A much needed update for families

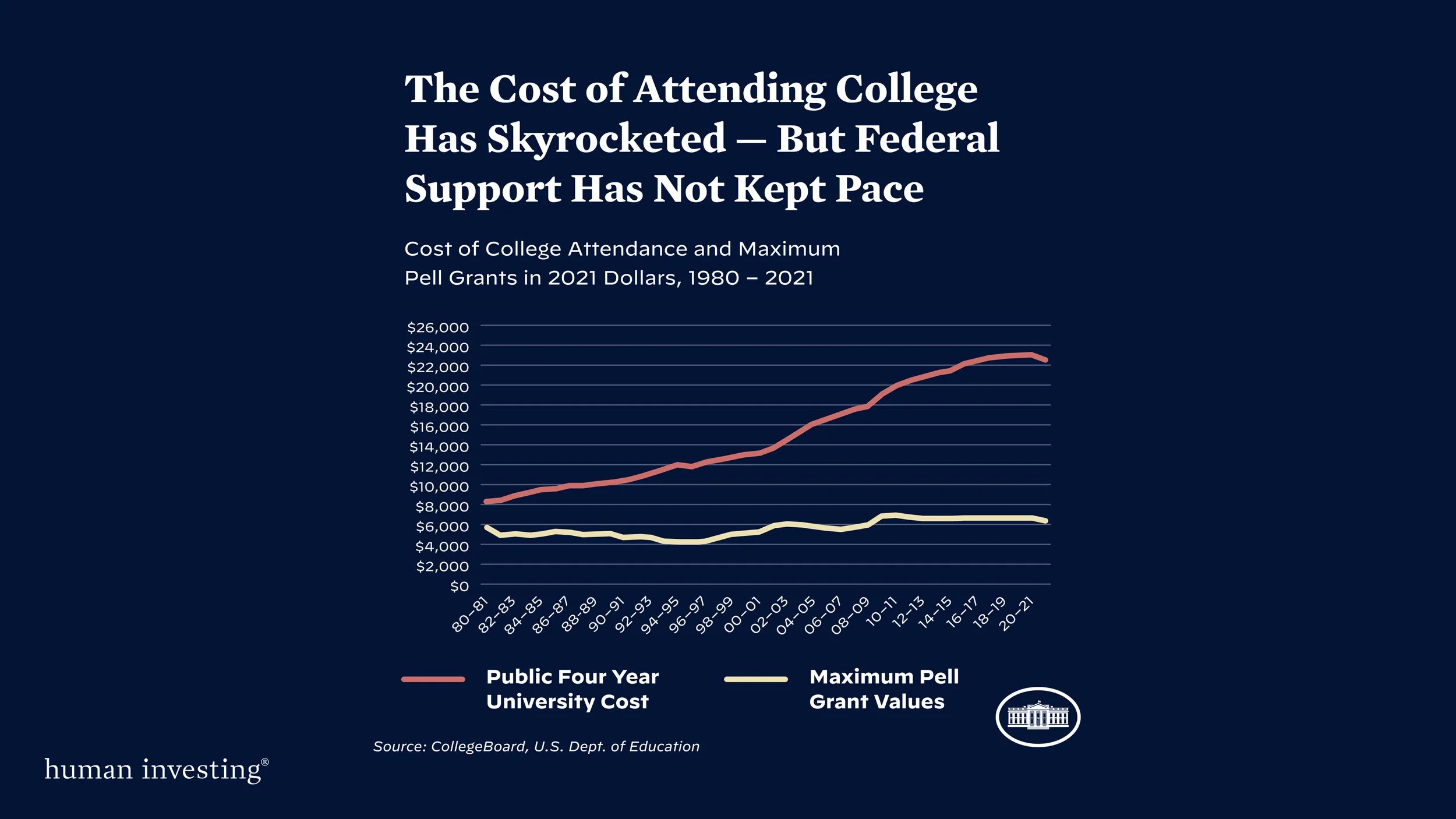

The Free Application for Federal Student Aid (FAFSA) Simplification Act of 2021 was passed by Congress for many reasons. For starters, the calculation was originally defined over four decades ago in 1972 and is in some need of updating. According to the National College Attainment Network (NCAN), only 61% of seniors applied for aid in 2017 and 54% in 2021.

Some consider COVID to be the main culprit for this sudden drop, but the complexity of the form is the other main issue. Currently, students are required to answer 100+ questions depending on their family's income level. As of now the new FAFSA form changes are set to be released in December 2023 and students and parents alike need to be aware of the specific aspects that will apply in the 2024-2025 academic year that may impact aid eligibility depending on their family situation.

What’s changing and why it matters

1. EFC (Expected Family Contribution) replaced with Student Aid Index (SAI)

Short answer: Fairer access to funds for lower-income households.

One of the more obvious changes was renaming the EFC to the SAI. The goal was to not only reduce the confusion around the actual costs of college and what families are responsible for paying but also ensure access to Federal Student Aid programs including Direct Student Loans, Parent PLUS Loans, Work-Study programs, and even Pell Grants for low-income households. This number can be negative with maximum Pell Grants awards giving a student up to -$1,500 in money back. Time will tell but the largest impact will fall on middle to upper income families who will no longer be able to divide the number of college students in the household that are currently in college. For example, a family that could pay $40k/year could split the aid evenly between the number of students in college at the time. They no longer have this luxury and will see a reduction in aid.

2. Custodial parent status changes

Short answer: For non-married couples, the parent who ultimately claims the child as their dependent on their tax return will submit the FAFSA.

Currently, the FAFSA only collects income and asset data from the parent a student lives with. In cases of divorced, separated, or non-married couples who reside together starting in 2024-2025 school year, the SAI calculation factors in the parent who provides the greatest financial support. In cases of divorce and separation starting in 2023 the SAI calculation will only require the parent who provides the majority of “support” to fill out the FAFSA. One household might pay the child support but the other pays for the mortgage, groceries, and sports clubs. The implications of this decision can be significant.

3. Formula changes

Short answer: Students can qualify for more awards.

As with the SAI calculation, the number of students a family has in school is no longer a factor for Pell Grant eligibility. By completing the FAFSA, you are considered for the maximum amount of Pell grants first (based on number of people in your household) and your AGI (Adjusted Gross Income) compared to the FPL (Federal Poverty Line). If not eligible, your maximum Pell Grant amount will be subtracted by the SAI. Finally, you will still be considered for a minimum Pell Grant if no award is given. These other factors in the formula for aid are listed in no order but should be noted for your situation.

The student income protection allowance threshold was raised from $6,800 to $9,400.

Businesses and farms that employ 100 or more employees will be considered an asset going forward

Capital Gains from the sale of investments will be considered income on the FAFSA

Child support received is now reported with assets NOT income

4. Student income from outside sources

Short answer: A student’s financial aid won’t be penalized for withdrawing 529 funds early.

Currently students must report gifts or distributions from a 529 owned by a non-parent (e.g. grandparents or other family members) or non-custodial parent if the student's parents are divorced. Due to the FAFSA’s prior income year rules, a student who needed access to those funds before Jan. 1 of their sophomore year of college would be penalized in the formula for the withdrawal. Now they are completely removed from the aid formula calculation.

5. New student allowances for the cost of attendance

Short answer: FAFSA will cover more day to day student expenses.

Although these are smaller changes, college students alike must not overlook these valuable new allowances that the FAFSA will allow students to claim for ancillary items. Not only is there a small allowance for personal expenses if a student works part-time but a personal computer purchase with no enrollment status requirement. You can even have an allowance for transportation between home, work, and school. More details can be found here.

Proactive financial aid resources to guide your family

For a current or future college student, utilize the free Student Aid Estimator.

If these changes make need-based options harder to attain, look for colleges that offer merit scholarships. This does not mean forgoing the FAFSA completely but intentionally seeking out Merit scholarships at specific institutions. This process, known as Early Action, is detailed in this article with a list of colleges that offer Merit Aid. We recommend starting this process early as many colleges recruit students as early as late spring of your child's junior year!

Finally, contact financial aid offices to see if they will be awarding institutional dollars based on the current formula not connected to the EFC/SAI numbers.

We can help with education planning

The FAFSA is changing for better or for worse and will affect how parents and students think about college for years to come. If it would be helpful to consult a team of credentialed advisors with expertise in college planning, schedule a call here.