“As America emerges from the pandemic, there are still serious health concerns, a yawning political divide, rising autocracy around the world, a brutal war in Europe and the highest inflation in 40 years. Moreover, anxiety triggered by these genuine problems is being amplified by cable channels and social media which ever more efficiently gather their audience by appealing to fear and outrage.[1]”

With this backdrop, I will try to share my thoughts on the market, economy, and implications for investors.

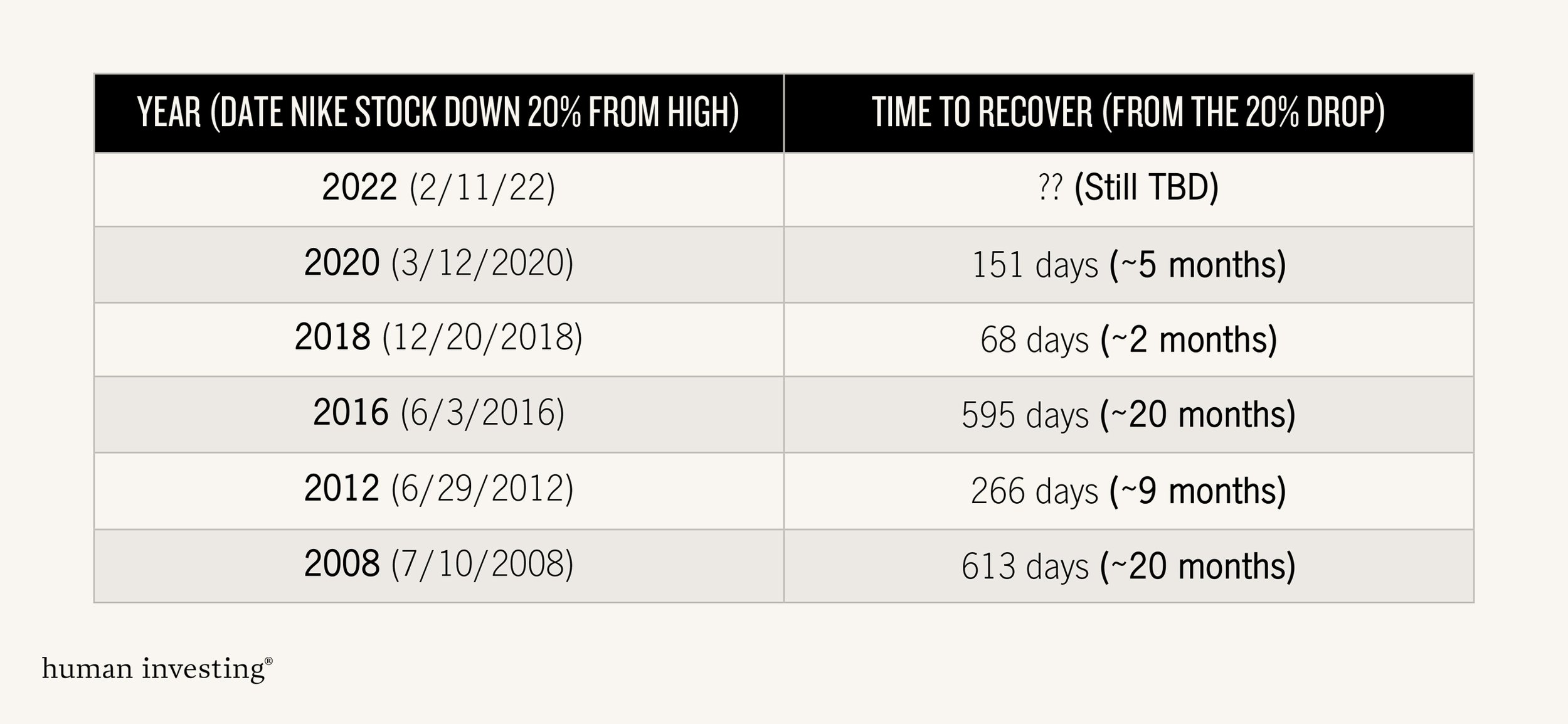

Market declines: We’ve been here before.

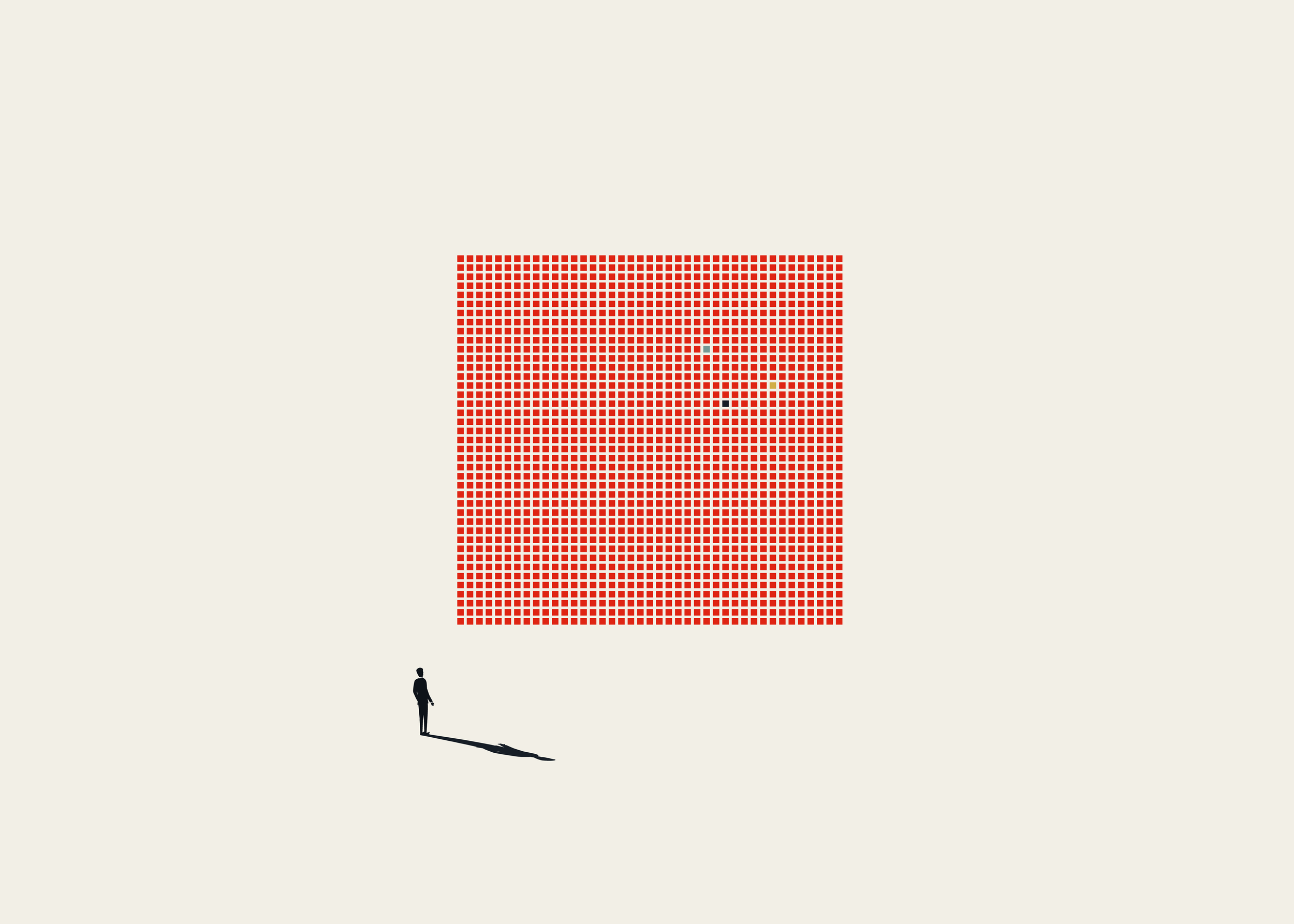

Whether looking at the stock market, bond market, or commercial and residential real estate markets (to name a few), all are down for the year. With widespread asset price declines, renewed volatility is unnerving for many of us. These are challenging times to have capital deployed into the market. However, volatility and risk are the primary reasons investors in the market have achieved meaningfully better returns than cash over most market cycles.

The narrative surrounding this market cycle continues to evolve—the reasons "why" we are experiencing market gyrations and asset declines today differ from past times. However, I have great hope and confidence markets will normalize and begin their next run higher—in the same way they have done following each of the last downturns dating back to 1825. [2] In my 25+ years advising clients, I have experienced managing assets through significant market declines, with the most recent being Q1 2020, and most memorable 2007-2009, and 2000-2002. The cause for these markets was different, but the result was the same for those who managed their emotions through turbulence.

How is the economy responding to the current market?

Economic activity is beginning to slow. The most notable remark came from Fed-Ex, which reported a slowdown in shipments—a real-time data point highlighting growing constraints from corporations and consumers alike. Although the Fed-Ex announcement is one observation, it is congruent with analysis conducted by Dr. Kelly and others, highlighting a slowing economy domestically and abroad.

The Federal Reserve (the Fed) job is exceedingly tricky, given that inflation affects everyone and the primary defense for rising prices is interest rate hikes. At the same time, if interest rate increases are applied excessively, they stand to constrain the economy, which in turn could inflict pain on households through job loss and a decline in asset prices. Concern over Federal Reserve policy mistakes has begun to capture the headlines, with notable economists Mohamed El-Erian and Jeremy Siegel blasting the Fed for raising interest rates too aggressively.

The tension between the actions of the Fed and prominent economists may cause the Fed to exercise more constraints when deciding on interest rate policy in the future. Ultimately, we hope Fed Chairman Powell and his colleagues around the country can orchestrate a soft landing for the economy—which involves moderating rate hikes and extinguishing inflation while maintaining reasonable economic growth.

Our financial plans factor in these conditions.

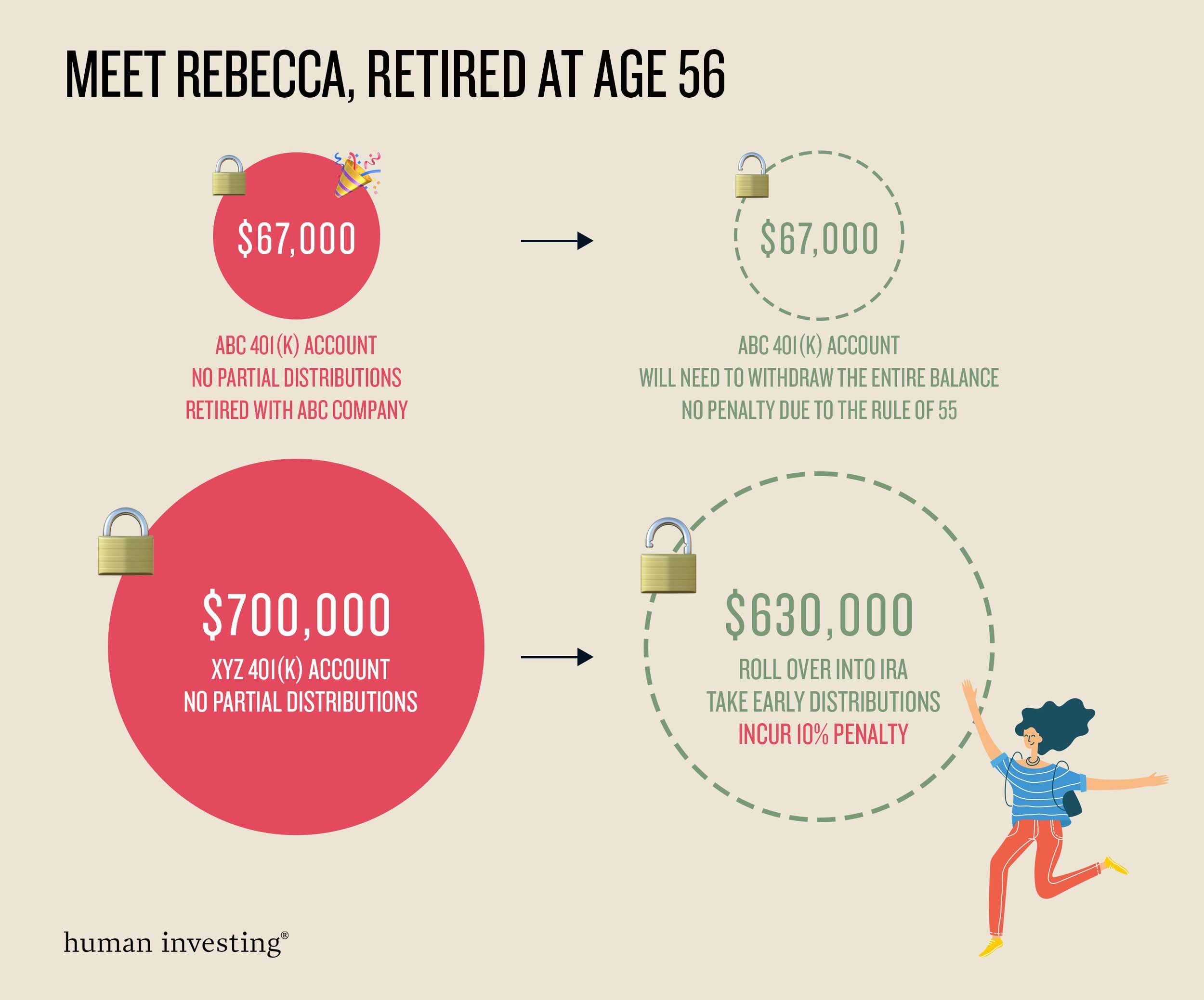

Financial planning is essential to helping to create positive customer outcomes and providing wise counsel in all market and economic conditions. Recently, a retired client and friend called concerned about the market. They asked if they should reduce their overall risk and sell a portion of their equities. After a review of their financial plan, it was determined that despite the market decline, they were on target to maintain their spending goals; therefore, no immediate action was needed.

Our recommendation for this client included a study on their financial plan's probability of success. The probability analysis simulates their plan's likely outcomes based on good and bad markets. When coupling their planning inputs with their probability analysis and considering their cash and bond holdings, it is easier to look past the market and focus on their plan, including simulations for markets like we are in now.

Please know we understand how unnerving it is to see account balances drop and to feel that the world is unraveling. However, it is imperative that we remain objective and focused on our disciplined approach to both planning and investing. When speaking with your advisor, their answer may be "stay the course." This is our way of saying we have looked at your plan and are prepared for times such as these. Attempting to control the market or predict capital market outcomes sets us up for failure. However, focusing on what we can control, utilizing industry-leading technology, and leveraging a team of experienced credentialed experts are the best approaches with the highest probability of success for our clients and their plans. [3]

As has been the case since hiring Marc Kadomatsu, CFP to Human Investing, financial advice dispensed through the lens of financial planning has been the cornerstone of our service offering at Human Investing. Marc previously served as the head of the Financial Planning Association for Oregon and SW Washington. We have added to his team the recent promotion of Will Kellar, CFP, to Partner. Will has tremendous experience in advising clients through a planning lens. Moreover, Will is responsible for training the next generation of financial planners as he currently serves on the faculty of Oregon's only accredited financial planning program at George Fox University.

Diversification may be the key to your peace of mind.

Emotion management is complicated—particularly for those whose primary source of income is their investment portfolio. To help manage the anxiousness that may accompany turbulent markets, please consider the concept of diversification. The term "diversification" means we don't put all your eggs in one basket. Although you have one account statement from your primary brokerage affiliation (Schwab, Fidelity, Betterment, etc.), you have various investments. Each investment serves a purpose in helping you achieve your goals. Some investments like cash and short-term bonds are what we tap into to provide necessary liquidity without having to sell at a significant loss. At the same time, equities are for longer-term appreciation to help your portfolio generate returns that outpace inflation and taxes.

Although your portfolio performance and holdings are aggregated into a single statement, we ensure that customers are adequately diversified into many different holdings. That way, when it's time to take a necessary withdrawal, we have many options for where we can go for the cash. There is no easy way to manage emotions in volatile markets. However, knowing ample investments can be accessed to provide the needed financial resources is something to consider when looking at the portfolio as a whole.

Markets of all kinds experience ups and downs—which has been my experience since 1996. The current downturn has several major markets down in excess of twenty percent year-to-date. Countries and regions go through economic cycles for various reasons and durations. The economy is showing signs of a slowdown, which could negatively impact consumers and businesses alike. With both the market and the economy on edge, we believe it is paramount for investors to stay disciplined, avoid acting on emotion and lean on their financial plan and advisor to help them make informed financial decisions.

[1] Kelly, D. (2022, September 19). Why the Fed should worry less about sticky inflation (but probably won't). Notes on the Week Ahead, JP Morgan Asset Management.

[2] Gladhill, A. (2019, September 12). Return histogram: Stock market annual returns 1825-2017. Investment Committee Q32019, Human Investing.

[3] Bennyhoff, D. G., & Kinniry Jr, F. M. (2016). Vanguard Advisor's Alpha®. Vanguard, June, http://bit. ly/2gXMDCs.