A growing complexity

As a Nike leader, you are provided a comprehensive range of benefits that help achieve financial and retirement goals. The downside is that these benefits often create confusing tax implications. Multiple measures over the last few years have passed to increase taxes on high-income earners, including the Metro and Multnomah County taxes. These tax measures in addition to regular Federal and Oregon taxes are becoming an increasing burden for Nike executives.

A clear understanding of the tax implications with these benefits is crucial. Employing appropriate strategies can both reduce your tax burden and also prevent any surprises during tax season in April.

Let’s examine the three biggest reasons you could get hit with a tax bill and review a recommended solution.

The 3 leading causes to tax surprises

1. Wrong tax withholding on supplemental pay

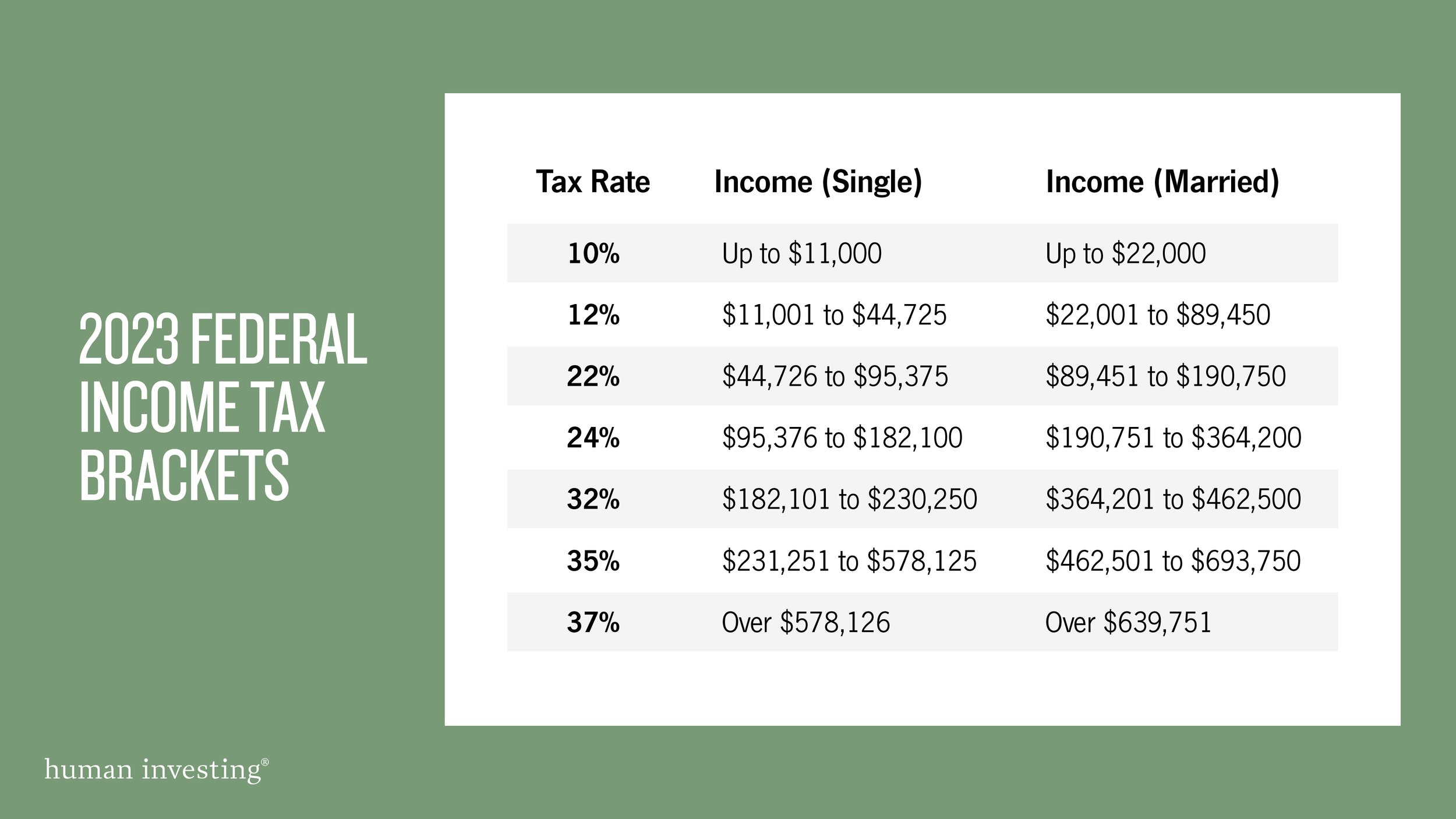

Many compensation sources at Nike beyond salary (such as PSP, LTIP/PSU vests, RSU vests, and stock option exercises) are taxed as “supplemental pay,” which come with a set percentage of tax withholding (22% Federal + 8% Oregon) regardless of your tax bracket or tax withholding elections on your salary. The reality is most Nike executives are in a much higher income tax bracket, sometimes as much as 17% higher than the amount withheld. This discrepancy leaves a significant gap in the amount taxes that should have been withheld versus the actual amount.

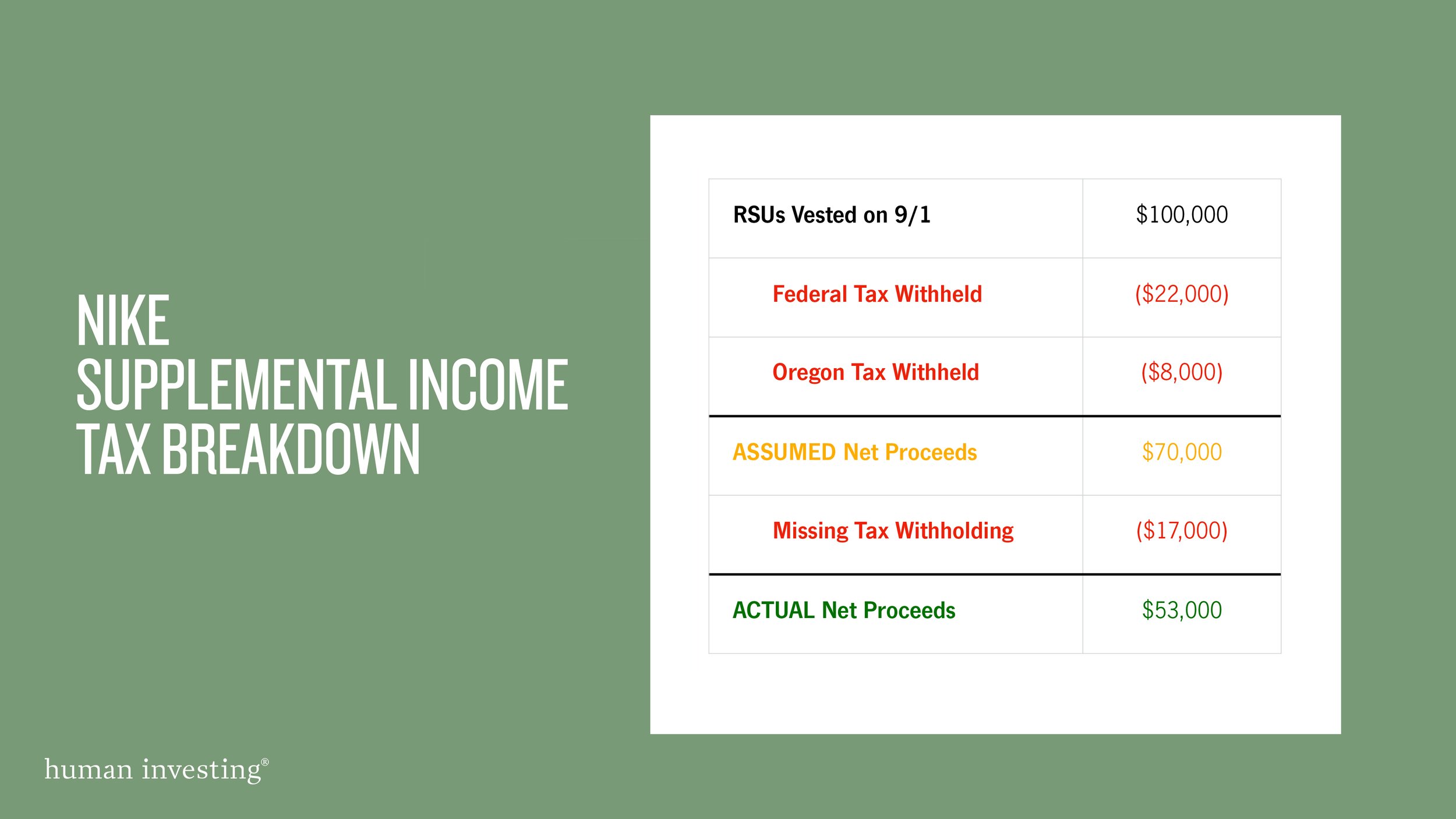

For example, Kate Executive has $100K of RSUs that vested on September 1st. With all her income sources (salary, PSP, LTIP/PSU, RSUs) her taxable income is $700K. The taxes automatically withheld on the $100K RSU vests would be about $30K (22% Federal + 8% State). However, based on her tax bracket, Kate will owe another $17,000 on that RSU vest.

2. No tax withholding for Multnomah County’s “Preschool for All” tax

For those who live in Multnomah County, you are likely subject to the “Preschool for All” tax that started in 2021. Unfortunately, Nike does not withhold taxes from payroll to cover this tax, so you will be responsible to fully cover this on your own. Multnomah County expects these payments to be received quarterly to avoid interest and penalties.

The Preschool for All tax is 1.5% on taxable income over $125,000 for individuals and $200,000 for joint filers, with an additional 1.5% on taxable income over $250,000 for individuals and $400,000 for joint filers. The rate will increase by 0.8% in 2026.

3. No coordination of Portland Metro tax payments for 2 working spouses

Since Nike headquarters is located within the Portland Metro, they do withhold taxes for the Metro Supportive Housing tax (a.k.a. Homeless tax) that also started in 2021. The Metro Supportive Housing Tax is a 1% tax that is applied on income over $125,000 single filer or $200,000 joint filer.

A common issue arises when you have two working spouses at different companies, since the income threshold for this tax is based on household income and the two different employers obviously do not communicate with each other.

For example, once a Nike executive’s income reaches $200K, Nike will start to withhold the Metro tax on any income above that amount. However, the other spouse’s employer does not know about the income at Nike and assumes that the spouse’s income is the household income. So, if that spouse earns $90K, no Metro tax is withheld on that amount even though all of it is subject to the Metro tax.

The 3 tax payment issues identified above often lead to a frustrating situation, where you either end up with a significant tax bill in April or you have been paying in the wrong quarterly estimated tax payment amounts given to you by your CPA.

Our recommended solution: The pay as you receive strategy

For many Nike executives, setting aside additional tax payments into your monthly household cash flow can become stressful, since the amounts can be so inconsistent.

The “Pay as You Receive” strategy is calculating the estimated amount of taxes due from each type of “Bonus Compensation” as you receive it and making those tax payments at that time, while you have the funds to do it. This will leave your monthly cash flow separate and unaffected.

If this sounds like a lot of work, you can make it simpler by applying this method during 2 key time periods.

Time Period #1: August – PSP, LTIP/PSU bonus’

Time Period #2: Early September: September 1st RSU vests

A more thorough approach is the also include any February retention RSU vests and stock option exercises as they occur.

These supplemental estimated tax payments, when combined with the withholding, should be equal to your anticipated tax bracket for the calendar year. This approach helps ensure that your total payment to the IRS, Oregon, Multnomah County, and Metro aligns with your tax obligations.

Additional strategies for minimizing your tax liabilities

If you’re looking for more tax savings or want to use your stock benefits to take care of tax payments, we highly recommend proactive tax planning. This involves looking beyond the past year and anticipating opportunities to reduce taxes in the future.

Proactive tax planning common solutions include:

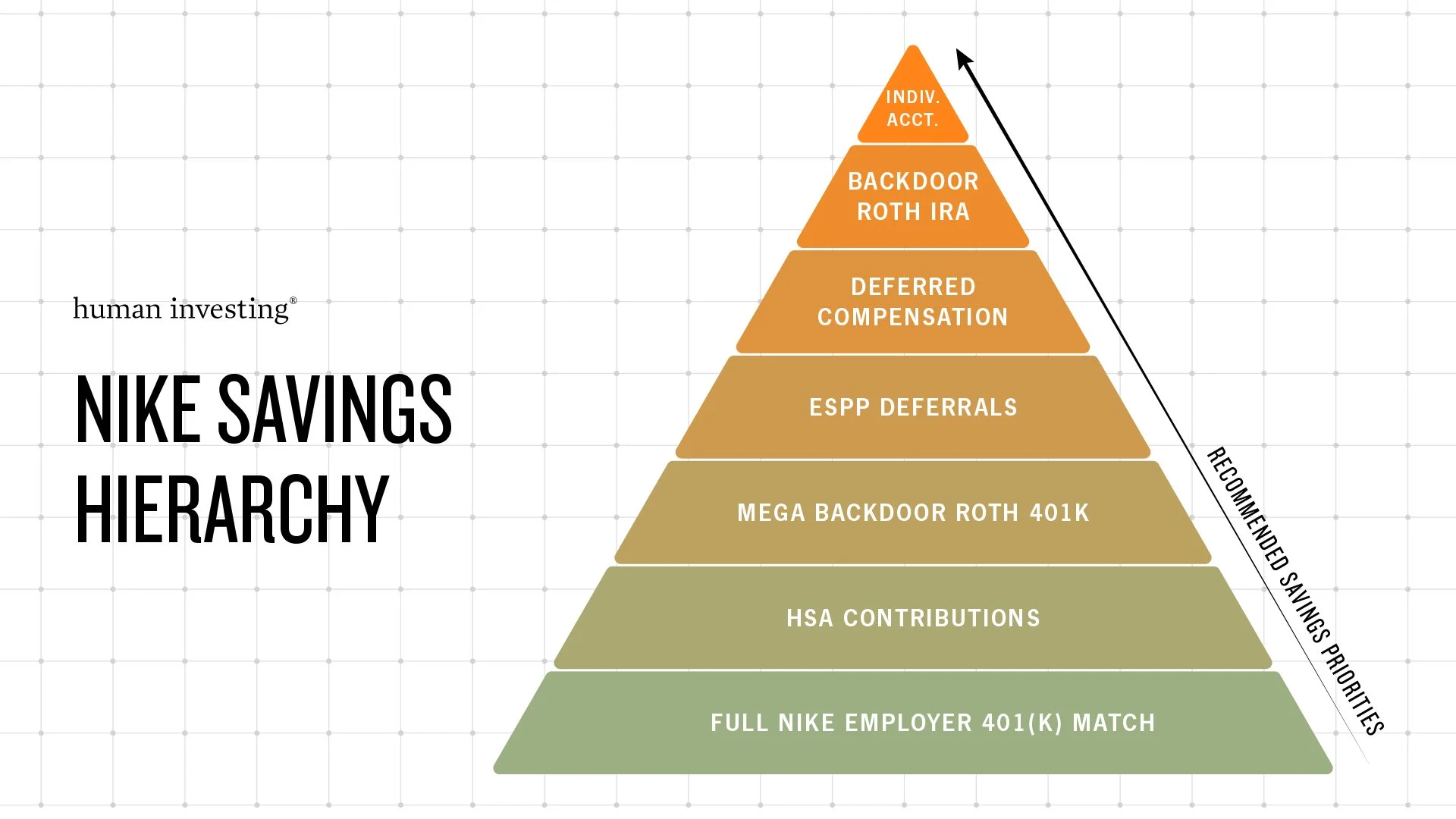

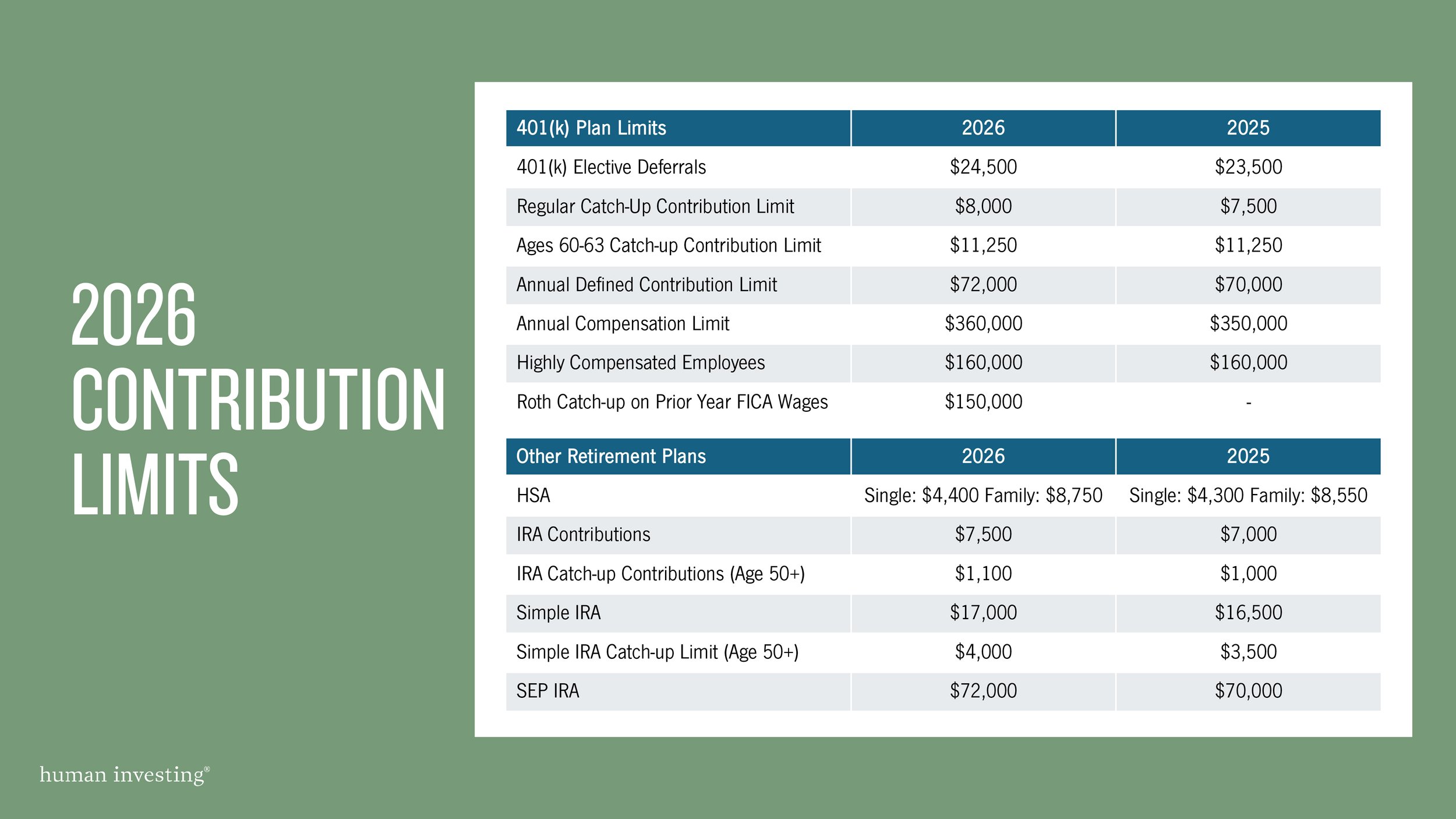

1. Maxing out your Nike 401(k) with pre-tax contributions

This is a simple strategy, yet it is often missed. With the maximum contribution amount increasing periodically with inflation and with opportunities for additional catch-up contributions at age 50, forgetting to review your contribution percentage each year is common. We recommend reviewing your 401k contribution amount after your PSP bonus is paid, since it is a variable amount that is part of the equation.

2. Selling the right type of Nike stock

If you ever need funds from Nike stock, find the most optimal type of Nike stock to sell to minimize your taxes. Typically, RSUs are preferred over ESPP from a tax standpoint, but this can depend on when it was purchased/vested, how long it has been held, and what the stock price is at the time.

3. Utilizing the Nike deferred compensation plan to defer your taxable income to a later date

Nike’s deferred compensation plan is generally the most powerful tax savings tool available for Nike leaders. There are specific IRS rules and many important considerations to plan around when using this strategy. To learn more click here.

4. Charitable giving

Most people assume that all donations to charities are tax-deductible. They can be tax-deductible but are not always, depending on your individual tax situation. To receive a charitable deduction, you need to exceed a certain threshold each year, and it may make sense to “bunch” donations (make multiple years-worth of contributions in a year) to cross that threshold and capture tax benefits. Coordinating your charitable strategy with the Nike charitable match can be an effective way to lower your taxes and benefit your desired charities at the same time. To find out more click here.

5. Residence planning

If you currently live in Multnomah County, you might consider moving to another county, such as Clackamas or Washington Counties, to avoid the Preschool for All tax. This solution should consider the estimated tax savings compared to the cost of selling your home, the tax implications of selling your home, the purchase price of a new home, and the difference in a new mortgage payment (especially because mortgage rates have increased significantly).

6. Planning around the Oregon state kicker

Oregon law has a provision known as the “kicker” credit. This is a surplus credit that is returned to you on your tax return when tax revenue is larger than predicted. By accounting for this, you can strategically recognize more income in “kicker” qualifying years so that your potential kicker credit is increased. The last kicker payment was 17.34% of the Oregon taxes you paid in 2020 and the next one is estimated to be even larger.

Bring in experienced experts

By implementing a proactive forward-looking tax strategy and payment plan, Nike leaders have a significant opportunity to improve their financial situation and relieve stress related to taxes. It is important to note that any tax payment and mitigation strategies should be part of a comprehensive financial plan that is tailored to your specific financial situation.

If you have questions about how to set up a proactive forward-looking tax strategy, please contact our team to learn more.